It is September in an election year and, yes, we are getting the question . . .

“What do you think will happen if (the presidential candidate you despise) wins the election?”

The answer? We don’t know.

But here’s what we do know. What is happening in the world (a.k.a. geopolitics) is much bigger than the president of the United States. Always has been. Always will be.

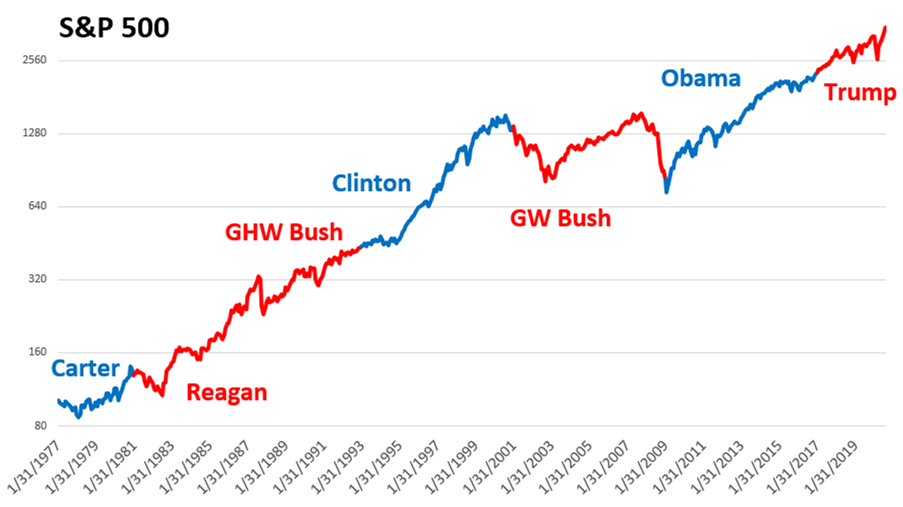

What we have repeatedly learned is that, throughout history, there has been little correlation between who the president is and how the stock market performs.

For the past forty-three years, we have had Presidents Carter, Reagan, Bush, Clinton, Bush, Obama, and Trump. Nineteen years of Democratic administrations and twenty-four years of Republican administrations. And for the past forty-three years, the S&P 500 index has returned over 11,000% (including dividends), or about 11.5% per year.

During that same period, interest rates, after peaking in 1981, have declined steadily, pretty much regardless of who was in office.

“Oh, but this is different,” you say. (The presidential candidate you despise) will definitely destroy America this time if he is elected/re-elected . . . as if COVID-19 hasn’t already done its best to destroy America.

Over and over the United States has proved to be incredibly resilient, partly because every four years we get to vote again. And we can assure you that if your candidate does not win, four years from now we will have another election.

Meanwhile, the stock market continues to chug along, primarily because there are few attractive alternatives. Interest rates are stubbornly low and, if you have been reading us for very many years, we continue to feel they will go even lower. When you can barely earn ½ of 1% owning a 10-year Treasury bond, it doesn’t seem insane to have a higher allocation of your investments in stocks.

But which stocks? It is so tempting to go after the popular “growth” stocks. These include the older ones such as Amazon, Google, Facebook, Apple, Microsoft . . . you know the names. And then the newer ones, such as Zoom, Tesla, and Snowflake (which became a publicly traded company this month at $120 per share and immediately shot up to $253 per share on its first day of trading.)

On the other hand, you could own “value” stocks — companies that may be trading below their “true” value and that provide the opportunity for a nice return when the stock price eventually goes back up to where it “should be.” Value stocks tend to be more boring (or out of favor) companies. Names such as Johnson & Johnson, AT&T, Exxon Mobil, IBM, and John Deere.

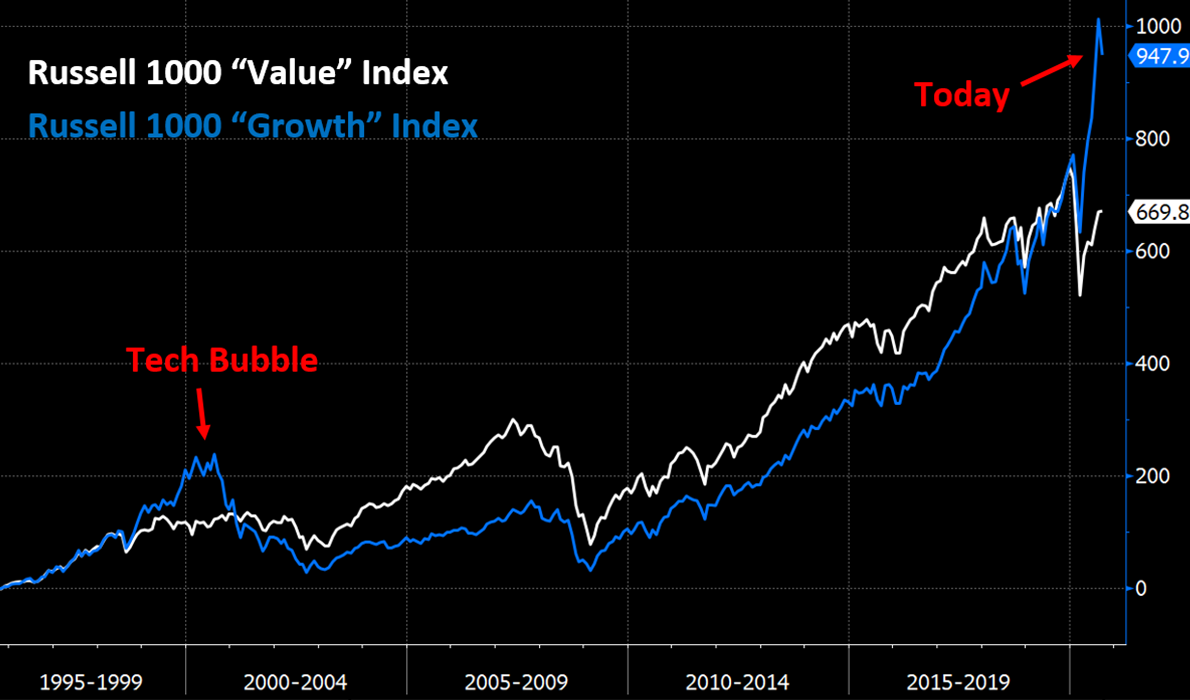

The chart below tracks the total return of value and growth stocks over the last 25+ years. The white line is value and the blue line is growth. You can see that during the past several months, growth has significantly outperformed value.

You can also see that the last time growth significantly outperformed value was during the Tech Bubble of the early 2000s. Back then, owning the “hot stocks” was as tempting as it is now (possibly more tempting), but ended in misery.

That’s not to say today’s market is the same as it was in 2000. And the classification of growth vs. value can be very subjective. Nonetheless, we believe that going forward, boring companies that pay dividends will probably fare better than the “hot stocks” of the month.

__________________________________________

The Fed spoke this week (yawn) and said it doesn’t expect to raise interest rates until 2023. The Fed members must be reading our monthly Investment Commentary, because we have been saying forever that rates will remain low and most likely trend lower. We’ll let the Fed know when it is time to raise rates again.

__________________________________________

Meanwhile, just when you thought the Brexit drama was over, headlines recently pointed to the inability of the EU and U.K. to come to an amicable divorce agreement:

No Deal Looms as U.K.-EU Talks Head for the Rocks: Brexit Update

Brexit Talks Hit Crisis as Boris Johnson Rejects Ultimatum

We could have written these headlines earlier this year when we pointed out in our February Investment Commentary that “striking an agreement within eleven months (if ever) seems incredibly unlikely. . . Don’t be surprised to see additional ‘extensions.’”

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.