Recently, Fitch, one of the three big credit-rating agencies, downgraded the debt of the United States from AAA to AA+. Fitch’s reasoning boils down to high and growing levels of government debt and an increasingly dysfunctional government.

There are several things to point out about this downgrade.

First, the downgrade means very little. There is virtually no chance our government won’t be able to pay its debts. It has the ability to generate tax revenue from the largest and most robust economy in the world.

Furthermore, it should be noted that a rating of AA+ is still a really, really, really, really good rating. It strongly implies that the issuer of the debt will never have any problems paying you back. Changing the letter “A” to a “+” certainly makes a statement, but nothing more.

Second, Fitch (as well as the other credit-rating agencies) is famously known for having given AAA ratings to subprime mortgages in 2007, right before they collapsed in 2008. So, it’s always a good idea to consider the source.

This clip from the 2015 film The Big Short, illustrates how distorted “expert” opinion can be.

Whether the ratings agencies are grossly incompetent or not, Fitch’s concerns have merit. U.S. government spending is beginning to resemble that of drunken sailors.

The United States has spent more money than it has taken in practically every year for the last century. Operating at budget deficits is the American way. But this spending has historically been within the realm of sanity ¾ spending more in bad times to boost a failing economy.

But that’s not the case today. Not counting 2020–2021 (the COVID years), we are spending more this year than ever, which is not supposed to happen during a good economy . . . with unemployment near all-time lows!

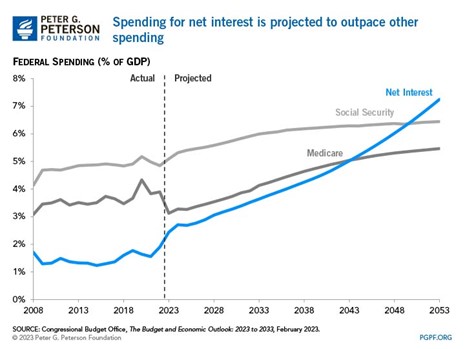

This will likely not end well. According to recent projections by the bipartisan Congressional Budget Office, the amount of interest the government will be paying on its debt will exceed the cost of Social Security and Medicare within the next thirty years.

(Again, consider the source. The CBO has a history of assuming the worst when it comes to interest rates. Its dire predictions in the past have always overestimated future interest rates. If the CBO is wrong again and rates are lower than predicted, interest payments on government debt become less ominous.)

So, yeah, maybe a “downgrade” is long overdue (actually, Standard & Poor’s downgraded U.S. debt in 2011), and maybe Fitch was just stubbornly optimistic (or S&P is curmudgeonly pessimistic?).

Perhaps downgrades like this will finally be a wake-up call for politicians to rein in runaway spending. But don’t hold your breath.

On a more positive note, we’ve had some good data lately. The economy grew 2.4% during the second quarter, inflation plummeted to 3% (as predicted by BCWM virtually every month since it peaked at 9% in June 2022), and workers’ wages are finally keeping up with inflation.

(This morning, it was announced that inflation for July ticked up a bit to 3.2%. This was expected as not all things move in a straight line. We continue to believe that the transitory spike in inflation in 2022 was just that, a transitory spike.)

But this strength is not being experienced evenly across the economy. Certain sectors such as manufacturing, banking, and real estate are in a slump. We are in a “reverse COVID” economy, where the service sector is thriving because consumers are spending money on vacations, movies, concerts, etc., things that they couldn’t enjoy during COVID. Services make up the largest share of our economy and have been driving growth.

Even if the economic outlook has improved, the stock market still looks overvalued, so we have decreased our exposure somewhat. With interest rates where they are today, we still think the best risk/reward tradeoff is in the bond market.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.