Twelve months ago, approximately one half of U.S. voters were fairly certain that the election of Donald Trump as President of the United States would bring quick havoc to the financial system. If stock market performance is a barometer of presidential performance (it isn’t), those voters were wrong. At least, so far.

In fact, 2017 saw something that no calendar year has ever seen. The U.S. stock market produced positive returns in every single calendar month. You didn’t have to be smart last year to make money in the stock market. A chimpanzee throwing darts at the Wall Street Journal stocks page could have made profitable trades.

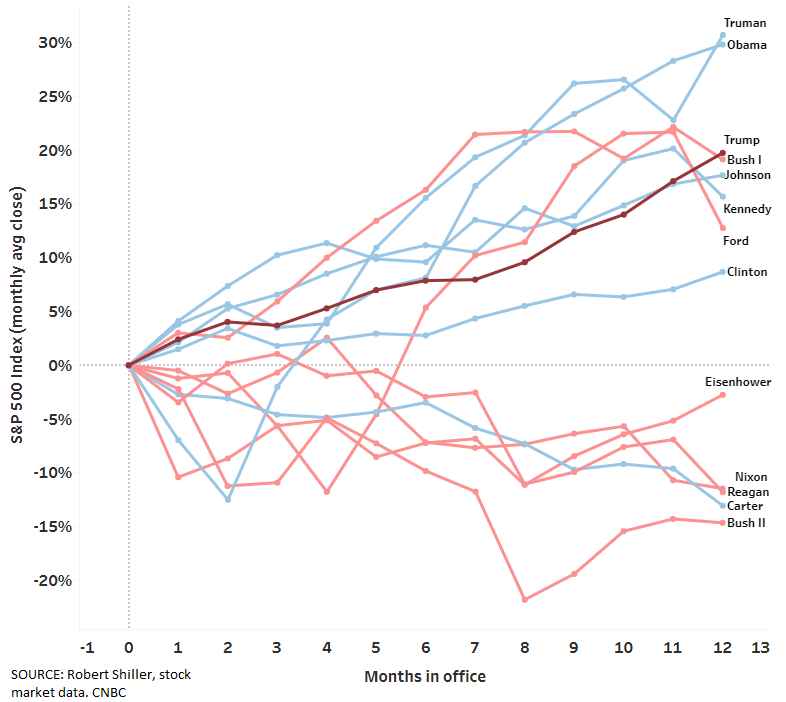

As the graph below makes clear, however, last year’s overall performance was not unprecedented in terms of first-year presidents. Mapped out are stock returns for the first year of each presidency since Harry Truman, thus demonstrating that market drivers run deeper than the occupant of the Oval Office. For example, in the first year of Obama’s tenure, stocks had just experienced one of the worst down markets ever and were recovering from the low point of the Great Recession. In 2017, corporate earnings and profitability were key drivers.

Someone asked the other day, “Well, the stock market is at an all-time high . . . what do you think it will do next year?” Our response was, “You could have asked that question last year . . . and the year before that . . . and the year before that . . . and” . . . you get the idea.

Not only has the U.S. stock market been upwardly biased, it has been extremely calm. The Volatility Index (VIX) was near all-time lows for all of 2017, and it hit its actual all-time low in September. It’s as if all the potential geo-political hot spots all over the world are on ice. Investors aren’t scared . . . yet.

Complacency in this type of market will eventually catch some investors off-guard.

________________________________________________________________

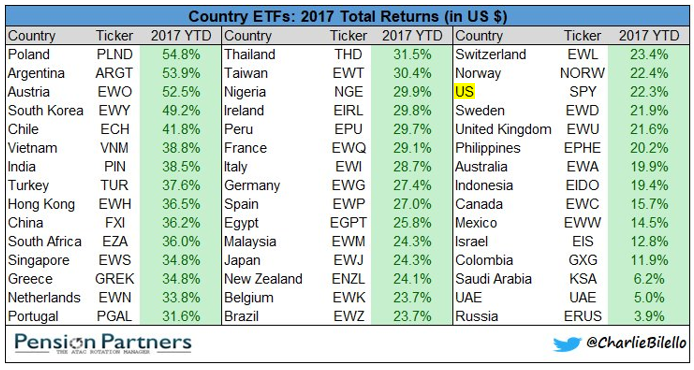

And if you thought U.S. stocks performed well, foreign stocks fared even better, particularly Emerging Markets. The table below offers the 2017 returns of every major country ETF (Exchange-Traded Funds) in the world. Notice how the top is dominated by emerging economies.

Emerging Markets is an asset class that has significantly underperformed U.S. stocks for the past six years, so it had a lot of catching up to do. And it still does. We maintain an overweight position to emerging market economies.

________________________________________________________________

As we are writing this, 2018 is off to a great start, up 2.5% in the first (holiday-shortened) week of the year. At the end of that week, we tweeted:

(By the way, you can follow us on Twitter at @boyercorporon.)

________________________________________________________________

As we move forward through 2018, the issues on our mind are the same as those at the beginning of 2017:

- Economic growth has puttered along post-crisis and we expect more of the same for 2018. We assign a low probability to any significant increase in the growth rate as a result of tax cuts, and we are watchful for when the economy does finally take a turn into recession territory. Tax cuts are typically much more effective when a country has less debt than the U.S. economy currently has.

- Inflation and interest rates remain near all-time lows. For eight years, many pundits have been convinced that inflation (and therefore interest rates) must go up, primarily due to quantitative easing (QE). They couldn’t have been more wrong, as interest rates have remained stubbornly low. Even after we saw multiple rounds of QE, rates continued to remain low. Now pundits are saying that because the Fed is shrinking its balance sheet (the opposite of QE) rates will go up. So we’re confused. Does QE make rates go up or does the reversal of QE make rates go up? Perhaps—just perhaps—there is very little correlation between the two.

________________________________________________________________

Last week the Dow Jones Industrial Average (DJIA) rose above 25,000 for the first time and the business news media got all worked up about it again, using words like “leapt” and “surged,” as if the DJIA Index is a living, breathing being.

Indexes are not living beings. They don’t “leap” or “surge” or “vault” or do any of the other stupid things for which the media gives them credit. They are nothing more than a reflection of the prices of stocks in that particular average. The reason we point this out is that those ridiculous verbs can make an investor emotional, and when investors become emotional, they almost always do the wrong thing.

And even if the DJIA Index rises a measly 10 points (less than one tenth of one percent), the phrase “record high” is invoked, as if stocks are now at some unsustainable plateau from which we will all most certainly plummet to our brutal financial deaths.

The economy is much larger today than it was twenty years ago and it will be much larger in twenty years than it is today. During the next twenty years there will be many days where the stock market hits another (boring) new record high. Ignore it.

That’s what we do at Boyer & Corporon Wealth Management. We ignore it. And we ignore everything else that isn’t relevant to making a sane and sound investment decision.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.