The Fed raised interest rates last week – a big whopping ¼ of 1% – the first increase in almost a decade. We’ve known this was coming for months… actually thought it might have occurred in September, so the increase in December was not a surprise. The only surprise would have been if they HADN’T raised the benchmark rate.

As I predicted months ago, this was one of the biggest non-events since Y2K. Raising the rate from ¼% to ½% is like increasing the temperature outside from 72° to 73°. Not really noticeable and the weather seems just as pleasant.

The reasons the Fed gave for the token rate increase is that job creation is on track and inflation targets are allegedly on track. At Boyer & Corporon Wealth Management, we think inflation possibilities are more “off track” than “on track.” They might be off track for a significant length of time. We feel the prospects for inflation are unlikely for many years to come. But since the “official” unemployment rate is hovering around 5%, it was enough of an excuse for the Fed to raise interest rates.

We are a generation that obsesses about inflation and high interest rates. We constantly look for warning signs that inflation is going to rise uncontrollably. That’s because we vividly remember our younger years when we experienced double-digit inflation and interest rates.

My parents’ generation lived through the depression as children in the 1930s. That period left them emotionally scarred, and they lived the rest of their lives doing whatever necessary to avoid a repeat. They lived frugally and saved, always worried that they could be out of work and penniless again.

My generation never had to live through a depression. However, we had to listen to our parents talk about it and that was pretty depressing. Although we never experienced a depression, we lived through a period of absurdly high inflation and high interest rates in the 70s and 80s. In 1981, inflation was 14%, mortgage rates were 16% and liquid money market funds were paying 18%. Like our parents who were obsessed about a repeat of the depression, we will go to our graves convinced that we will see double-digit interest rates again in our lifetime. Which is really stupid because it is not likely to occur.

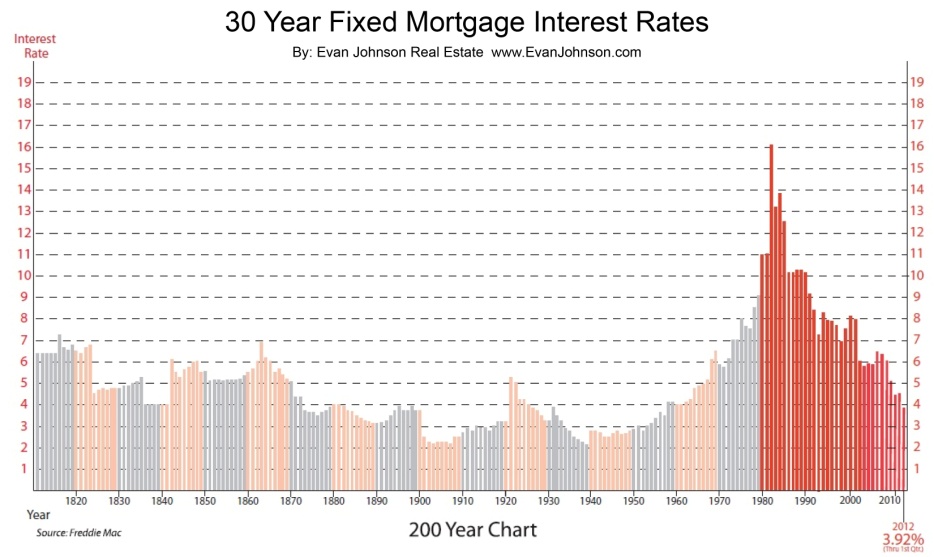

Below is a chart showing 30-year fixed mortgage interest rates going back to 1800. I’m not sure what kind of houses they were buying 65 years before the Civil War and lending sources were probably quite a bit more scarce than today. Nevertheless, they apparently had 30-year mortgages and someone apparently kept a record of them. Mortgage rates have NEVER been in double digits except the period when MY generation wanted to buy a house. NEVER! And they probably won’t be for another 200 years, which is not good news for those guys wanting to sell you gold bullion.

So if you are rushing to get that mortgage on your new home before mortgage rates skyrocket, you can relax. It’s not gonna happen anytime soon. Mortgage rates might even go lower.

The chart below shows the interest rate on a 10-year US Treasury bond since 1790. That’s right, 1790! Fourteen years after we became a country! Again, it’s pretty obvious that double-digit interest rates are pretty much a Baby Boomer phenomenon and will not likely repeat itself during our lifetime… or our children’s lifetimes. But that won’t stop us from worrying about it.

Another reason we are not likely to see inflation any time soon is because the Chinese economy hit the brakes a while back, and the rest of the world went through the windshield. The economic slowdown in China has had a dramatic impact on commodity prices around the world. The Commodities Research Board Index (an index that includes metals, energy, livestock and agriculture) has declined 35% in the past four years, much of that in the past two years (below).

Until global demand picks up, this trend will continue.

Meanwhile, you get to enjoy gasoline at low prices for a longer period than you may have thought possible. This is good.

November was quietly mixed. U.S. stocks (the S&P 500) were just barely positive (+.30%), while foreign stocks suffered another decline (-2.21%).

For the 12-month period ending November, U.S. stocks increased almost 3%, while foreign stock declined almost 10%, leading us to believe that foreign stocks (and debt) are getting close to being a good investment since NOBODY seems to want to own them.

Speaking of nobody wanting to own them, high yield bonds seem to be currently suffering from “bond mutual fund investor panic.” It occurs when investors hear pundits on television shout warnings about a particular asset class. Five years ago, it was California municipal bonds. Today, it is corporate high yield bonds, as well as foreign bonds. As investors call their mutual fund company to redeem shares of their high yield bond fund, the fund manager is forced to liquidate bonds at precisely the same time that other bond fund managers are doing the same thing for the same reason. With only sellers in the marketplace, liquidity dries up and prices plummet.

Meanwhile, Treasury bonds were totally unimpressed by the Fed’s rate increase. The 10-year Treasury finished November at 2.2%. A year ago, it had a yield of 2.16%. Stay tuned for the next Fed rate increase. I predict it also will be a colossal non-event.

At Boyer & Corporon Wealth Management, we have a higher allocation to cash than normal and are slowly looking for opportunities in the equity markets. And we are not as concerned about portfolio duration as we used to be.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.