Ron DeSantis finally threw in the towel this week, leaving Nikki Haley as the lone Republican candidate who hasn’t yet figured out that she has no chance against Donald Trump.

Trump had a landslide victory in the Iowa caucus and he didn’t even campaign! He was busy defending himself in the New York courts on a variety of charges.

For whatever reason, Republican voters are clearly stating they are “all in” on Donald Trump as their man for the White House . . . officially making this the most polarizing and tumultuous election year in the history of Planet Earth.

So, then the question is . . . who will 78-year-old Donald Trump be running against? Will it be 82-year-old Joe Biden? Or Dean Phillips, who is starting to make some noise? Or . . . ?

It’s almost February, and this is still not yet clear. What IS clear is that no one can mobilize the Democratic voter like Donald Trump.

It is a good time to remind you once again that whoever sits in the Oval Office gets way too much credit when the economy does well and way too much blame when it does poorly. There are so many forces at work that the president has no control over – $34 trillion of national debt, an aging and increasingly polarized population, de-globalization, etc.

Perhaps the most pressing issue facing the next president is the rise in geopolitical tensions across the globe. The world is increasingly at war. In fact, the latest Armed Conflict Survey, published by the International Institute for Strategic Studies, revealed that the number of regional conflicts is the highest in three decades. Expect Air Force One to rack up frequent-flier miles.

At this time last year, it was widely expected that the economy would have a hard time growing, and could even possibly shrink in 2023. However, consumers kept on spending, as did our government, and the economy grew nicely (2.5%).

We do not expect government spending to prop up the economy in 2024, and we are still on recession watch. Over the past couple of years, the Federal Reserve hiked short-term interest rates from 0% to 5.25%, to slow the economy and tame inflation. This worked well and inflation dropped from 9.1% to just over 3%. Now, all eyes are on the Fed to see if it will take its foot off the brakes, signaling inflation is back under control.

Perhaps inflation will decline further and the economy will keep chugging along, but our expectation is that the economy will show more signs of weakness and the Fed will soon be forced to cut interest rates to stimulate growth.

In March of last year, we wrote that the Fed rate hikes would have unintended consequences.

Too much stress on any system and things start to break. We saw it with cryptocurrencies (FTX) and then regional banks . . . and the pain for the latter isn’t over yet. The next domino to fall will likely be commercial real estate.

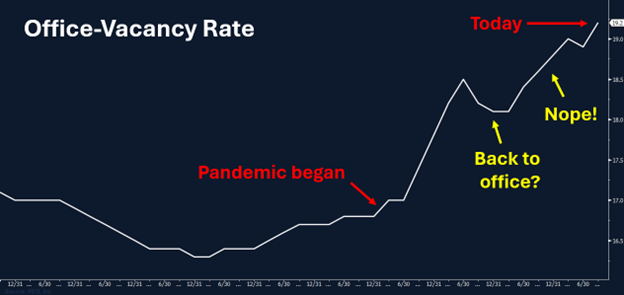

COVID hit the commercial real estate (CRE) market with a double-whammy: it made office buildings less necessary (people started working from home) and it jacked up the cost of owning them (interest rates went up).

In a recent “60 Minutes” segment, Columbia Business School Professor Stijn Van Nieuwerburgh called the CRE market a “train wreck in slow motion.”

That’s because the average American is working more days from home than they were before the pandemic, and many of their employers haven’t yet had to make decisions about renewing their office lease. The work-from-home phenomenon happened in the last four years, and a typical office lease is five years. Employers are now asking themselves, “Do I want to renew this space? Do I want to go somewhere else? Maybe I only need half the space.”

Some tenants have already been making these decisions and we’ve seen the office-vacancy rate in the U.S. climb.

Leases aren’t the only contracts that come up for renewal every five to ten years – the loans that building owners use to finance office buildings do as well.

These aren’t like home mortgages on 30-year terms that are paid down over time. They are much shorter and often “interest only,” with a balloon payment at the end of the term. The assumption typically is that those loans will be refinanced with little friction.

Not anymore.

Rising interest rates have highlighted problems on bank balance sheets (ahem, ahem . . . Silicon Valley Bank), and those same regional banks are the biggest lenders to the commercial real estate market. They own $2 trillion of the $3 trillion in CRE loans. And most of them weren’t sold off to investors. The banks still hold them on their balance sheets.

And the buildings backing the loans have dropped significantly in value. So, as the loans come up for refinancing, the banks are being much more stringent with their loan terms. Borrowers are being asked to cough up larger down payments. And even those who qualify are then facing higher loan payments, owing to higher interest rates. Building owners have big, ugly decisions to make: Do I refinance and put more of my own cash at stake, or do I walk away and let the bank have the building?

The best thing that can happen for banks is for interest rates to decline, allowing building owners to refinance at more favorable rates.

The worst thing that can happen is that they end up as landlords of real estate that used to be worth $2 trillion but isn’t anymore, resulting in a fresh banking crisis.

Fun.

Every January, the market gurus on Wall Street dust off their crystal ball and project how the stock market will perform during the year. Everyone wants to know the unknowable: What return should they expect?

At BCWM, we do things differently, focusing more on investment risk, not return. We try to assess the opportunity for making a good return.

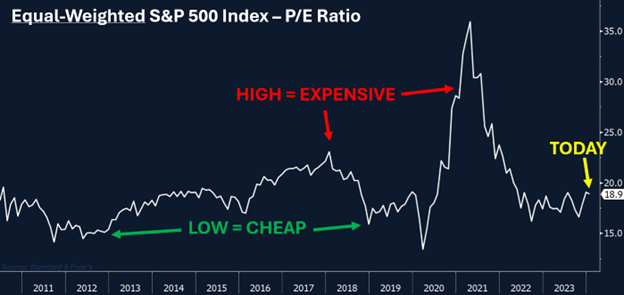

For example, if you can buy a stock cheaply, then there is less risk of losing money. Buy an expensive stock and there is more risk of the value dropping if the company can’t deliver on high expectations. The price-to-earnings ratio is one way to measure this. The higher the P/E ratio, the more expensive a stock or stock index (and vice versa).

Today, the P/E ratio of the S&P 500 Index is high (23.6) relative to the average historical range (16-18) suggesting the stock market is expensive, and the risk of investing is higher.

We have discussed how the S&P 500 is distorted by the largest companies in the index. The Magnificent Seven, as they are known – Microsoft, Apple, Meta (Facebook), Alphabet (Google), Amazon, Tesla, and Nvidia – make up a ridiculously large portion of the index. If you want to get a more accurate measure of how the average stock is doing, you need to look at the Equal-Weighted S&P 500 Index. Same set of stocks, just giving each of them an equal impact on the overall value.

Today, the average stock is not all that expensive. The P/E ratio of the Equal-Weighted S&P 500 Index (18.9) is near the historical average. There is not a higher inherent risk in stock prices. It only looks that way because of the Magnificent Seven.

2023 was a good year in the stock market, but it was a magnificent year for tech stocks and anything that seemed to be associated with Artificial Intelligence (AI). Today, AI is being used to boost productivity and profits for some companies, but it will take time for it to become more widespread (while hopefully staying human friendly). And just as with every other technology, as it starts to gain traction, there is way too much hype, which the stock market reflects.

We think 2024 could be a lame year for tech stocks, solely because there was too much exuberance in 2023. That’s before you start talking about the “R” word . . . recession.

If we do get a recession in 2024, the stock market will likely not perform well, no matter how you measure. However, the stocks that we expect to hold up the best will be those that trade at fair prices. That’s why we care about things such as stock valuations and P/E ratios, because they help us manage risk in investment portfolios.

At BCWM, we like stocks that deliver steady returns and pay dividends. And our number one piece of investment advice for 2024 is to maintain a healthy allocation to investment-grade bonds. They offer the best risk-adjusted return.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.