OK, when we’re wrong, we’re wrong. A year ago, we predicted that Nicolas Maduro wouldn’t make it through the year as Venezuela’s leader. At the time, Venezuela had an inflation rate of 10,000%, and 85% of the population lived in poverty. Things are not much better today.

But somehow Maduro is still making the rules and signing the checks. And although we’re still convinced that his presidency is on a short leash, he has nonetheless managed to hang in there much longer than one would have imagined possible in a country that has proven once again, in a most profound way, that socialism is not a successful economic or political solution.

__________________________________________

Here is a very interesting but useless factoid from the investment management nerds at BCWM: In 2014, the Kansas City Royals made it back to the World Series for the first time in almost thirty years, coinciding with the Ebola virus outbreak. This year, the Kansas City Chiefs made it back to the Super Bowl for the first time in 50 years, the same year as the coronavirus outbreak. So far, there is no evidence of correlation or causation.

And oh, by the way, the only thing you get from drinking a lot of Corona beer is drunk. You don’t catch a virus.

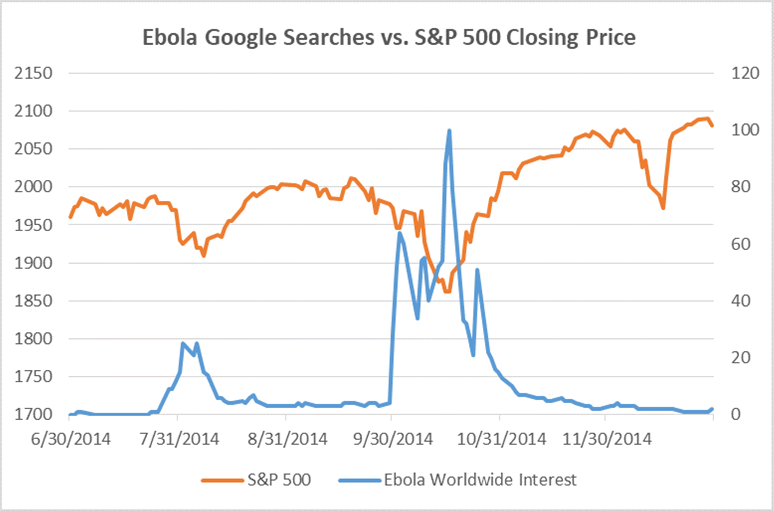

On a more serious note and with information that might actually have some merit, it appears that virus outbreaks make investors nervous. Below is a graph showing the performance of the stock market (S&P 500) graphed against the number of Google searches for the Ebola virus in the second half of 2014. It would seem that the more people read about the Ebola virus, the less they wanted to own stocks.

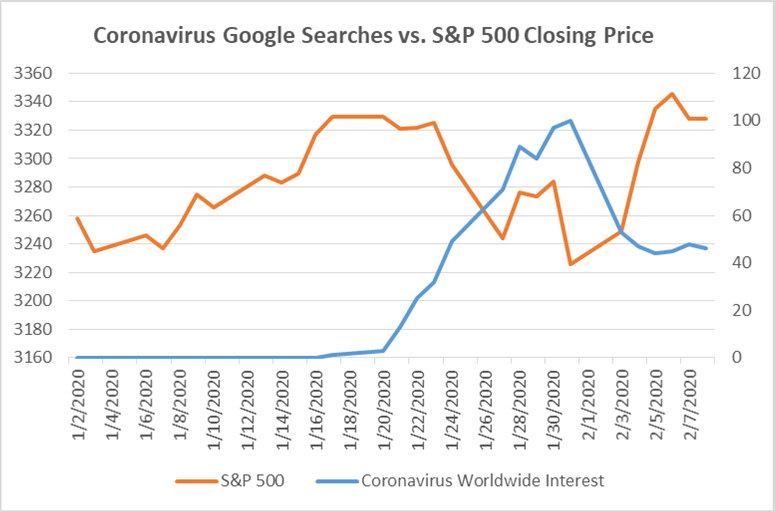

Fast forward six years and the same pattern holds when comparing Google searches for the coronavirus.

So if we get the notion that the coronavirus is going to be much larger than it currently is, we may begin to lighten up our exposure to equities. At this printing, we have no reason to feel that way.

By the way, here is what Richard Boyer wrote in 2014 about the Ebola virus:

- It is transmitted through contact with blood or bodily fluids, not through the air like influenza. That is a good thing. If it was contracted through the air, we all might be quarantined already.(OOPS! The coronavirus is spread through the air.)

- Symptoms don’t appear immediately. They can take a couple of days or more after exposure to the virus although 8–10 days is most common. This is a bad thing. Walking around with the virus unaware you’re infected can cause others to contract it.(Yeah, same problem now.)

- It is deadly.(So far, more than 1,000 have died on mainland China.)

I am not yet all that worried about the health issues associated with the virus. What I am worried about are the economic issues associated with the virus. What concerns me is that people will get scared about contracting the virus . . . scared enough that they begin to dramatically change their behavior.

__________________________________________

As promised over three years ago, Britain has finally left the European Union . . . well, almost. On January 31, Brexit became official, but it didn’t become final. By that we mean that there are still some details to work out, details that can now be attended to without the distraction of a “Brexit cancellation possibility.”

Both sides now have to muck through a “transition period,” which is supposed to end December 31, 2020. (Though, if the transition period is anything like Brexit, it could be December 31 of 2023.) This transition phase could prove even nastier than what has played out thus far. Among the obvious concerns (trade, security, law enforcement), there are a plethora of other items to work out (access to fishing waters, banking, data- and intelligence-sharing, etc.).

Britain will hope to achieve near-frictionless trade with the EU while enjoying the ability to strike its own trade deals with the rest of the world. Given their bargaining position, it is unlikely they will get to have their cake and eat it too. The EU will want to keep Britain’s regulations as close to that of the EU’s as possible and ensure businesses in the EU are on a level playing field with those in the UK (i.e., no huge tax breaks to entice businesses to move to Britain).

One of the biggest roadblocks to the withdrawal agreement and thus to the conclusion of this next chapter is sorting out the border between the Republic of Ireland and Northern Ireland. In short, Northern Ireland is part of the United Kingdom and will be leaving the EU, but it shares a land border with Ireland, which is a sovereign nation and will remain a part of the EU.

Striking an agreement within 11 months seems incredibly unlikely. But failure to reach any consensus would mean that Britain would crash out of the EU bloc with no deal at all, raising the prospect of tariffs and border disruption leading to economic damage for both sides and possibly the rest of the world. Don’t be surprised to see additional “extensions.”

__________________________________________

The economic backdrop has not changed dramatically in recent months. We learned that the U.S. economy grew a so-so 2.3% in 2019, making it 14 straight years of sub-3% growth. Economic growth like this is not going to send inflation higher anytime soon, therefore we maintain the “lower for longer” outlook on interest rates. As we write this, the 30-year U.S. Treasury is less than a tenth of a percent from its all-time low.

That being said, U.S. stocks are at all-time highs. Being diversified and diligent in managing portfolio risk is more important now than ever.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.