Every once in a while, the thought occurs to me that maybe I should write these Investment Commentaries quarterly instead of monthly. It would be refreshing to only have to publish such gloomy and discouraging comments every three months. Nevertheless, brace yourselves.

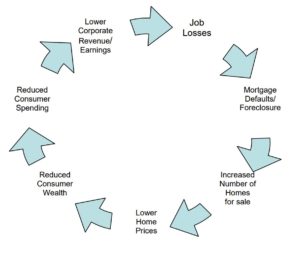

If you thought it couldn’t get any worse, you were mistaken. In our September Commentary we predicted that 2008 was going to experience a “reality” Christmas. The “reality” was retail sales were the worst since the data was first recorded in 1970. After the initial massive wave of mortgage defaults and foreclosures, the economy was hit with rapidly declining home values. Declining home values led to reduced consumer wealth which led to reduced consumer spending. Because of reduced consumer spending, corporate earnings suffered dramatically which has resulted in massive job cuts and increased unemployment. Higher unemployment will certainly cause more people to default on their mortgages leading to more foreclosures perpetuating the vicious cycle.

Approximately 2.6 million jobs were lost in 2008, the highest annual job-loss total since 1945. On Monday, January 26th, major corporations announced job cuts totaling over 70,000….just that day alone!!! If you have been reading my monthly commentary, you know that I feel an economic recovery (and ultimately a recovery of the securities markets) will not occur as long as real estate values continue to suffer. On January 15th, RealtyTrac announced that there were 303,410 new foreclosures in December. This was a 40% increase over December, 2007 and a 17% increase over the previous month.

What is extremely significant about this is that on November 20, Fannie Mae and Freddie Mac declared a “moratorium” on owner-occupied homes between November 26th and January 9th. Fannie and Freddie apparently are the same organizations that are in charge of a Middle East cease-fire. If there were 303,410 new foreclosures during a moratorium, it might be shocking to discover how many foreclosures there are AFTER the moratorium was lifted. We will find out in mid-February.

The Wall Street Journal reported that a popular form of mortgages issued between 2004 and 2007 is beginning to experience increased default rates. These mortgages, known as Option ARM, are not considered “subprime” and were supposedly issued to borrowers with higher credit scores. They appeared attractive to the borrower at the time because they were adjustable rate mortgages which initially gave the home buyer a choice of how much to pay each month. Some “minimum” payments allowed the home buyer to pay LESS than the amount of monthly interest that was due. This is known as “negative amortization” (“NEG-AM” to mortgage business insiders) and causes the principal balance owed to increase.

Here’s the scary part:

Over $750 billion were issued in that three year period

Over 55% of those with Option ARM mortgages owe more on their house than it is worth today

As of year-end, 28% of Option ARM mortgages are delinquent or in some stage of foreclosure.

Gross Domestic Product for the 4th quarter of 2008 declined 3.8%. However, GDP includes “inventories” which is products that have been made (or are in the process of being made) but have not yet been sold.

Excluding inventories, GDP declined 5.1%. The 4th quarter GDP decline was the worst since 1982. Consumer spending in the 2nd half of 2008 was the worst 6-month period since 1947.

The build-up in inventories during the 4th quarter might lead to a worse GDP number in the 1st quarter of 2009. If a corporation has too much inventory, that means consumers are not buying. It means the corporation needs to reduce production, which likely will lead to job cuts. To finish this thought, go back and re-read the second paragraph.

The U.S. stock markets hit bottom on November 20th and then rallied over 20% through January 6th. Since January 6th, they have declined over 10% and the Dow Jones Industrial Average finished the month of January down 8.84%. This was the worst January for the DJIA EVER!! It was also the worst January EVER for the S&P 500 (down 8.57%).

Last month I postulated that more Ponzi Schemes would be exposed as markets declined and investors asked for their money back. In the month of January there were at least six alleged Ponzi Schemes uncovered, one for $350 million. If six were uncovered that quickly, you can bet there are many more. If you are paying someone to manage your money, you should not be paying that entity to hold your money as well. The custodian of your funds should be separate from the manager of your funds.

On January 20th, Barack Obama was inaugurated and citizens flocked to Washington like investors to a Ponzi Scheme. It was a beautiful day (although extremely cold) and it was nice to see American citizens excited about government. Having said that, remember that this economic crisis is much larger than the President of the United States. The House of Representatives approved an $819 billion economic stimulus package and the Senate will soon vote for a $900 billion package.

Ultimately, whatever is agreed upon will almost certainly exceed $1 trillion. I will probably read the final version so that I can explain it to you in my March Commentary but I don’t even pretend to believe it has any power to change the current course of our economy. I don’t even think President Obama believes it will cause significant positive change. However, as a newly elected President, he MUST propose something and APPEAR to be taking constructive action. He would receive a large amount of criticism if he did nothing and allowed the only real solution to this problem to play out.

What is the only real solution? Time and pain. Our economic plight was not created overnight. It took several years of economic mismanagement and it was successfully exported all over the globe. I chuckle when I hear lawmakers talking about creating a “bad bank” to take the toxic investment assets off the books of our banks so banks can begin lending again. What about banks in Europe? What about banks in Asia? Is this “bad bank” going to buy their toxic investment assets too?

When the last bad mortgage has been foreclosed upon and the demand for homes begins to exceed the supply of homes and the average person can qualify for a modest mortgage (and can make a DOWN PAYMENT!!!), we should begin to see a slow, modest economic recovery. I don’t know how that can be less than a couple of years.

A lot of bad news is reflected in the prices of securities. Stock prices in general are lower than they were ten years ago. Yields on Treasury Bonds are still very low relative to municipal bonds and corporate bonds. The “flight to quality” drove Treasury yields to extremely low levels which we feel are not sustainable. However, at Boyer & Corporon Wealth Management, we feel there continues to be the threat of additional financial surprises throughout the world…unpleasant surprises that are not yet reflected. Money market yields are close to 1% but investing elsewhere should be done with caution. One doesn’t get additional reward without additional risk.

I am more worried today about 2009 than I was one year ago today about 2008. We continue to hedge our equity positions. We are also beginning to hedge our fixed income positions since Treasury yields are likely to rise. Meanwhile we continue to search for yield in safe, short-term fixed income securities.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.