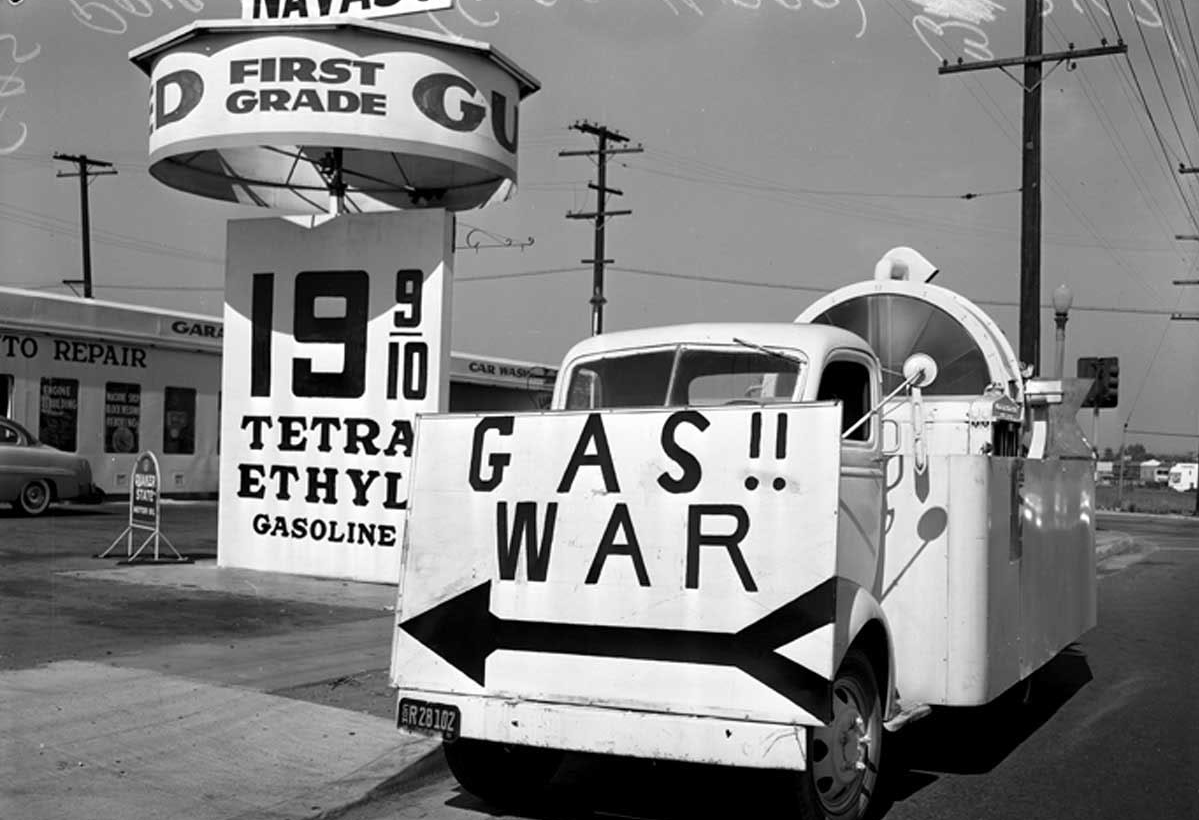

It will probably never get to the point where competing gas stations conduct “gas wars” like they did back in the 60s. Heck, it’s hard to find two stations across the street from each other anymore. But if the price of oil continues to plummet, it may start to FEEL like stations are having a gas war. One can only hope.

There is probably no better gauge of a slowing global economy than the decreasing price of oil. Oil is the one common engine that provides the energy for virtually every modern economy. If there were any doubt that global economic activity is slowing, the recent collapse in the price of a barrel of oil should convince you otherwise.

In June, a barrel of oil (also known as West Texas Intermediate (WTI) crude) traded as high as $101. As I am writing this, a barrel of WTI is trading just below $56 per barrel, a decline of almost 45% in less than six months. During this period, almost all other commodities have also declined in price, though not to the same extent.

Of course, a slowing global economy is not the only reason the price of oil has collapsed. Increased production, particularly in the United States has led to the eventual point where supply outpaced demand. Fracking in the Dakotas and Texas has made the U.S. a major player in oil production.

Because of the global slowdown, stocks in foreign markets, particularly “emerging markets,” have been getting blistered this past month. Greece (a perpetual emerging market) lost 22%, Brazil 21%, Chile 10% and Russia over 30%. Russia, it should be noted relies heavily on oil exports for much of its income, so it’s getting crushed because of the global economy AND the drop in oil prices.

What’s interesting is that the U.S. economy is actually slowly continuing to heal and expand. After the balance sheet recession of 2008-2009, we are now experiencing GDP growth in excess of 2% year over year. That rate of growth is certainly lackluster compared to historical standards in the United States, but nevertheless, it has been growing very consistently now for more than five years.

Over 320,000 jobs were added in November, the tenth consecutive month of job gains in excess of 200,000. Wages are increasing (slightly) in some areas. Retail sales are up and the reduced cost of filling your tank at the pump is giving most Americans more money to spend or pay down debt. All this and more has led the Consumer Sentiment to rise in December to almost an 8-year high. Improved prospects for jobs, higher wages and lower gasoline prices have everyone feeling giddy.

All the extra money that people will save on gasoline this year should make for happy holidays. This could be one of the best holiday shopping seasons in years.

And it continues to happen during a period of very low inflation so the increase in spendable dollars is very REAL, not imagined.

One other result of a slow global economy is that interest rates continue to stay low… and trend lower. Several months ago, I stated that we thought we would see the 10-year Treasury bond close to 3% by year-end. It is now officially safe to say I was wrong. Last month it was around 2.3% and it is at 2.1% today. I don’t think we are going to see 3% in the next two weeks

And the 30-year Treasury bond, which has been above 3% most of the year, is now trading at 2.7%.

Is the Federal Reserve Bank going to raise the Fed Funds rate any time soon? After all, unemployment is now down to a respectable 5.8%, and we are beginning to see some wage growth. Both of those indicators were allegedly key metrics for helping the Fed make the decision to tighten the reins on money supply.

The answer? It doesn’t really matter what the Fed does or when they do it. The bond market is telling you the Fed is not going to raise interest rates in the near future, but who really cares? Way too much money has been gambled and lost trying to figure out what the Fed is going to do, and when they are going to do it. Quit worrying about the Fed and pay attention to the economy.

The U.S. dollar continues to strengthen against most major currencies, which is another reason the Fed might be reticent to raise interest rates. Higher interest rates attract money from around the world, which drives the value of the dollar even higher. The Fed doesn’t want a strong dollar. A strong dollar makes our goods more expensive to foreign consumers, and it makes foreign goods cheaper to us.

While we’re talking about currency moves, it’s amazing to witness the devaluation of the Russian ruble vs. the U.S. dollar. Last December, you could buy 32 rubles with a dollar. This year? 64 rubles. The Russian currency has lost half its value in one year! That makes it very cheap to take that trip to St. Petersburg you were planning.

Just today, Russia announced an increase in its key lending rate from 10.5% to 17%. The fact that their key lending rate was at 10.5% in the first place tells you how much trouble they are in. There are a lot of numbers between 10.5% and 17% and they skipped all of them and went right to 17%. Hiking it to 17% is a desperate attempt at attracting capital to a country whose currency is plummeting in value.

At Boyer & Corporon Wealth Management, we are taking advantage of lower interest rates to reduce the duration of our fixed income portfolio. The eventual rise in interest rates (eventual being a vague term) will not be kind to fixed income portfolios. Although we still have a significant allocation to zero-coupon municipal bonds (primarily from cities and school districts in California), it is approximately half the allocation it was earlier this year.

Emerging markets have taken their toll on portfolio performance and they may continue to do so for a while. Although we like making contrarian investments, we are not adding to our emerging market allocation at this time.

We continue to view the U.S. market as “not cheap” and have written/sold extensive covered calls against many of our equity positions.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.