We’ve noticed tiny little bits of evidence that the American economy is coming back from the COVID disaster: calling a restaurant for dinner reservations only to discover it’s booked solid, news anchors broadcasting from the studio instead of their respective living rooms, airplanes no longer leaving that “middle seat” empty . . .

. . . and people going to the movie theater!

You know people are desperate to get out of the house for ANYTHING when Godzilla vs. Kong rakes in $32 million the first weekend. At one point (back in the dark days), it seemed as though there was a remote chance that the cinema might go the way of the pay phone, what with everyone learning how to stream movies on their gigantic high-definition TVs. We are glad to discover that’s not the case! Now if Hollywood would just make some movies that aren’t so depressing.

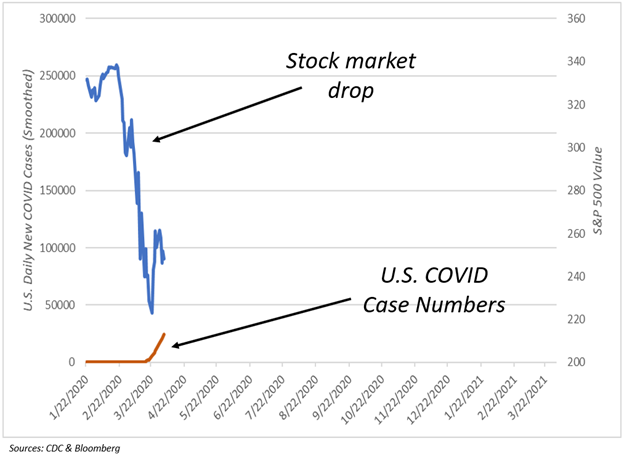

Of course, the stock market has been indicating that America is coming back for over a year now. The S&P 500 Index hit bottom March 23 last year and has rallied about 90% since then.

Somehow, the stock market seems to have an uncanny ability to look beyond what is happening today.

When everything looks great (like last February), somehow the market seems to realize that disaster is lurking. Even though we had very few COVID cases in the U.S., the market fell 34%.

When everything was at its most miserable (when COVID cases were rising in the U.S. causing lockdowns), somehow the market seemed to realize that the world couldn’t get any worse and that good times were around the corner.

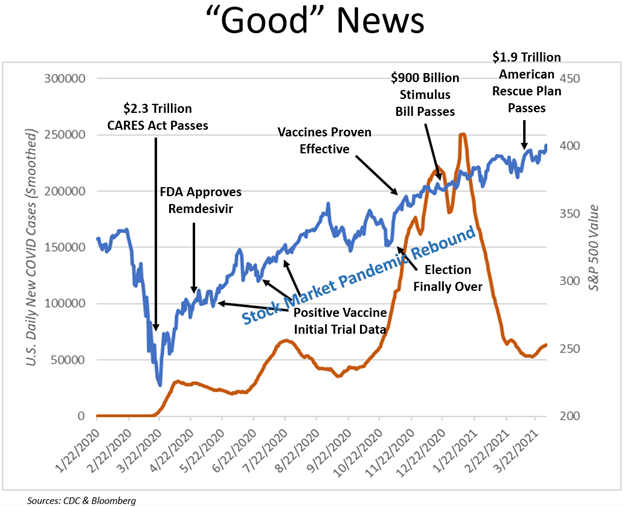

We didn’t know it at the time, but about a year ago a steady flow of good news had just begun. Even as COVID cases rose (brown line), the stock market marched upward (blue line) due to all the good news that developed over time.

Reported COVID cases took a nosedive once vaccines started rolling out in early 2021. And the stock market has continued to improve, as has the economy.

The economy still has a lot of ground to make up, but things are looking much better. It seems COVID is almost in our rearview mirror (in the U.S. at least). This all would not have happened so quickly without the massive amount of money the government threw at the problem.

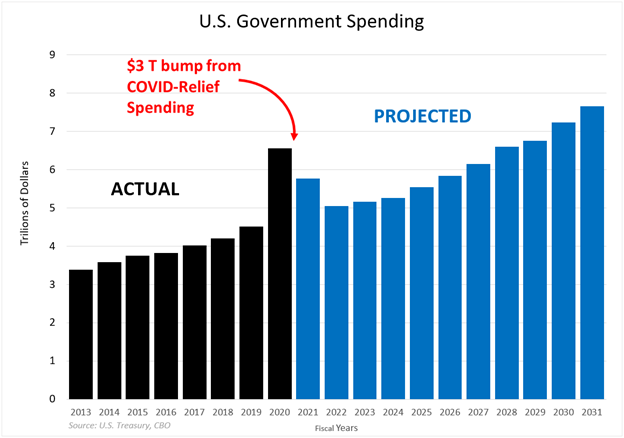

Spending our way out of COVID seems to be working for now. Nonetheless, excessive government spending is creating additional problems, namely, debt that will restrict economic growth in the future. Government spending has been increasing for years and shows no real signs of abating.

The graph above shows the $3 trillion “speed bump” related to COVID payouts during the past year. However, it does not include the effects of the recently passed $1.9 trillion COVID relief package or the recently proposed $2.3 trillion infrastructure bill. In the coming weeks, President Biden is expected to present plans for even more spending. It is likely, though, that some of the proposed spending will be offset by tax hikes.

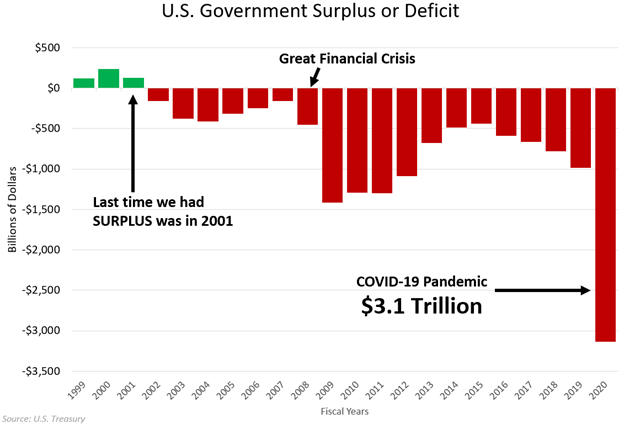

Generally, higher taxes are no friend to the economy, but the government has a bad habit of spending more than it takes in and thus needs to make up the difference somewhere. We have been running budget deficits for years. In 2020 alone, the government spent about $3 trillion more than it took in. In 2021, the budget deficit is expected to be around $2 trillion. With no planned spending cuts, tax hikes seem to be the primary solution to this problem.

The infrastructure bill in particular is supposed to be offset with higher corporate taxes. We expect such a tax increase to create a headwind for the stock market, but this proposal is not a surprise to anyone. Stocks have been pricing in the effects of this policy for months. And considering that we’re still sitting near all-time highs, we think the market is taking this news in stride . . . so far.

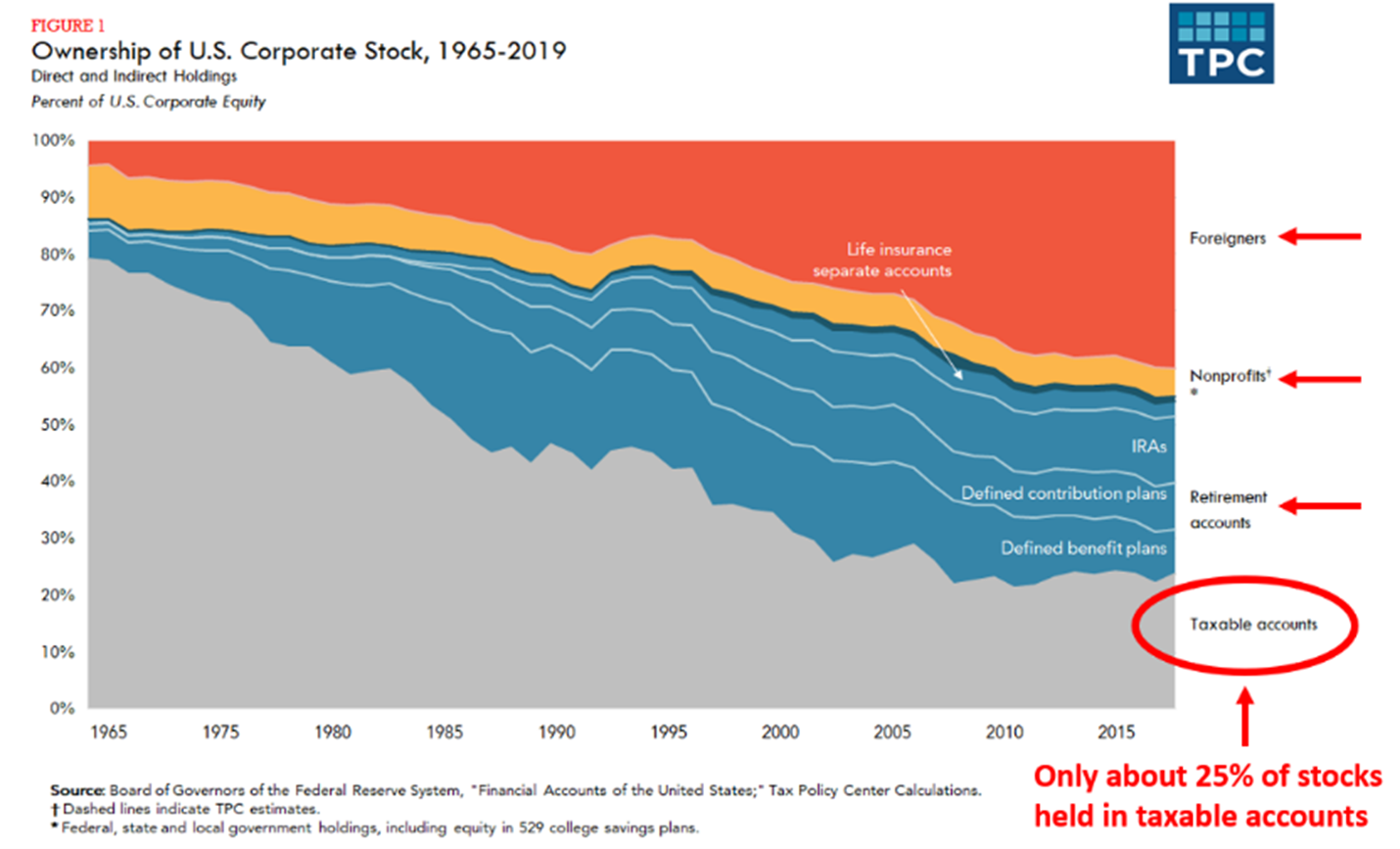

Changes to personal income taxes are on the horizon as well, including higher taxes on stock market returns (dividends and capital gains) for high wage earners. Intuitively, you may assume this would hurt the stock market, but look at who this tax would affect.

Today, the majority of U.S. stocks are held by foreigners, nonprofit organizations, or retirement accounts (such as IRAs and 401ks) that don’t pay annual taxes. Only about 25% of stocks are held in taxable accounts. Additionally, we expect that only those who earn over $1 million per year will be subject to the tax, further reducing the number of investors who would be affected.

Even if these tax hikes do come to pass, the vast majority of investors won’t bat an eye.

Actually, it seems very little is able to spook the stock market lately and we think stocks are still relatively expensive. As life in the U.S. morphs back into what we remember from the pre-COVID days, we are keeping an eye on whether the economy will catch back up with the stock market.

At BCWM, we know to never get too happy with the stock market. We know to never get too complacent. And, oh, after hitting recent highs in late March, interest rates seem to be continuing their downward trajectory.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.