Here we are at the end of another decade, one that seems to have passed rather quickly, as trite as that may sound. Ten years ago, our Investment Commentary noted that the period of 2000–2009 resulted in a negative rate of return for the stock market. It’s rare that you experience any period of that length with sub-zero stock market returns. Here’s what we wrote then:

An investment in the U.S. stock market from the end of 1999 to 2009 netted you a loss of just under 1% per year for ten years. In contrast, the eighteen-year period prior to 2000 was a very rewarding time to be invested in stocks. There were many years that an investor did not have to be smart in order to look smart. Everyone was a stock market expert in the 90s. If your invest process assumes that “investment pendulums” swing back and forth, you might be tempted to expect the next decade to be more rewarding.

Well, the investment pendulum did swing back and shareholders were rewarded with fantastic returns over the decade that followed (2010–2019). For the past ten years, the S&P 500 stock market index provided an annual return of over 13%! And that obviously means that during the next decade you definitely need to . . .

Wait. Not so fast. The investment world will never be that easy. Ten- and twenty-year periods are not large enough samples from which to draw definite conclusions. But if you believe in that whole pendulum thing, you probably don’t want to be 100% invested in stocks.

Here’s an interesting note: Even though stocks were negative one decade and very, very positive the next, their average annual rate of return over that 20-year period was a very boring 5.94%.

Though, over that same 20-year period the Bloomberg Barclays U.S. Aggregate Bond Index provided an average annual return of 5.05%, which is clearly a very similar return with a lot less volatility.

It stands to reason that a combination of stocks and bonds would likely have provided an average annual rate of return somewhere between 5% and 6% without all of the volatility that comes with having all your money in the stock market.

Bottom line: Since past performance does not correlate well with future performance, you might want to consider a well-balanced, well-diversified portfolio that provides a decent rate of return with the least amount of ups and downs.

__________________________________________

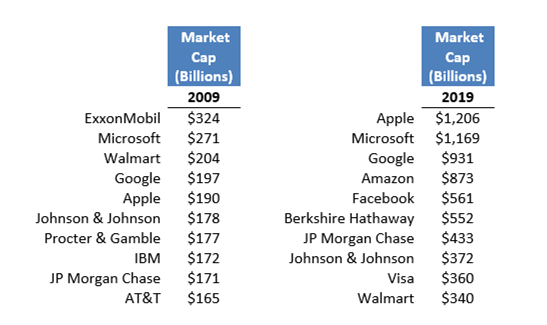

Society has changed a great deal this past decade. Using the stock market as a guide, the turnover in the list of the largest U.S. public companies reveals a lot.

Two new companies that make the list need no introduction: Amazon and Facebook. While they both existed 10 years ago, they have since grown to dominate their respective industries. And many people in the world interact with Amazon or Facebook every single day.

Also, we now have a much heavier concentration of tech companies. No longer in the top ten are the likes of ExxonMobil, one of the world’s largest oil companies, and AT&T, the world’s largest telecom and media company. However, the five largest companies today are all tech.

Some of these large tech companies sell products, but for the most part, “selling stuff” is no longer a top priority. Apple is focused on growing their Services segment, as the smartphone market is maturing/slowing. Google and Facebook thrive on access to your data. And not everyone knows that the majority of Amazon’s profits do not come from online sales, but from providing cloud-computing services (an industry they also dominate). Microsoft is big in the cloud-computing game, too.

The digital age is truly getting into full swing now that information is more valuable than anything else.

Some things are so commonplace today, you may hardly remember that they barely existed 10 years ago. Consider these game changers:

- The rise of the smartphone. In 2009, market penetration of smartphones had just begun. Today, phones (should we even call them “telephones”) do so much more than make calls. The iPod market disappeared five years ago because the smartphone became your iPod . . . as well as your calendar, your camera, your photo album, your game console, etc. If you misplace your phone today, it is a majorpanic moment.

- Netflix and other streaming services spent this decade (actually the last half of the decade) disrupting the TV industry that has stood since the Eisenhower administration. And you no longer even need a television to watch TV. You can watch from your computer, your iPad, or your phone. This trend will continue.

- Completely electric vehicles emerged during this past decade. We had the hybrid, but then along came the Tesla—completely electric, with technology and functionality not available on any other car. Say what you want about Tesla, but Elon Musk has changed the future of the automobile industry. Fifty years from now, grandparents will be telling their grandchildren about these places we called “gas stations.”

- Although it is not something most Americans experience firsthand, the change in the energy sector has been spectacular. At the beginning of this decade, fracking was still rather new and still somewhat expensive. Every year, technology has improved the efficiency and cost effectiveness of fracking, so that, just a couple of years ago, the U.S. went from being a net importer of energy to being a net exporter of energy. We are no longer dependent on any other nation for the energy resources needed to run our country.

This change in the energy landscape has the biggest implications for our future. Ten years ago, hardly anyone saw this coming. Who would have guessed that the United States would be energy independent? Good or bad, this gives the U.S. tremendous leverage when negotiating with other nations . . . or, rather, it takes away the leverage they might otherwise have over the U.S. (which is kind of the same thing).

Energy independence also gives the United States less of an incentive to be the world’s policeman. Americans used to have an overriding concern about unrest in the Middle East, because it was the source of most of our oil. We needed peace and quiet in the Middle East because we have millions of automobiles that need gasoline every day. If there were war and unrest in that region, we might have to pay as much for gas as the people in California do right now. That’s right, more than double what the rest of us are paying today.

But now when there is unrest in the Middle East (such as when Iran bombed the Saudi oil fields in September), it is barely a blip on our energy landscape. We just yawn and think, “Well, I hope nobody got hurt. And, by the why, I’m sure glad I don’t have to fill up my car in California.”

__________________________________________

The dramatic change in the way we produce energy is only starting to affect geopolitics worldwide. It’s possible that these changes will not have a big impact in the upcoming decade, but we think that these changes in energy sources have the potential to significantly reshuffle global power for many years to come.

Looking on to the next decade, we see a handful of issues that we could be reflecting on in 2029:

- Artificial Intelligence and the “internet of things” is the next forefront of groundbreaking technology. Because our lives are becoming more and more dependent upon our things talking to each other, cybersecurity is becoming more important by the day. Smart houses and self-driving cars are just the beginning. What’s next?

- Cyberspace is developing into the next battlefront. Traditional military forces will still have a lot of power, obviously, but countries with a weak military can still wield power with the use of cyber warfare. Cyber threats to the average Joe will also continue to grow exponentially.

- The production of fully electric vehicles will continue to evolve into a robust industry. Production costs will drop, battery lives will increase, and charging stations will proliferate. We may even start to see the value of internal combustion engine vehicles (what we call today’s “automobiles”) drop because of consumer uncertainty about their long-term re-sale value.

- Shopping malls were upended last decade. That’s old news. But what will become of the real estate? Those currently sparsely populated buildings will either evolve into entertainment destinations or distribution warehouses, or they’ll be destroyed.

And as we have said many, many times before . . . demographic trends will continue to play a significant role in driving investment returns. Baby boomers hold the greatest amount of wealth in this country, and thousands of them are retiring each day. The cohort of millennials living at home and saddled with student debt will eventually become homeowners, driving the next wave of consumer spending. And most importantly, the global binge on debt we have experienced in the last decade will weigh on future growth.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.