“Green Shoots”. Ben Bernanke used this phrase once to describe positive signs that the economy is improving (green shoots are those things that come up out of the ground in the spring and soon turn into flowers). It has become one of the most overused phrases since “Where’s the beef?” And in the month of June it was difficult to watch any business show on any business day without hearing a new piece of economic data touted as a green shoot. Here are a few “green shoots”:

Non-farm payrolls declined by 345,000 jobs in the month of May, which was well below the estimate of 530,000 jobs. This was seen as a positive by everyone except the 345,000 people who lost their jobs.

Productivity increased as fewer workers are being required to do more. Hourly output increased by 1.6%, almost double the forecast. This was seen as a positive by all except those workers who are being required to do more for the same (or less) pay.

Housing starts increased 17.2% from April to May. This statistic can have more to do with April being a miserable month for housing starts or a month of bad weather than a sign of economic improvement.

Another potential “green shoot” that may arrive soon: better than expected earnings by financial companies. The second calendar quarter just ended and earnings will be made public later this month. If financial firms report better than expected earnings, you should be skeptical. The financial industry has successfully lobbied to change a method by which they account for and report their earnings. It has to do with an accounting rule known as “mark to market” accounting. Let me attempt to explain:

Years ago, if you were an investor in a pool of mortgages, you purchased your shares of that pool in $1,000 increments (these $1,000 shares are called bonds, also known as Mortgage Backed Securities or MBS). You could reasonably expect that, over the life of your investment, you would receive interest and little pieces of principal every month as the homeowners made their house payments. The bonds are liquid and could be sold to other investors at any time. In most economies, a seller of these bonds could expect to receive close to 100¢ on the dollar (representing all the principal and interest payments). If the investor/owner of the bond is a bank, the bonds would be reflected on the bank’s balance sheet at close to 100¢ on the dollar….which is important because there are strict rules about asset levels that banks must maintain in order to continue operating as a bank. If those reserve levels get too low, the Federal Deposit Insurance Corporation (FDIC) could declare the bank to be insolvent. Then the FDIC would suddenly walk in on a Friday afternoon, close the bank, rename the bank and open it again on Monday morning.

A couple of years ago, the interest rates on sub-prime adjustable rate mortgages began to adjust upward and homeowners started to have trouble making their mortgage payments. As homeowners began to default and face foreclosure, the likelihood that principal and interest would be completely repaid to the MBS investors appeared to decline. Because of that, the market value of the MBS began to decline. Let’s face it, if you suspect homeowners are NOT going to make their monthly payment….if banks are going to have to foreclose on the homes….if the homes will have to be sold at a price lower than expected.…you would not likely pay 100¢ on the dollar for such an investment. This became very disconcerting to the financial firms that owned these securities.

Because the future delinquency rates and foreclosure rates were unknown (but didn’t appear optimistic) potential buyers for these MBS became scarce. In order to find buyers, owners of these bonds had to keep lowering the price from 100¢ on the dollar to 80¢ to 50¢ to…..eventually Merrill Lynch sold approximately $30 million face value for a little over $6 million or 22¢ on the dollar.

This didn’t make other banks very happy because of the “mark to market” rule. The mark to market rule states that investments you own have to be valued (marked) at the most recent market price. If the most recent public trade of a subprime MBS was executed by a bank at 22¢ on the dollar, then other banks would have to value their MBS similarly. That wouldn’t be such a problem unless a bank had stupidly purchased a gazillion of these bonds because they didn’t think there was very much risk.

So if you are a bank that owns a gazillion MBS and you issued a lot of loans to bank customers based upon the value of these reserve assets…..and now your reserve assets are valued at a fifth of what you paid for them, you are in big trouble. As history now shows, many large banks all over the world were in big trouble. They had been binging on MBS securities for the past several years and never dreamed they would be trading for 22¢ on the dollar. This effectively put many banks out of business and led to a domino-style credit crisis that charged its way through the entire economy and is still a long way from over.

At the beginning of this topic I alluded to possible positive earnings being announced this quarter by big financial firms. Now I can explain further. Earlier this year bank lobbyists put pressure on Congress to change the “mark to market” rule. As a matter of fact, all 33 members of the House Financial Services Committee (led by Barney Frank) received campaign contributions from the American Banking Association during the first quarter of this year. The ABA blamed the “mark to market” rule for the collapse of the banking system and for the credit crisis. It didn’t seem to occur to them that purchasing a gazillion dollars of anything might not be prudent. No, the problem was NOT the banks’ lack of investment acumen….the problem was FASB (pronounced FAZBEE, which stands for the Financial Accounting Standards Board). FASB determines how assets and liabilities should be valued on a company’s financial statements. FASB was apparently operating under the misguided assumption that, if someone will only pay you 22¢ on the dollar for a financial asset…..well, it must only be worth 22¢ on the dollar. The financial services industry convinced Congress that the actual value of an investment asset might be worth more than the most recent market price (never once considering that the investment asset might actually be worth LESS).

Congress, always looking for ways to fix the problem they created with the “everyone should have a right to own a home” campaign in the 1990’s, was eager to take credit for fixing a problem they claimed was created by Wall Street (Congress created the problem and Wall Street made the problem mushroom). So Congress told FASB they needed to change the “mark to market” rule….and if FASB didn’t do so forthwith, FASB would find itself under new supervision. As a matter of fact, legislation was introduced that would place FASB under the supervision of the SEC, the Federal Reserve Board, the Treasury Department, the FDIC and the Public Company Accounting Oversight Board. I’m not sure how they left out the Environmental Protection Agency.

On April 2nd FASB reluctantly changed the rule to state that financial firms could “presume” that markets were dysfunctional unless ample evidence could prove otherwise. If markets are presumed to be dysfunctional, financial firms don’t have to use market prices. Rather, they are able to use “internal models” to determine the values of investment assets. Do you get it now? Last fall, when financial firms had to recognize that the market value of their investment assets had dramatically declined, they took huge losses. Temporarily those losses were only on paper because many mortgages at that time were only presumed to be bad. Many actual delinquencies and foreclosures were yet to happen. Financial firms no longer have to concern themselves with the actual market value of those securities. They can more or less value them wherever they want. And if they increase the value of those assets on their balance sheets, financial firms will show huge profits….again, only on paper since it merely reflects a change in the reported value of those assets. So as the financial firms announce impressive earnings for the 2nd quarter, don’t be impressed.

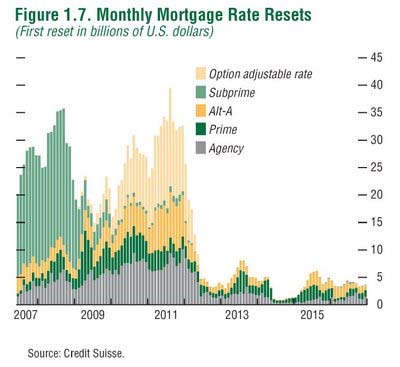

An additional reason you may not want to be impressed is illustrated in the chart below. This chart shows the dollar amount of adjustable rate mortgages that “re-set” every year. When they re-set, the higher interest rate and increased mortgage payment lead to increased delinquencies and foreclosures. The green bars on the far left represent sub-prime mortgages which are almost completely a thing of the past. The orange and yellow bars to the right represent Alt-A mortgages and Option ARM mortgages (I wrote about these last month) which have yet to re-set and represent another large wave of delinquencies and foreclosures (and potential problems for financial firms owning these mortgages):

Government intervention and political manipulation do not solve the problem. They mask and prolong the problem. Poorly run financial firms (and auto manufacturers) should be allowed to disappear, leaving more efficiently run companies in their places. Yes, there have been over 50 banks closed this year by the FDIC (surpassing the total for 2008) but the evolution of capitalism has not been allowed to run its course with the institutions deemed “too big to fail”.

Another example of misguided government intervention occurred this month in California. Governor Schwarzenegger declared a three-month moratorium on home foreclosures in California. In our April Investment Commentary, I included the following chart which is now updated through May. This chart shows the total number of home foreclosures filed each month for the past four years.

Because California represents a large part of the total foreclosure picture, you can expect to see the total number of foreclosures decline significantly for three months and then spike to another new high shortly thereafter. The moratorium will not solve the problem. It will merely mask and postpone the problem….just like the change in the FASB “mark to market” rule. Perhaps the Governor thinks property values will stabilize. Perhaps he thinks the homeowners and the lenders will come to a financial compromise that avoids foreclosure. Perhaps he doesn’t believe either and merely caved in to political pressure to appear to be doing SOMETHING.

U.S. unemployment is 9.5%. Unemployment in Europe is over 9% (Spain is suffering from 18%+ unemployment). The median national home price in the U.S. fell almost 17% from a year earlier. Companies continue to announce layoffs….in the month of May, 2,933 companies laid off at least 50 workers each.

Anecdotally, I occasionally update readers about my daily bicycle ride. For a couple of years, I have ridden my bicycle through several neighborhoods. In the summer of 2007, when we began to worry about the looming sub-prime mortgage problem, I began counting real estate “For Sale” signs in the yards of homes on my ride. That summer I counted as many as 8. Last summer, the highest count was 26. This year, as I began riding in April when the weather warmed up, the count was at 20. Could this be a green shoot? No such luck. At the end of June, the count has bounced back to 26.

At Boyer & Corporon Wealth Management, we do not yet view news that is “less bad” as “green shoots”. We continue to be very cautious and are maintaining larger than normal allocations to short-term fixed income. In accounts we manage that are not ultraconservative, we have purchased a few stocks. However, we don’t view the stock market as being cheap. This year, the U.S., Canada and Europe will make up less than half of Global economic output and that trend will continue. For this reason, we are looking to invest in international companies as well as domestic.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.