Every now and then there comes a year that proves to be a very difficult time to make money. 2022 is shaping up to be one of those years. Both U.S. and international stock markets are down over 15%.

The worst stocks to own this year have been in the NASDAQ index, primarily those “stay at home” stocks. That index has declined 24% this year.

In addition, bonds and precious metals have failed to offer a safe haven. Bonds are down 10%, and while the price of gold rose 11% through March 7, it gave it all back (and then some) in the ensuing two months.

And if you thought Bitcoin would provide a hedge against all your other investments, think again. It’s down 35% this year. (BCWM does not own any cryptocurrency in any client portfolios . . . and we do not anticipate adding them any time soon).

__________________________________________

Spooking the markets has been the fear of increasing inflation and rising interest rates.

Some inflation can be good for an economy, but too much, too fast can spell trouble. When that happens, the Federal Reserve (the Fed) does what it can to slow down the economy, and that involves increasing interest rates.

Rising rates reduce demand for credit (you are less likely to take out a mortgage when rates are 5% vs. 3%), which results in less spending, thus solving the inflation problem . . . but often creating other problems. Exhibit A: Of the fourteen “Fed tightening cycles” on record (going back to the 1950s), eleven have ended in a recession. The Fed wants to suppress inflation, but in doing so it may suffocate the economy.

The Fed Funds Rate has already increased from 0% to 0.75% this year, and the market expects the Fed to raise rates to 2.75% by the end of 2022.

Rising rates have simultaneously hurt both stock and bond prices.

And the one-two punch of high inflation followed by rising interest rates just might throw the economy into recession . . . and that is bad for stocks. But it is not bad for bonds, because in recessions, investors flock to U.S. Treasuries. They also flock to gold and stable, dividend-paying stocks. This is why BCWM maintains larger allocations to all three of those assets.

It’s our opinion that we may have already entered a recession and that inflation may have already peaked. And although we don’t expect it to disappear quickly, we do think that the worst inflation is behind us, and it will gradually ebb.

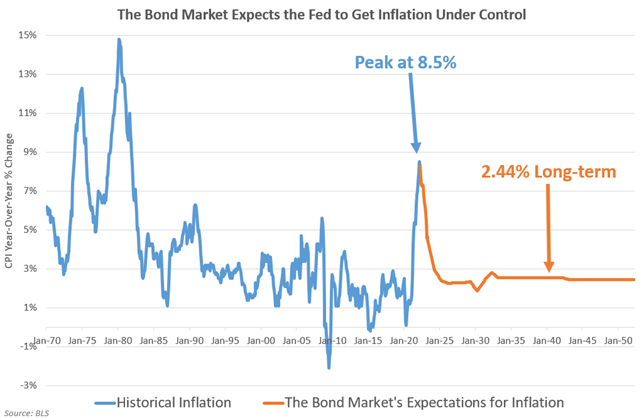

The bond market agrees. You can see historical inflation (the blue line) below. In March, we had the highest reported year-over-year inflation in over 40 years (8.5%). But April came in at 8.3%. Not much less, but in the right direction. The orange line is the bond market’s expectation for inflation going forward.

Other reasons we are concerned more about long-term disinflation/deflation rather than inflation:

- The almost $7 trillion added to the national debt since the start of 2020

- That debt fueled economic growth and demand for goods and services, but eventually we are going to pay the price for pulling demand forward during the last two years.

- No more stimulus = decline in demand relative to 2020 & 2021.

- Increased government spending accelerated economic growth in 2021. But a reduction in that spending will slow growth in 2022.

- Q1 2022, the economy shrank at a 1.4% annual rate.

- Demographics are Destiny

- Working-age population growth in the U.S. is on the decline. Historically, this has had a remarkable correlation with inflation.

Note that while the Fed might be able to bring the headline rate of inflation down, in the current situation, pockets of inflation are likely to remain elevated thanks in large part to Vladimir Putin (namely, energy and food costs).

__________________________________________

A quick note.

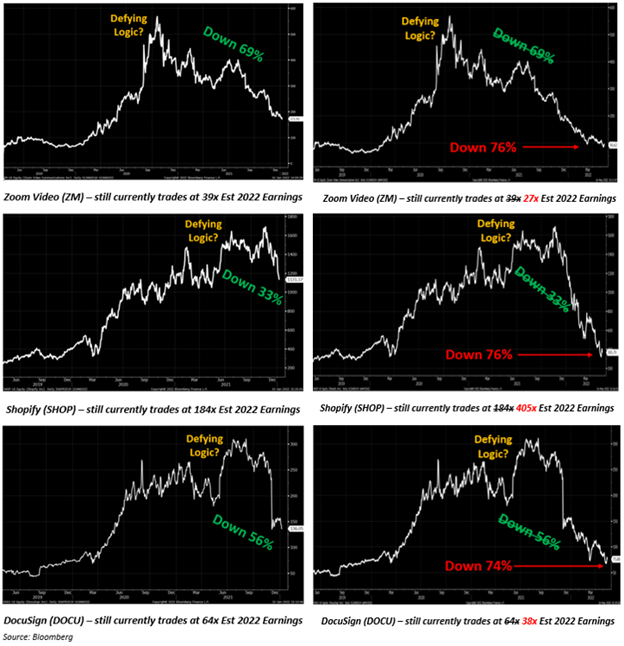

In our January investment commentary, we addressed the historical importance of buying low and selling high. We gave examples of three stocks whose charts showed stock prices that seemed to be defying logic. And even though they had already experienced incredible declines, we still argued that they were not cheap.

We said, “These charts remind us of the “dot-com” bubble of 1999–2000, when investors (we use that term loosely) were buying stocks merely because they were “going up.” Stocks were being purchased for the sole purpose of selling them to someone else at a higher price . . . very soon.”

Well, the COVID-bubble has been bursting, just like the dot-com bubble did. The charts on the left were in our January commentary. The charts on the right are updated through May 13.

At BCWM, we focus on buying companies at the right price. During the post-pandemic stimulus surge of 2021, that became very difficult to do . . . and made us look like we missed the party. Today we feel justified in our investment strategy as our equities have meaningfully outperformed the broader stock market. And while bond prices are suppressed (due to higher interest rates), they continue to make cash interest payments despite price fluctuations. If the economy does find itself in a recession, we expect bonds to be one of the best “hiding spots” in an ugly market.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.