In February 2022, Russia invaded Ukraine, and at the time, conventional wisdom seemed to say that Russia was so massive and powerful and Ukraine so much smaller and not powerful that it would be a rather short conflict.

Sixteen months later, the ultimate outcome still seems rather in doubt . . . particularly after this past weekend.

A week ago, news began to leak that a potential Russian coup d’état was in progress. (It should be noted here that the word “news” doesn’t carry the same weight that it once did and that anything you hear/read should ALWAYS carry with it a decent dose of cynicism and doubt – particularly ANY news out of Russia.)

Allegedly, the top general (Prigozhin) of the Wagner Group (a paramilitary group officially known to be funded by Russia) decided to march his troops toward Moscow with the alleged (there’s that word again) intent to overthrow Putin’s government.

Allegedly, Prigozhin abandoned the scheme mid-march and is now “safely” holed up in Belarus, and it has all been “one big non-event.”

However, it makes us wonder if someday there will be a similar situation where it actually turns out to be more than “one big non-event”

The geo-political instability that would then ensue will almost certainly favor the investor who owns boring U.S. government bonds. Because when investors panic, they buy U.S. government bonds (which then become not very boring at all).

__________________________________________

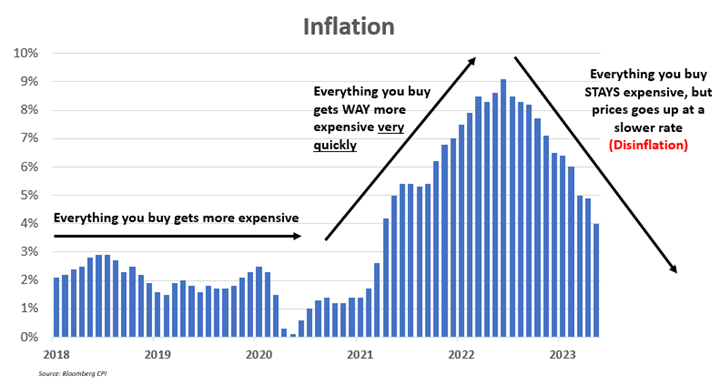

Last July, after it was reported that June’s inflation rate was 9.1% (the largest increase in forty-one years!), we said that inflation would decline over the next several months.

Guess what? One year later, we were oh, so right. Every month since then, inflation has declined, and last month it clocked in at 4% . . . and next month it is expected to drop to even lower (surprise, surprise).

That doesn’t mean prices are going to go back down to where they were. It just means they will stop increasing as fast as they have been.

Pre-pandemic, inflation had been hovering around 2% for years. Then the pandemic hit and the government threw a ton of money at consumers at the same time businesses were shutting down (increased demand/decreased supply) and everything got WAY more expensive very quickly. As we return to normality, things are still getting more expensive, just at a slower rate. That’s called DIS-inflation. If things get LESS expensive, that’s called DE-flation, something we haven’t seen since 2009 (and not since the 1950s before that).

By the way, remember when Jerome Powell was berated for hinting a year ago that inflation might be transitory? The chart above looks pretty damn transitory to us. Props to Jerome.

__________________________________________

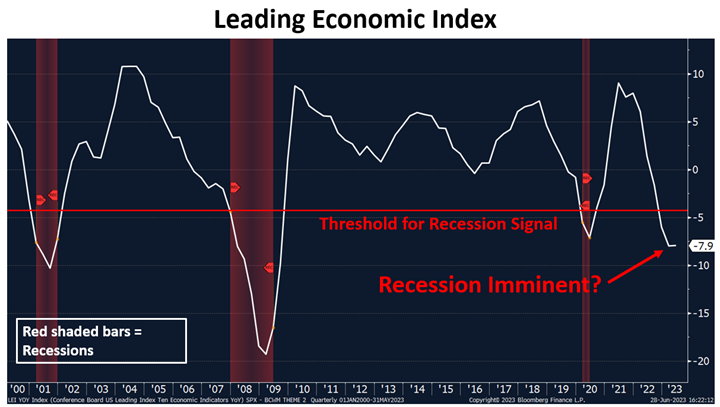

One of the tools used to predict changes in the overall health and direction of the economy, the Conference Board’s Leading Economic Index, has been flashing recession signals since late 2022. The index tracks various factors that tend to change before the economy does . . . things like consumer expectations, measures of business activity, building permits, jobless claims, lending activity, yada, yada, yada. If history is a guide to the future, this chart is signaling a recession within the next twelve months.

The economy is surely facing obstacles: relatively high interest rates, tight monetary policy, and lower government spending. Students are finally being forced to repay their loans again, and some owners of commercial real estate could have trouble making loan payments in the near future.

But the job market is strong, adding an average of 310,000 people every month. The unemployment rate is near the lowest level it’s been since the Nixon Administration. The bad news is that recessions are often preceded by low unemployment.

Everyone seems to be predicting a recession at the end of this year or the beginning of 2024. But all the talking heads are also calling for only a “mild” recession. We don’t necessarily agree or disagree. And since the definition of a recession is rather vague, calling it a “mild” recession seems rather vague-er.

We echo the sentiments of WSJ writer and author Jason Zweig, who wrote:

I have become convinced that the prevailing view of what the future holds is almost always wrong. In fact, the only incontrovertible evidence that the past offers about the financial markets is that they will surprise us in the future. The corollary to this historical law is that the future will most brutally surprise those who are the most certain they understand it. Sooner or later, sometimes slowly and sometimes suddenly – but with a diabolical ability to root out everyone who has ever gazed into a crystal ball – the financial markets always humiliate whoever thinks he knows what’s coming. So the best way to immunize yourself against being surprised is to expect to be surprised.

The key to “expecting to be surprised” is to have a diversified portfolio . . . a portfolio of some investments doing well and some investments doing not as well regardless of what the market throws at you.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.