The human mind has a convenient way of helping us forget painful events . . . a way of emphasizing good memories and minimizing scary ones. Empty toilet paper shelves, empty office buildings, and empty movie theaters all seem to be distant and less severe images today than a year ago. The rush to manufacture face masks and hand sanitizer seems almost surreal today.

March of 2020 was loaded with uncertainty and the fear of a virus whose scope and breadth seemed capable of permanently crippling our planet. (The rest of the year was loaded with that anxiety plus a contentious presidential election.)

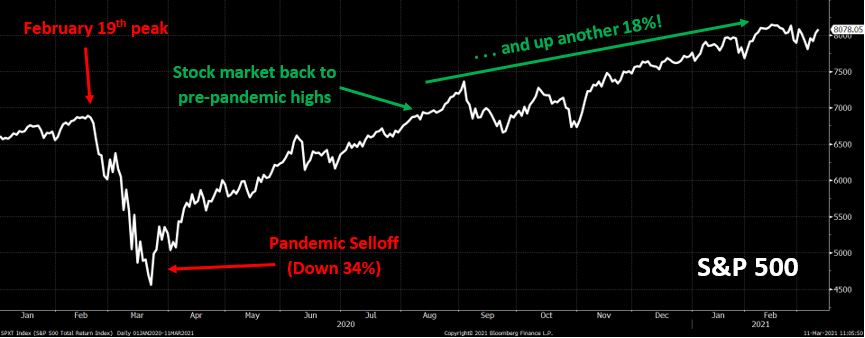

Those fears spilled over into the investment world, and the U.S. stock markets plunged 34% in 32 days ending March 23 . . . seemingly the darkest hour of 2020 in what was arguably the darkest year of our collective lives.

No one knew exactly how this pandemic might play out, but we gave it our best shot in our March 2020 Investment Commentary, “March (Coronavirus) Madness,” where we wrote:

. . . we feel the securities markets are way overreacting. Business will be lost for sure. Planes, if they fly, will have fewer passengers. Hotels, if they are open, will have fewer guests. Movie theaters and restaurants will feel the pain. Basketball games and tournaments have gone from “sparsely attended” to “no attendees allowed” to “canceled.”

We went on to say:

But let’s be clear about this . . . what is happening today is NOTHING like the sub-prime mortgage crisis of 2008–2009.

And although the “crisis” lasted longer than our prediction of “a few months,” we accurately stated that these stock prices will have looked cheap. Some of them ridiculously cheap.

So where are we today — one year later?

Well, it kind of depends on your starting point. February 19 last year was the peak before the plunge and yet the S&P 500 is up 18% since then. EIGHTEEN PERCENT! And for the past two years, the S&P 500 is up an annualized 20% per year. It’s as if a pandemic never happened.

And although almost every country in the world is still dealing with COVID to some extent, the U.S. economy continues to exhibit tremendous signs of resilience.

This is a country of people who want to work, a country of consumers who want to spend, and a country of stir-crazy people who want to travel.

Better-than-could-be-expected news on the vaccine front is making all this gradually possible.

The FDA recently approved the new Johnson and Johnson (JNJ) vaccine, which, unlike those made by Pfizer and Moderna, is a single shot (one and done). It is also fairly cheap and can be stored in a refrigerator. Meanwhile, the pace of manufacturing for the existing vaccines has ramped up such that the United States will see an explosion in vaccinations in the weeks to come and should be flooded with doses by this summer. By July, anyone who wants a vaccine in the U.S. should be able to get one.

The biggest question marks concern the variants of the virus. There are strains that could create a fourth wave of cases. However, a fourth wave of deaths in the U.S. is unlikely thanks to the most vulnerable populations being prioritized for vaccination. Manufacturers of the vaccines are working on formulas to manage the new variants and there will likely be booster shots available by October.

While the United States and our North American neighbors are on schedule to have enough vaccines to put this thing behind us by this fall, the rest of the developed world is unlikely to have enough vaccines until next year . . . and the developing world not until the end of next year.

Also, we don’t know whether we will need an annual shot to manage the virus (as with the flu) or whether it’ll be a one and done (as with polio). There are ongoing trials to assess this question, among others, but one thing is for sure: Moderna’s stock is being priced as though the population will need an annual shot for many, many years.

Vaccine development has gone about as well as could have been expected and the stock market is reflecting that. The human ingenuity behind the development and manufacturing of three effective vaccines in the course of one year is remarkable and should be celebrated.

__________________________________________

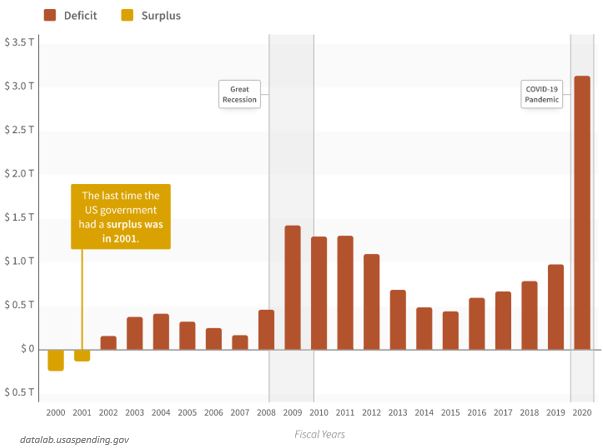

Just as the scientific community answered the call to fight COVID, governments around the world are breaking the bank to prop up their respective economies.

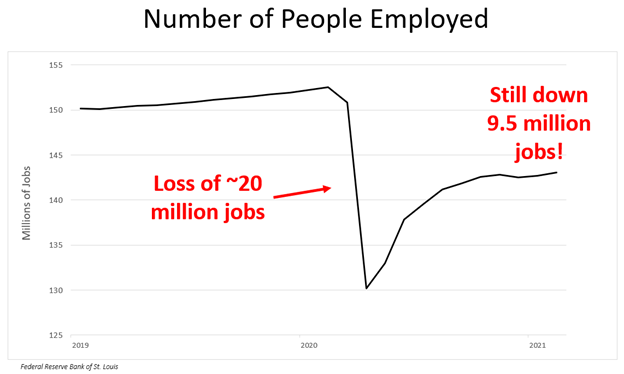

The United States alone spent almost $3 trillion in 2020 and is set to spend another ~$2 trillion just this month. Ultimately, the goal of this “stimulus spending” is to put people back to work and to allow the economy to propel itself forward again (without needing continued cash injections by the government). The stimulus helps those who are out of work to survive, but we won’t see a recovery of jobs until society is allowed to fully re-open.

Even before the pandemic, the federal government was paying out much more than it was taking in. The “budget deficit” was about $1 trillion. A couple rounds of COVID-relief spending later, and the deficit ballooned to over $3 trillion last year. This year it seems it could get even worse.

Conventional wisdom says that all this spending will spur inflation and higher interest rates. As our readers know, our viewpoint is quite the opposite. Over the long term, higher debt constrains economic growth which leads to lower inflation and lower interest rates. However, we would not be surprised to see inflation run a little higher in the next year or so. Consumers are loaded with cash and ready spend.

It is true that inflation has picked up in 2021. It should be no surprise that the timing lines up perfectly with the vaccine rollout and the last leg in our “back to normal” journey. But when you look at other “core” inflation measures that strip out volatile prices such as food and energy, you actually see disinflation — inflation that is going down (not up)! Put all together, it appears that we are seeing a modest temporary pick-up in inflation, but we expect it to be short-lived. You cannot “bounce back” from a pandemic and a quarantined economy every year. After this “bounce back,” we expect interest rates to return to previous low levels.

You know who else watches inflation? The Federal Reserve. It’s their job to make sure the economy doesn’t overheat and spark runaway inflation. They also expect this recent inflation to be fleeting — so much so that they continue to keep the fed funds rate at zero to stimulate the economy. And the stock market loves this.

But at some point the economy is still going to have to catch up with the stock market.

It was great to see how quickly jobs were gained when the economy “re-opened” last summer, but today, jobs are being added at a much more moderate pace. One might see the current 6.2% unemployment rate and think the job market is in decent shape. But this number does not factor in the millions of people who just stopped looking for work and the millions of people who are struggling in the “gig economy” (independent contractors such as Uber drivers, food delivery couriers, etc.). Even if the U.S. finally knocks out COVID this summer, how quickly will all the lost jobs return?

We expect that in the next few months, the economy will have probably recovered to its pre-pandemic level. That would be zero economic growth over 12–18 months, yet the stock market is already 18% higher than its pre-pandemic high. All the government spending has undoubtedly helped the economy, but that’s not sustainable growth. We’re optimistic about life returning to normal soon, but cautious of a booming stock market predicated on an economy stuck on government life support.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.