Last month, we noted that rising uncertainty was already starting to spill into the markets. That uncertainty has now escalated with a new round of tariff announcements and swift retaliatory measures. Markets are no longer reacting just to the possibility of a trade conflict—they’re reacting to the reality of one unfolding. The result? A sharp… Read more »

Archives: Publications

Reality Check

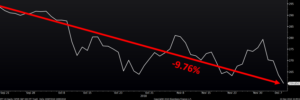

On February 19th, the S&P 500 peaked and, over the next 22 days (including weekends), declined just over 10%—officially hitting “correction” territory. Interestingly enough, on February 19th of 2020, the S&P 500 peaked and, over the next 32 days (including weekends), declined over 33%. The drop five years ago was very clearly related to the… Read more »

This Time It’s Different

At BCWM, we are fond of saying that the president of the United States gets way too much credit when the economy is good and way too much blame when the economy is bad—that there are much larger forces at work determining our financial fate (demographics and geopolitical issues, to name a couple). The 47th… Read more »

No Confidence

It’s the end of an era – the Taylor Swift “Eras” Tour, that is. The 21-month global extravaganza ended earlier this month in Vancouver, British Columbia. While “Swifties” across the globe are going to miss seeing the superstar on stage, the local economies where she performed might miss her even more. Swift’s tour was a… Read more »

Trumped Again

It wasn’t necessarily a surprise that Donald Trump became the 47th president of the United States. As late as Election Day afternoon, the race was considered by most to be “too close to call.” It was a surprise, though, that it was a landslide victory, with Trump garnishing 312 Electoral College votes, and almost 75… Read more »

The First Cut

It’s always been hazardous to be president of the United States, or even being a candidate campaigning to be president. Seems like there is always someone somewhere who wants to bring you harm, no matter your party affiliation. The 1968 assassination of Robert F. Kennedy (just five years after his brother was assassinated) brought that… Read more »

Market Mayhem, Monopoly, and Missing Jobs

During the first three trading days of this month, the stock market made a lot of noise. Weeks of lackluster economic data culminated in a pair of worrisome job reports that sparked a two-day selloff. On the third day, gasoline was poured onto the fire. Something called the “unwinding of the yen carry trade” (the… Read more »

Prepare for Landing

What a difference a month can make. The day after we published our last Commentary, Donald Trump and Joe Biden were about to square off in the first presidential debate, and we wrote: “If Trump appears to have gained the upper hand in the debate, look for the Democratic Party to quickly find another presidential… Read more »

No Debate: America Loses

Tomorrow night, President Joe Biden will square off in a debate against former President Donald Trump . . . a very old man vs. a slightly older very old man. This will likely be the most-watched presidential debate in history . . . and at the same time the most “painful to watch” presidential debate… Read more »

Emerge, Make Noise, and Die

This year is witnessing the emergence of two massive broods of cicadas (pronounced sә-kādә): Brood XIX and Brood XIII. These cicada populations stay underground for 13 and 17 years, respectively, and live off the sap of tree roots. Then they come out for six weeks to make a lot of noise, mate, and die while… Read more »

I’ll Be Back

Forty years ago, Arnold Schwarzenegger starred in “The Terminator,” a movie about a cybernetic assassin who travels back in time to kill a woman whose son (yet to be born) will save the world from extinction . . . extinction from an Artificial Intelligence in a “post-apocalyptic world.” What’s interesting (and a tad bit scary)… Read more »

Lost Decades and Late Payments

Happy Leap Day, everyone! Unfortunately, if you’re a salaried employee, you are working for free today. But we also have good news to deliver. This morning, it was announced that the Federal Reserve’s preferred inflation gauge continued its decline in January, clocking in at 2.8%. Woohoo! The Japanese stock market (the Nikkei 225… Read more »

Election Anxiety? Over-Rated.

Ron DeSantis finally threw in the towel this week, leaving Nikki Haley as the lone Republican candidate who hasn’t yet figured out that she has no chance against Donald Trump. Trump had a landslide victory in the Iowa caucus and he didn’t even campaign! He was busy defending himself in the New York courts… Read more »

Dollarization

At the risk of being repetitive and potentially boring, we find it necessary to point out that inflation managed to find a new recent low. The annual inflation rate at the end of October came in at 3.2%, and the rate for the month of October (drum roll) was zero percent(!). That’s right, for one… Read more »

Blame Fracking

Almost three weeks ago, terrorists from Hamas launched an attack on Israeli citizens in southern Israel. For several days thereafter, fighting escalated as Israel fought back. And the more than two hundred people who were kidnapped during the initial attack continue to be held as hostages in Gaza. This conflict has the potential to become… Read more »

Don’t Drink the Kool-Aid

Late last year, a slew of worrisome economic data suggested that a recession was right around the corner. And suddenly EVERYONE was bracing for a downturn in the economy. Many were calling it the most anticipated recession of all time. At BCWM, we were also on recession watch. The same troubling data had us concerned…. Read more »

Consider the Source

Recently, Fitch, one of the three big credit-rating agencies, downgraded the debt of the United States from AAA to AA+. Fitch’s reasoning boils down to high and growing levels of government debt and an increasingly dysfunctional government. There are several things to point out about this downgrade. First, the downgrade means very little. There is… Read more »

One Big Non-Event?

In February 2022, Russia invaded Ukraine, and at the time, conventional wisdom seemed to say that Russia was so massive and powerful and Ukraine so much smaller and not powerful that it would be a rather short conflict. Sixteen months later, the ultimate outcome still seems rather in doubt . . . particularly after this… Read more »

Global Deadbeat? . . . Not Quite Yet.

Allegedly, the United States will soon run out of money. Unless Congress quickly votes to increase the amount of debt we are authorized to issue (aka the “debt ceiling”), our country will soon be a very large global deadbeat. The largest global deadbeat in the history of the globe. We say “allegedly,” because every time… Read more »

It’s a Wonderful Life

A year ago today, the Federal Reserve began raising interest rates to fight inflation. And since then, the Fed has raised rates eight times (a total of 4.5%). Prior to this, we were in an environment where rates were held artificially low. And it was a wild world. Just like in 2008, when people were… Read more »

The Obvious is Hardly Ever Obvious

The most interesting technology grabbing headlines over the past couple of months is called ChatGPT. It is essentially a Google search on steroids. You can ask it anything and it will provide an answer, even answering in the style of your choosing (Southern drawl, Shakespearean prose, biblical, etc.). It can write poetry, solve math problems,… Read more »

Back to Basics

This past year was the most difficult investment year in a long, long time. During previous bad markets, there were typically other asset classes (bonds?) that offset the decline in stock prices. For example, during the sub-prime mortgage crisis of late 2007 through early 2009, the stock market declined 55%, but there were other asset… Read more »

The Inevitable Crypto Scam

It now appears that the great Red Wave didn’t quite materialize during the mid-term elections. (We fondly recall the days when election results were almost always announced the following day.) And although Republicans now have a House majority, the Senate is still somewhat undecided. With a run-off election in Georgia yet to come, the Democrats… Read more »

The “R” Word

In the past two months, the stock market has rallied, gaining over 17%. Of course, that’s on the heels of a decline in excess of 22% since year end, so the market is still down about 9% for calendar year 2022. (Trust us, the math is correct.) As we have noted before, the most significant… Read more »

While You Weren’t Looking

The most recent inflation report stated that prices had increased 9.1% in the past year, “the largest increase in forty-one years.” The largest increase in forty-one years? Wow! We know this sounds crazy, but one of our co-founders actually began his career exactly forty-one years ago. And he notes some startling differences between 9.1% inflation… Read more »

Kumbaya or Nah?

There are two likely paths for the U.S. economy in the year ahead: 1) Continued high inflation 2) Recession There is also a third possibility: a combination of the two, also known as “stagflation,” but we don’t classify it as “likely.” With continued high inflation, the Federal Reserve is in the hot seat. Its goal… Read more »

Nowhere to Run, Nowhere to Hide

Every now and then there comes a year that proves to be a very difficult time to make money. 2022 is shaping up to be one of those years. Both U.S. and international stock markets are down over 15%. The worst stocks to own this year have been in the NASDAQ index, primarily those “stay… Read more »

Ukraine and Inflation

When we published our Investment Commentary at the end of February, Russia had just invaded Ukraine. Since then, more than ten million people have fled their homes in Ukraine (a quarter of the country) and an unconfirmed number have died (likely in the thousands). The Western world condemned the invasion and almost immediately instituted economic… Read more »

The Cold War Heats Up

Late last night, Russia launched a full-scale invasion of Ukraine. It’s no secret it has been building up troops with precisely this in mind. Contrary to President Vladimir Putin’s recent assertions that Russia was undertaking a limited “liberation” of separatist regions of Ukraine, he has now opted for a full-scale takeover of the country. So,… Read more »

Inflation, Deflation, and a Dot-com Redux

For the 12-month period ending in December, the CPI (Consumer Price Index, a measure of inflation) increased 7%. The past few months have seen the largest increase in this measure in forty years. This was not much of a surprise to anyone and there are more than a few that believe the CPI number actually… Read more »

“Help Wanted”

This is the most perplexing labor market in our lifetimes. It’s unclear if there are too many workers or too few. “Help Wanted” signs are everywhere, but the most recent “jobs report” stated that 7.6 million Americans are unemployed and millions more are underemployed (i.e., you have a really miserable job for which you are… Read more »

Excessive Excesses Always End Badly

We heard an interesting factoid the other day. But it was one of those moments where you’re somewhat listening and not really paying attention. It said that the Japanese stock market had just hit a 31-year high, which sounds like a good thing. But then we thought, “the Japanese stock market is JUST NOW higher… Read more »

Global Superpowers Battle for Gold (and Economic Supremacy)

After a yearlong delay due to COVID, the 2020 Olympic Games were finally pulled off. Viewers around the world tuned in to watch the best athletes compete for gold in gymnastics, track and field, swimming, and . . . dressage? The world also watched as the United States and China competed in the overall medal… Read more »

Free Popcorn, Double Your Money

This piece really has nothing to do with how we manage investments for our clients, but we just can’t help writing about it. The investment world we live in today keeps getting more entertaining and just when you think you have seen every insane, stupid thing our stock markets can possibly offer, along comes something… Read more »

FOMO

Fear Of Missing Out: A dangerous psychological malady that can cause one to feel that he is missing out on the investment of a lifetime (think dot-coms in 2000, houses in 2007, or Bitcoin today). This fear is usually exacerbated by sensational media headlines. But more recently, FOMO has also been the result of tweets… Read more »

Godzilla, Kong and Higher Taxes

We’ve noticed tiny little bits of evidence that the American economy is coming back from the COVID disaster: calling a restaurant for dinner reservations only to discover it’s booked solid, news anchors broadcasting from the studio instead of their respective living rooms, airplanes no longer leaving that “middle seat” empty . . . . …. Read more »

One (Difficult) Year Later

The human mind has a convenient way of helping us forget painful events . . . a way of emphasizing good memories and minimizing scary ones. Empty toilet paper shelves, empty office buildings, and empty movie theaters all seem to be distant and less severe images today than a year ago. The rush to manufacture… Read more »

What We Don’t Do . . .

Most of our investors have a general idea of what we do. Manage money. Look for good investment opportunities. Avoid unnecessary risk. You know, the usual stuff. Every now and then comes the opportunity to illustrate what we don’t do. If you have been paying attention (and believe us, it’s better if you haven’t been… Read more »

The Year to Remember to Forget

Last week we conducted a webinar for private clients of BCWM where we recapped last year, the worst year in recent history. Not the worst year for investments . . . just the worst year. We reflected back to January 2020, when headlines began warning of a new virus originating in Wuhan, China (and how… Read more »

Where’s the Money?

The first eleven months of 2020 have been some of the most memorable months on record . . . and we hope to never remember them again. December, by comparison, has been rather mundane and somewhat boring so far in terms of financial news. While the COVID infection numbers continue to increase each day, the … Read more »

America: Bigger Than Who is President

When it comes to politics, there seems to be little you can know for certain anymore. But one thing all of us can absolutely bank on in the future is that we can safely ignore pollsters. Where do they get these people? Apparently once you have completely failed at every possible occupation, you have officially… Read more »

Elections and COVID. . . Can’t Wait for Both to be History

Only 18 more days until our country experiences the most contentious election in over 150 years. The election of 1864 might have been a tad bit more contentious . . . . . . but the Trump/Biden election seems to be right up there. A couple of weeks ago we hosted a private webinar for… Read more »

Stock Markets and Presidents

It is September in an election year and, yes, we are getting the question . . . “What do you think will happen if (the presidential candidate you despise) wins the election?” The answer? We don’t know. But here’s what we do know. What is happening in the world (a.k.a. geopolitics) is much bigger than the president… Read more »

DON’T TRY THIS AT HOME (we are professionals)

The wonderful (and dangerous) thing about our business is that it frequently appears to be so simple. And some days it actually IS simple . . . until it isn’t. True story. Back in the good old “dot com” days, we had a client call up and say “I just got a hot tip. I… Read more »

Why Is the Stock Market Going Up When It’s Supposed to Go Down?

During a recent webinar for the private clients of BCWM, we reminded everyone that everything you’re already aware of, everything you hear on TV, and everything you read on the Internet . . . . . . is already public information AND is already priced into the stock market. It is often tempting to make… Read more »

Social Media can be Harmful to your Wealth

One of the biggest unintended consequences of everyone on the planet being quarantined for an indefinite period of time is that people began spending an unhealthy amount of time watching TV news or surfing the Internet, activities that previously took up far less of most people’s days. Neither activity is particularly beneficial for anyone attempting… Read more »

Free of Charge: A Barrel of Oil and a Steak Dinner

An interesting thing happened last week. The price of oil fell through the roof and then through the main floor and then it created a large hole in the basement. On Friday, April 17th, the price of crude oil (West Texas Intermediate, aka WTI) closed the trading day at $18 per barrel. On the ensuing… Read more »

March (Coronavirus) Madness

Monday, March 9th of this week marked the 11th anniversary of the stock market bottom during the sub-prime mortgage crash of 2008-2009. So what did the stock market do Monday? It celebrated by falling 7% immediately upon the opening. Since March 9, 2009, we have experienced an 11-year bull market, possibly the longest bull market in history…. Read more »

Coronavirus Update

This past week has seen Coronavirus headlines proliferate faster than the Coronavirus itself. No one knows how far this contagion will spread…and we don’t mean to take lightly that it has already claimed some victims…but if it is anything like SARS, N1H1 (swine flu), or Ebola, there is a good chance it will be in… Read more »

Equities Survive Pandemic…So Far

OK, when we’re wrong, we’re wrong. A year ago, we predicted that Nicolas Maduro wouldn’t make it through the year as Venezuela’s leader. At the time, Venezuela had an inflation rate of 10,000%, and 85% of the population lived in poverty. Things are not much better today. But somehow Maduro is still making the rules… Read more »

Brief “War” a Mere Blip in this Bull Market

After ten years, the economic expansion in the United States continues. Unemployment remains extremely low, and the holiday shopping season showed that the American consumer is in the mood to spend. And the stock market appears to “want” to go higher. Why do we say it seems to want to go higher? Look at what… Read more »

Hindsight is 2020

Here we are at the end of another decade, one that seems to have passed rather quickly, as trite as that may sound. Ten years ago, our Investment Commentary noted that the period of 2000–2009 resulted in a negative rate of return for the stock market. It’s rare that you experience any period of that… Read more »

Something for Nothing

Back in the day, stock brokerage firms could charge an arm and a leg when helping you purchase or sell shares of stock. And they did. Sometimes more.

The Tweet Effect

This just in . . . Drone strikes on a Saudi Arabian oil facility over the weekend sidelined more than half of the kingdom’s output and removed about 5% of the global oil supply from the market. It is the biggest one-day oil disruption in history.

Your Mattress or Negative Interest Rates

Up until the very last day, July was so boring. So accommodating. So mundane. Watching your investment account during July was like watching your neighbor’s cousin’s nephew’s swim meet.

Hong Kong, North Korea, and the Unintended Consequences of Large Crowds

Every month brings a new crop of interesting international headlines (and some of them occasionally have nothing to do with the Trump administration). June was no exception. For starters, two million people hit the streets in Hong Kong to protest a newly proposed law that would allow mainland China to extradite fugitives from Hong Kong… Read more »

A Pessimist and an Optimist Walk into a Bar…

The month of May almost always finds us attending a couple of the best investment conferences our industry has to offer. This year, Richard attended the annual conference of the CFA (Chartered Financial Analyst) Institute, which was held in London. And Laura went to the Strategic Investment Conference (SIC) in Dallas.

Dog Food Is Not Special

Despite this week’s selloff, 2019 has been a good stock market year so far. Through the end of April, the S&P 500 increased over 17%! That’s an annualized rate of approximately 54%. Of course, annualizing stock market returns after four months is like thinking “Superbowl” after your team’s fifth consecutive win. The football season can… Read more »

Breaking Up Is Hard To Do

Brexit in a nutshell . . . A guy decides to get a divorce and says he doesn’t want to pay alimony. The judge says, “Sorry, you have to pay alimony.” The guy says he doesn’t want to pay child support. The judge says, “Sorry, you had the children, you have to pay child support.”

How Low Can You Go?

We have repeatedly stated that we believe interest rates will remain low and eventually go lower. This has been somewhat of a contrary view in that most people can list a litany of reasons why interest rates will rise. For example:

Everyone Has Nothing

After experiencing the WORST December stock market in over eighty-five years, we had the BEST January in thirty years. That’s right, after dropping over 9% in December, the S&P 500 gained 8% in January. Not quite back to even, but enough to help nervous investors sleep better. But before those investors get too comfortable, we… Read more »

December to Remember

The good old days. A gallon of gas cost 10 cents. You could buy a house and a car for less than $8,000. Construction of the Empire State Building was completed, and gambling was legalized in Nevada. The country was in the grips of “The Great Depression” and the unemployment rate exceeded 16%.

What Did You Expect?

U.S. stocks are down almost 10% since they peaked September 20th and some investors are starting to act disappointed and concerned. To them we say, “What did you expect? Stocks have increased in value almost nonstop for over nine years. Were you expecting that to just continue and continue?” Did you honestly think that a… Read more »

Free Dinners Aren’t Free

Every week we receive mail inviting us to a “Free Steak Dinner” at a local high-end restaurant. Sometimes twice a week. The offer usually comes with the promise of helping to reduce or avoid taxes in retirement. Virtually all of these free dinners are conducted by financial advisors (we use that term very loosely) whose… Read more »

Could Amazon Go Bankrupt? Ever?

Imagine 100 years from now that Amazon files for bankruptcy. Today, that future seems almost inconceivable given that the majority of Americans use Amazon to shop online. The company blazed the trail of online shopping, and today it is synonymous with U.S. retail. A long time ago, Americans felt the same about Sears. Founded in… Read more »

Misleading Indexes and Tesla Drama

It used to be that most of us gauged stock market performance relative to an index of 500 stocks called the Standard & Poor’s 500 (S&P 500). It may be that the S&P 500 is no longer a good reflection of financial reality. We noted last month that the performance of the S&P 500 is… Read more »

$1 Trillion Dollars!

In the two days following Apple Inc.’s earnings announcement, shares of its stock increased 9%, making it the first company in history to be worth more than ONE TRILLION DOLLARS. Sometimes it seems that the average American bandies the words “billion” and “trillion” about just a little too casually, not truly understanding the magnitude of… Read more »

World Trade and the World Cup

In our December Investment Commentary, Cryptocurrencies and Cheeseburgers, we noted that Bitcoin was a tad bit speculative—as a reliable currency or as an investment. Our sentiment hasn’t changed and its price activity this week (down 8%) prompted us to re-visit Bitcoin.

ABSOLUTELY. POSITIVELY. NOT.

One of the things we’ve learned in our business is that when virtually the entire investment world is absolutely, positively sure something is going to occur, not only does it NOT occur but the opposite usually does. Occasionally these are called “bubbles,” like the tech-stock bubble when everyone was convinced tech stocks would only go… Read more »

The Risk of Looking Wrong

Our business is an interesting one. Every day we have to decide how to get the best potential return with the least amount of risk. It’s a business that requires us to peer into the future and attempt to determine the risks, based upon market levels, historical performance outcomes, and geo-political possibilities.

Learning the Hard Way

There’s an old joke we like to repeat from time to time. It goes like this: “How do you make a 33 year-old guy act like a 43 year-old guy?” The answer? “Wait ten years.” It’s not the kind of joke that elicits huge belly laughs, but delivered at the proper moment and in the… Read more »

February Madness

In our Investment Commentary last month, Good News is Bad News, we illustrated how the dramatic drop in the stock market was instigated by ONE measly data point. Wage growth for the month of January ran a little higher than expected, stoking fears of inflation. We didn’t panic because we were not concerned (yet) that… Read more »

Good News is Bad News

This week witnessed one of the largest selloffs in the market since 2011. CNBC couldn’t have been more giddy. Perceived fear and panic equal increased ratings. And television news is NOT about relevant information. It is about ratings. Even our own local meteorologist tweeted about the selloff on Monday: Proving that meteorologists should stick to… Read more »

Cruel Expectations

Twelve months ago, approximately one half of U.S. voters were fairly certain that the election of Donald Trump as President of the United States would bring quick havoc to the financial system. If stock market performance is a barometer of presidential performance (it isn’t), those voters were wrong. At least, so far. In fact, 2017… Read more »

Cryptocurrencies and Cheeseburgers

Although there might be a remote (extremely remote) possibility that Bitcoin could someday become the predominant worldwide currency, we feel until there is a likelihood that Joe Schmo could easily use it at the drive-thru to pick up a cheeseburger, its adoption by the common person will be stubbornly slow outside the nerd-world. There is… Read more »

One Year Later

One year ago, millions of Americans went to the polls and voted against their least favorite candidate. And although more people voted against Trump, the Electoral College once again kept our country from being ruled by California and New York. Just prior to the 2016 election, we wrote in our November Investment Commentary, “Calm Before… Read more »

“It’s the Economy, Stupid”

Threats from North Korea, mass-murder in Las Vegas, major hurricanes hammering Texas and Florida, earthquakes in Mexico, and more terror attacks in Europe . . . clearly an environment that would have investors running for the exits. Yet, despite this deluge of disaster, the stock market has persisted to be strong this past month, rising… Read more »

Don’t Mess with Texas (or Florida)

It is a relief to hear that all of the friends, family, and clients of Boyer & Corporon Wealth Management who live in Texas, Florida, and the Caribbean weathered both hurricanes successfully. If there is anything good that can be taken from storms that cause over $200 billion in damage, it is the anecdotal stories… Read more »

Just When You Think It Can’t Get Any Quieter

The silence is almost deafening. Navigating the quiet markets is like being in a library. (Remember those places you used to go to find books before you could buy them online for $8.00?) We’ve alluded to the Volatility Index (VIX) in past Investment Commentaries. The VIX, which is derived from a complicated formula, measures the… Read more »

Energy Independence

Recently, we attended a couple of industry conferences… conferences loaded with “knowledgeable experts” who somehow manage to disagree with each other from time to time. Disagreements aside, we came away with several nuggets that we feel will help us negotiate the securities markets today. Here are several of them: Our long-held view that interest rates… Read more »

Reaccommodate

It is both interesting and disgusting that a business (any business) can intentionally screw up (routinely booking too many passengers as a course of business) and then hold their customers responsible for that screw up. United Airlines must win the prize this year for the most reprehensible corporate policy for dealing with the people who… Read more »

Happy Anniversary to a Raging Bull Market

It is widely expected that the Federal Reserve Bank will raise the federal funds rate at its March meeting this week. According to the futures market, there is a greater than 90% chance they will raise rates. Because a rate increase is so highly anticipated, we expect there will be virtually no market reaction when… Read more »

You Trumped Our Brexit

CNBC is in big trouble. The Dow Jones Industrial Average (DJIA) finally broke through 20,000, and now the network is going to have to find something else to talk about. Its anchors have been anticipating this breakthrough for weeks and talking about it frequently almost every day, flashing ridiculous headlines on the screen that the… Read more »

Strangest Election Ever

In the last Investment Commentary sent out the day before the election, Calm Before the Cloudy Skies, we wrote, “It would be a cruel joke on Donald Trump if he accidentally won the election,” noting that he ran his campaign as if he wanted to lose and would be disappointed if he was elected president… Read more »

Calm Before the Cloudy Skies

In a year when almost any Republican candidate could have beaten Hillary Clinton to become president of the United States, somehow the Republican party nominated the one candidate who, if he could win, simply won’t let himself win. It’s as if running for president has been nothing more than free publicity for whatever TV show… Read more »

Talking Heads

Aside from Super Bowls, the first 2016 presidential debate to be held on September 26th figures to be the most watched prime time program in the history of television. Which is really odd because when I talk to people, I don’t seem to run into very many “undecided” voters. With rare exception, virtually every person… Read more »

VOTE!

In what will easily be the most bizarre presidential campaign in our lives (maybe in history), I am telling you today that it is important that you vote. I’m not telling you which candidate should receive your vote. My Investment Commentary remains impartial for a reason. But never in my life have I heard so… Read more »

Negative Interest Rates

“Invest your money with me. I guarantee I’ll give you back less than what you invested.” This is what investors are hearing all over the world as over $10 trillion of sovereign bonds are trading at negative interest rates today. That’s right, if you invest in bonds issued by Germany, Japan and several other legitimate… Read more »

Nuggets from Montreal

Last week, Laura Carley and I attended the 69th CFA Institute Annual Conference in Montreal. Over 2,000 Chartered Financial Analysts gathered from 70 different countries. It was like a big global nerd convention. It turns out that nerds from other countries are a lot like nerds from the USA. There are always a few good… Read more »

Negative Interest Rates are Not a Positive

The first quarter of 2016 appeared to be a non-event in the stock market. The S&P 500 gained a little over 1%. Foreign stocks declined just a smidge. No big deal, right? Unless you were backpacking in the Himalayas with no internet access, you know that the first quarter was anything but a non-event. January… Read more »

Gold and a Not So Golden Presidential Campaign

Gold has been on a tear lately. It is exciting for all those “investors” (I use that term loosely) who perpetually think the investment world is ending to see the price of gold cease its relentless descent. Gold has frustrated doomsday investors. After peaking in 2010 at almost $1,900 an ounce, its price plummeted more… Read more »

Blame China

January stunk it up. The first two weeks of January really reeked. January stunk it up so badly that it made 2015 smell good. And February is starting out like it wants to make January smell good. After the first two weeks of January, U.S. markets were down about 8%. Foreign markets were slightly worse…. Read more »

WORST START EVER!

No, I’m not talking about the Philadelphia 76’ers or the Titanic. I’m talking about the stock market in 2016. In the first week of trading this year, the Dow Jones Industrial Average declined 6.2%. Foreign stocks (the MSCI All World Index ex-US) declined 5.8%. According to pundits on CNBC that is the worst 5-day start… Read more »

Don’t Be in a Hurry to Get That Mortgage

The Fed raised interest rates last week – a big whopping ¼ of 1% – the first increase in almost a decade. We’ve known this was coming for months… actually thought it might have occurred in September, so the increase in December was not a surprise. The only surprise would have been if they HADN’T… Read more »

Fed Does Nothing

August and September were the kind of months that make you question why you ever invested in the stock market in the first place. Months like August and September make you forget how much money you made in the stock market PRIOR to August and ONLY focus on how much you lost. (Even worse, with… Read more »

The China Sky is Not Falling

Due to the stock market selloff and extreme volatility we experienced in August, we sent an e-blast last week reminding our readers that this is not 2008-2009 and that the recessionary conditions that loomed then are nowhere to be found today. In 2008-2009: We had a fragile banking system and a major banking crisis. We… Read more »

Republicans Trumped

I watched the “Republican Candidates Debate” last Thursday evening. This early in the campaign, watching the event is something you typically do when you have no other plans. However, the first Republican debate was some of the better prime time programming shown on television in a while. Donald Trump was a total wild card and… Read more »

Greece Needs to Switch Conferences

In the Trains, Cranes and Demographics Investment Commentary, I noted the impressive number of construction cranes I saw throughout Switzerland in April. Cranes are a sign of economic activity and optimism about the future. Although Switzerland was the only place I noticed a plethora of cranes, recent numbers reveal that economic growth has been slowly… Read more »

Trains, Cranes & Demographics

Last month, I attended the annual conference of the CFA Institute, a gathering of Chartered Financial Analysts from all over the world. This year’s conference was held in Frankfurt, Germany, attracting more attendees from Europe and Asia than usual. My wife and I arrived a week early to take advantage of the opportunity to travel… Read more »

Sibling Rivalries & Dick-tatorships

I will be in Frankfurt, Germany next week where the 68th annual conference for Chartered Financial Analysts is being held. Once a year, nerds from all over the globe gather to talk about the current state of the economic world. Usually, host cities alternate between the U.S. and a foreign destination (last year was Seattle… Read more »

Fed Up

Janet Yellen, Chair of the Board of Governors of the Federal Reserve System, spoke last week after the Board’s two-day meeting. Her speech was an attempt to clarify the Fed’s stance on raising interest rates someday. We all know they will eventually raise interest rates, but many economic “know-it-alls” keep playing a cat and mouse… Read more »

Statistics Can Be Deceiving

My October Investment Commentary (KC Royals) included a graph illustrating the S&P 500 Index’s growth since 1985. In that graph, I pointed out high and low points and suggested that we might be currently near a high point. Statistics (and graphs made from statistics) can be deceiving. Chris Harrington, our senior portfolio manager, pointed out… Read more »

Dollar is Still King

Last year proved to be another good year for the U.S. economy, as well as the U.S. stock market, while wreaking havoc on foreign economies and foreign stock markets. The S&P 500 increased 13.66% while the All World (ex U.S.) Index declined 3.87%. A 50%+ decline in the price of oil blistered countries (and companies)… Read more »

Gas Wars

It will probably never get to the point where competing gas stations conduct “gas wars” like they did back in the 60s. Heck, it’s hard to find two stations across the street from each other anymore. But if the price of oil continues to plummet, it may start to FEEL like stations are having a… Read more »

A Tale of Two Stock Markets

October. It was the worst of times, it was the best of times. But I’m NOT referring to the Kansas City Royals making it to Game 7 of the World Series (the best of times), leaving the tying run stranded on third base with two outs in the bottom of the 9th inning (the worst… Read more »

KC Royals

This past week the Kansas City Royals qualified for the playoffs for the first time since 1985, the year they won the World Series. That 29-year drought was the longest non-playoff drought of any major sports franchise in America. George Brett led the Royals to the 1985 World Championship, and there are many young children… Read more »

Mid-Term Elections and the ECB

The nastiness has begun. It’s a mid-term election year and everyone running for office wants to tell you how horrible his or her opponent is. As our country waffles back and forth between our version of capitalism and our version of socialism, it appears that Republicans stand a very good chance of winning back the… Read more »

Ebola & Uber

July was ambitiously aiming for another month of stock market gains. Then POW! July 31st wiped out the entire month’s gains and then some. Stocks on U.S. exchanges lost almost 2% in one day, continuing downward the first few days of August. Well, what were you expecting? The stock market is up over 190% since… Read more »

Ready to Fly the (Un)Friendly Skies Again

We have officially removed airlines from our list of industries in which we would absolutely never invest. Years ago, I decided it was a dicey proposition to invest in airline stocks and vowed to avoid them. It was an industry that always seemed to figure out how to shoot itself in the foot, and I… Read more »

Why Doomsday Isn’t Today (or Tomorrow)

Since the stock market “bottom” of March 2009, the S&P 500 has climbed 169%, which translates to over 21% per year. Conventional wisdom would tell you that the stock market is overvalued and is due for a correction. But then conventional wisdom probably told you the same thing a year ago when the S&P 500… Read more »

Demographics and Idiots

I attended the 67th CFA Institute Annual Conference in Seattle earlier this month. It brings together CFA (Chartered Financial Analyst) charterholders from all over the world to hear what some of the industry’s most brilliant minds have to say. Last year’s conference was held in Singapore, and next year it will be in Frankfurt (Germany, not… Read more »

Ukraine Pain

For the first time in over a year, investors were faced recently with legitimate “headline risk.” Not since the bogus “Fiscal Cliff” scare of late 2012 have there been headlines frightening enough to make investors worry. I have said all along that securities markets prefer tranquility. They don’t like noise and uncertainty. Markets like Disney… Read more »

January Chill

January got everyone’s attention. A declining stock market always gets attention and last month the S&P lost 3.4% after a 30% increase in 2013. The Dow Jones Industrial Average lost over 5% and foreign stock markets were down as well. As usual, pundits are falling all over themselves assigning blame for the sell-off in January…. Read more »

Prohibition Déjà Vu

Colorado approved the sale of marijuana for “recreational use” starting January 1 this year. Let’s be frank… any state that has ever approved marijuana for any use has essentially approved it for use recreationally. Twenty states have already approved the use of marijuana for “medicinal” use, but we all know that was just an end… Read more »

Another Boring Month of Stock Market Gains

We received an email recently from a client requesting that we wire $85,000 to an overseas account. What was intriguing about the email was that it was very authentic at first glance. The email was sent from our client’s Gmail account. It was not the beginning of a new dialogue, but rather a reply to… Read more »

Twitter, Obamacare and JFK

I love Twitter. One of the coolest things ever created, Twitter is a worldwide digital forum where anyone can express a thought, an opinion or give directions about anything anytime. As a social media website that has gathered a tremendous amount of traction, Twitter provides a means of quick and efficient communication between people who… Read more »

R.I.P. Joe Granville

Last month, one of the more memorable characters in the investment industry passed away. In the 1970s and 1980s, Joe Granville was one of the most, if not THE most, famous stock market prognosticators in America. I didn’t say he was the BEST prognosticator, just one of the most famous. According to the Hulbert Financial… Read more »

Syrian Angst Short-Lived

For the first time in a long time, investors are experiencing global economic and geo-political headline risk. Since late last year I have been saying that in the absence of significant “uncertainty,” stock markets might trend upward. Stock markets like quiet and certainty and they LOVED the first half of 2013. Until August, the most… Read more »

More Easy Money from the Fed

Federal Reserve Chairman, Ben Bernanke, announced that the Federal Reserve Bank would continue its monthly purchases of Treasury securities ($45 billion) and mortgage-backed securities ($40 billion). He didn’t say specifically for how long, but stated the Fed may start scaling back later this year and halt them entirely in mid-2014. Don’t hold your breath. Reasons… Read more »

Doomsday Investing is Always Premature

The first stock market downturn arrived in June after seven consecutive months of positive returns. The U.S. markets declined only a little more than 1% and foreign markets (the EAFE Index) declined about 3.5%. After yearly gains of over 20%, it is surprising how rattled some investors get after a tiny bit of profit taking…. Read more »

My Dentist is Busy

May marked the seventh consecutive month of increases for the Dow Jones Industrial Average and the S&P 500. Since the end of October, the DJIA and the S&P 500 have increased just over 17% each. Over the past twelve months, the S&P 500 has increased over 27%! Both indexes have hit new highs in the… Read more »

Race to the Bottom

I just returned from the annual Strategic Investment Conference in Carlsbad, California where some of our industry’s brightest minds exchanged thoughts, ideas, data and predictions. Economists, hedge fund managers, analysts and high-net worth investors gather here each year to try to figure out how to best navigate the economic and geo-political waters for the next… Read more »

Brahms’ Lullaby Economy

March Madness has come and gone, leaving in its wake a stock market that can’t seem to find investors willing to sell. The S&P 500 increased 3.75% in March and 10.6% for the first quarter of the year. Attempts to sell stocks and drive the stock market down have been miserable failures for the past… Read more »

Ten Years After

Globally, stock markets are on a tear and the U.S. stock markets are no exception. In the first two months of 2013, the S&P 500 is up over 6% and, as I’m writing this in March, it is hitting new highs. Last December I wrote, “We don’t feel stocks are horribly expensive and see some… Read more »

AAA, Apple and Complacency

The Department of Justice (DOJ) announced it is suing Standard & Poor’s (S&P) over actions related to the sub-prime mortgage disaster. If you recall, investors all over the world lost billions of dollars by investing in mortgage-backed securities (MBS) to which S&P (and other ratings agencies) gave their top rating of AAA…right before those MBS’s… Read more »

Buy and Hold? Not Necessarily.

On New Year’s Day, Congress and the White House reached resolution regarding the “fiscal cliff,” and the next day the Dow Jones Industrial Average climbed 308 points (2.35%). Those of us in the investment business love to make predictions to show how smart we are. Of course, we aren’t always correct with our predictions, but when we… Read more »

Twinkies & Ding Dongs

Hardly a day goes by that we don’t get a phone call from someone about the “fiscal cliff”…you know, that period of time beginning January 1 when all the Bush tax cuts expire. None of the calls are from someone trying to reassure us that everything is going to be OK. All of the calls… Read more »

Fiscal Mudslide

Just prior to the election four years ago, in my November Investment Commentary I wrote, “The economic issues today…are much bigger than either of the presidential candidates. The loser might be the winner in this election.” I could repeat that statement today except the part about the loser being the winner. I’m confident Mitt Romney… Read more »

Vice Presidential Debate – Biden Accomplishes Goal – DON’T LOSE!

The vice presidential debate was not about substance. It was about style. Let’s face it, very few voters, if any, will cast their ballot based on the outcome of any vice-presidential debate. However, after Obama’s lackluster performance in the first presidential debate, a sound defeat of Biden by Ryan would have been a significant setback… Read more »

Round 1 – Romney in a TKO

Is it just me or did President Obama decide he didn’t need to prepare for the first presidential debate? I know it’s a busy job being president of the most powerful nation on the planet but what was going on this past week that kept him from rehearsing his responses? Did he think he could… Read more »

Still Hoping for Change

Four years ago this month, the financial world walked to the edge of a cliff just weeks before a presidential election. During September, 2008, Fannie Mae and Freddie Mac were placed into conservatorship and taken over by the U.S. Government. Merrill Lynch was taken over by Bank of America, Washington Mutual by JP Morgan, Wachovia… Read more »

Ryan Gives Romney a Chance

The race for President of the United States just got interesting. Mitt Romney’s choice of Paul Ryan as his running mate pits Romney/Ryan against Obama/what’s-his-name. Romney has signaled his lack of desperation by NOT choosing a running mate as inexperienced as what’s-her-name, and his choice of Paul Ryan is a bold statement that this campaign… Read more »

SCOTUS

The Supreme Court of the United States (SCOTUS) recently upheld the constitutionality of the Patient Protection and Affordable Care Act, aka “Obamacare.” The justices didn’t say they liked Obamacare…they just stated it was constitutional. In a 5-4 vote, the Court ruled that it was within the power of Congress to impose a tax on a… Read more »

Facebook and Other Natural Disasters

Facebook shares began trading publicly this past month. The Initial Public Offering (IPO) of Facebook was the most exciting and over-hyped IPO in a long time… maybe ever. Everyone wanted in on it because everyone was sure the stock price would do nothing but go up after the first minute of trading. The media absolutely… Read more »

He Undressed the Maid Himself

I just returned from back-to-back conferences featuring some of the brightest minds in the investment industry. The Strategic Investment Conference, May 2-5, was followed by the 65th annual Conference of the CFA Institute May 6-9. At the CFA Conference, Daniel Kahneman delivered a talk he called “Psychology for Behavioral Finance” in which he attempted to… Read more »

The Supremes

The United States Supreme Court recently heard arguments regarding the Patient Protection and Affordable Care Act… also known as Obamacare (you can read all 906 pages of it at http://www.gpo.gov/fdsys/pkg/BILLS-111hr3590enr/pdf/BILLS-111hr3590enr.pdf). At issue is whether it is constitutional to enact a law forcing every citizen to purchase health insurance… or pay a fine/tax/penalty if they don’t…. Read more »

Beware the Ides? Not this March

I’m a little late posting my Investment Commentary for March. I’ve been waiting for something to write about. I have become used to disaster and excitement. The world has become eerily quiet and uneventful. No dictatorships have been overthrown lately, Syria notwithstanding (they’re working on it). Occupy Wall Street has become “Go Back Home and Occupy Mom… Read more »

Class Warfare? The Speech Obama should have Delivered

When President Obama was running for election four years ago, part of his campaign theme had to do with the unification of America. You know, bring everyone together as patriotic Americans against common enemies and for common causes. Ironically, his attempts to increase taxes on “the wealthy” have not resembled anything remotely similar to unification… Read more »

A Lot of Noise for Nothing

You’re standing at the front of the line as the previous riders come gliding back into the boarding station. You saw them depart a few minutes earlier, a look of calm hiding their anxiety. And now you see them return, wild-eyed, frightened and relieved to have the ride behind them. Some of them vow to… Read more »

That was the DEAL!

You may have seen this commercial on television. It is sponsored and paid for by AARP (American Association of Retired Persons). I don’t remember all the details of the commercial… just that it featured a series of senior citizens each imploring the viewer to contact his/her congressional representative for the purpose of making NO changes… Read more »

¡TOMA LA CALLE!

I was driving in downtown Topeka a couple of weeks ago and as I was crossing 7th Street on Kansas Avenue, I saw young ladies, one on the left corner and one on the right corner, holding up large placards. One sign said something about corporate greed and the other declared membership in the club… Read more »

Paying Your Fair Share

Wealthy people have been getting bashed pretty regularly lately… even by themselves. Warren Buffet gave President Obama extra fuel for higher taxes by admitting his “secretary” pays taxes at a higher rate than he does. Rest assured she doesn’t actually pay more tax than Buffet, she just pays at a higher rate because virtually all… Read more »

September 11

It was mid-afternoon and I was in Mrs. Rawlings fourth grade class. I don’t recall if there was an announcement over the school speaker or if Mrs. Rawlings told us directly, but we were informed that our school was closing for the day and we were all instructed to go home. Walk home I guess…. Read more »

Democracy Can Be Ugly

This is written a little later than usual. The alleged deadline for Congress to raise the debt ceiling was August 2nd, so I didn’t want to write an investment comment on August 1st with potentially significant news coming out the next day. After the debt ceiling was raised, investors discovered all sorts of other things… Read more »

Thirty Years of Investing

Thirty years ago today (July 1st) I got my start in the investment industry as a stockbroker at a firm called Kidder, Peabody & co. I was reminded of that today when I walked into the office and there were signs and balloons (30 of them) congratulating me for… surviving? Technically I think they were… Read more »

Why Inflation is Not a Problem Anytime Soon

I spent the second week of May at the 64th annual conference of the CFA Institute. The venue this year was Edinburgh, Scotland and I was able to include a couple rounds of golf. It’s truly a wonder how one can experience rain, heat, sun, rain, strong winds and calm sunshine again… all in one… Read more »

If Everybody’s Expecting It, It Probably Won’t Happen

Last month, Boyer & Corporon Wealth Management was honored as one of the top 25 companies in Kansas City with fewer than 25 employees. We were recognized at an award banquet and as we went up to receive the award, they played a video of Mindy and me… a 60-second video which was edited and… Read more »

Japan Aftershocks

What occurred March 11th is going to have some interesting and dramatic effects on the course of global economics. The earthquake off the coast of Japan and the ensuing tsunami wave that devastated Japan will have economic repercussions throughout the world for years to come. Japan, the third largest economy in the world (recently passed… Read more »

No New Taxes? Think again.

I filled my gas tank last night: $55.30. A new record for my Toyota Solera. Last month, it took just under $50 if my tank was near empty. I know you are probably thinking, why do I wait until my tank is almost empty to fill it? Well, it’s a winter thing. I hate getting… Read more »

No Food? Give Us a New Leader!

Commodity prices are on fire. The cost of food in the past twelve months has exploded. To name a few: Corn +84% Wheat +76% Soy Beans +57% Coffee +87% Live Cattle +27% In addition, the prices of some non-food commodities like cotton (+150%) are much higher than one year ago. To the… Read more »

Local Governments Have Some Problems, But . . .

Every so often markets experience extreme reactions to situations that, in retrospect, turn out to be not nearly as extreme as anticipated. Near the end of 2000, prices of technology stocks soared to absurd levels and then crashed… crashed when the magnitude of economic growth from the internet was not nearly as extreme as anticipated…. Read more »

PIIGS Get Slaughtered

A sad paradox of lending and borrowing is that the borrowers who need money the most are the ones who must pay the highest rate of interest. Those who need it the least can borrow at extremely low rates of interest. High interest rates make it difficult to repay one’s debts, frequently causing one to… Read more »

Gold Rush

Hardly a day goes by that someone does not ask me what I think about investing in gold. Do I think the price of gold is going higher? How high do I think the price of gold can go? Is gold a good investment? The answer to any and all questions of that nature is… Read more »

Recession is Over. Watch Out for the Recovery.

I stopped in Chickasha, Oklahoma the other day and pulled into a McDonalds to purchase a small Coke. Chickasha is not a destination… it is a place you stop to get a Coke on your way to your destination. It is the county seat of Grady County and home to the annual “Festival of Light.”… Read more »

Where Are the Jobs?

Below is one of the most daunting graphs I have come across during this recession. It is not nearly as complicated as it appears so don’t give up on it easily. The graph, from www.calculatedriskblog.com compares the amount of jobs lost during each of the recessions since World War II (1945) . . . and how long… Read more »

Why Stocks Might Be Cheap . . . And Why They Might Stay That Way

Corporate profits are up. One by one, throughout the month of July, corporations announced earnings for the quarter which ended June 30th and the vast majority declared they are making money. Some, like General Electric, have raised their dividend….dividends which were drastically cut two years ago. Corporate balance sheets are flush with cash and, on… Read more »

Stimulus or Austerity?

After getting off to an optimistic start, the stock market ended the first half of 2010 with an ugly finish. The first four months of the year continued the rally which began March 9th of 2009, but the market declined over 7% in May and over 5% in June, completely wiping out the gains of… Read more »

Volatility is Back

Thursday, May 6th the stock market began like most days. Since it hit the panic bottom in March, 2009, it steadily climbed each month with very little volatility. The 12-month period ending April 30th realized a 38%+ gain. However, recent market increases have been accompanied by worries of how several European countries are going to… Read more »

Goldman Accused and Greece Refused

Last week’s Senate hearings regarding alleged improprieties at Goldman Sachs provided some of the best daytime television since the late 80’s when the Senate grilled Oliver North regarding his role in the Iran-Contra scandal. North was a member of the National Security Council which was secretly selling weapons to Iran in order to encourage the… Read more »

Health Care Reform and Investor Behavior

Health care reform is here. Whether you are looking forward to it or whether you are dreading the changes it will bring to your life, it is here. Barring constitutional challenges from Republicans regarding the Administration’s legal ability to mandate the purchase of anything (in this case, the purchase of health insurance) to the legitimacy… Read more »

Greek Tragedy

You may intrinsically have an idea of when a recession begins (when your neighbors lose their jobs) or when a depression begins (when you lose your job). You might even feel like you know when it has finally ended (when your 401K has returned to the value it was 2 years ago). But did you know that… Read more »

Housing Uncertainty Still a Drag

In my April Investment Commentary, I printed a chart illustrating the increasing number of new home foreclosure filings for the past several years. Under the chart I wrote that, until the trend is a downward one, we continue to wait for better opportunities to purchase equities (stocks). As it turns out, the stock market rallied… Read more »

The High Value of Declining Interest Rates

The U.S. stock market showed impressive gains in 2009. The S&P 500 increased over 26%. However, even after an impressive gain in 2009, the S&P 500 experienced a NEGATIVE rate of return for the decade that just ended. That’s correct. An investment in the U.S. stock market from the end of 1999 to the end of 2009 netted you… Read more »

Putting Things in Perspective by Reviewing 30-year Trends

Recently, we have been asked our opinion about gold. More specifically, should we be buying a lot of it? The conventional wisdom is that the Federal Reserve is printing a lot of money and the Obama administration is running massive budget deficits, both of which are going to make the dollar worth less, if not… Read more »

November 2009 Investment Commentary

The third quarter of 2009 showed positive economic growth for the first time in over a year. Gross Domestic Product was reported to have increased 3.5% in the quarter ending September 30th. However, most of the reported “growth” could be attributed to government stimulus. It is estimated the “Cash for Clunkers” program contributed to approximately… Read more »

October 2009 Investment Commentary

Almost 80 years ago, after the stock market crash of 1929 and the ensuing depression, Congress enacted the Securities Act of 1933, the Securities Exchange Act of 1934 and the Investment Advisors Act of 1940. The 1933 Act required companies to provide better information to investors. It was meant to prohibit misrepresentation and fraud (can… Read more »

August 2009 Investment Commentary

The stock market enjoyed another positive month, rallying over 7% during July. It has increased over 40% since the market bottom on March 9th. Interestingly enough, it is still down over 35% from the market peak in October, 2007. This illustrates how important it is to avoid the investing “torpedoes”. When your investments decline by… Read more »

July 2009 Investment Commentary

“Green Shoots”. Ben Bernanke used this phrase once to describe positive signs that the economy is improving (green shoots are those things that come up out of the ground in the spring and soon turn into flowers). It has become one of the most overused phrases since “Where’s the beef?” And in the month of… Read more »

June 2009 Investment Commentary

There have been signs of good news in our economy and around the world ….signs that the credit crisis is over, that the recession has ended and that the bear stock market is history. The stock market is certainly factoring in a fair amount of optimism. Since March 9th, the Dow Jones Industrial Average has… Read more »

May 2009 Investment Commentary

I just returned from the annual CFA Conference which was held at a Disney resort in Orlando. It was an incredible 3 days. The conference was attended by Financial Analysts from all over the world. Last year it was held in Vancouver and the next two conferences will be in Boston and Singapore. The 2008… Read more »

April 2009 Investment Commentary

Last week I attended the annual Wealth Management Conference hosted by the Chicago Society of the CFA Institute. I have attended this conference every year for the past several years and couldn’t help but notice that attendance appeared to be less than half of previous years. This economy has been unkind to many industries. It… Read more »

March 2009 Investment Commentary

President Barack Obama addressed the joint houses of Congress Tuesday evening, February 24th. The speech outlined his plan for leading our nation out of the economic abyss in which we find ourselves. Without handicapping any likelihood of success his plan might achieve, I took a small degree of pleasure in that Obama at least SOUNDS… Read more »

February 2009 Investment Commentary

Every once in a while, the thought occurs to me that maybe I should write these Investment Commentaries quarterly instead of monthly. It would be refreshing to only have to publish such gloomy and discouraging comments every three months. Nevertheless, brace yourselves. If you thought it couldn’t get any worse, you were mistaken. In our… Read more »

January 2009 Investment Commentary

Happy New Year!! Most of you are probably glad to put 2008 behind you….and for good reasons. From a financial standpoint, 2008 was clearly the most volatile, tumultuous, uncertain and painful calendar year in my adult life (I have been able to vote for 36 years). Surely 2009 cannot be any worse, can it? Surely… Read more »

December 2008 Investment Commentary

As we expected, Barack Obama was elected President of the United States by an overwhelming majority. Obama garnered 365 electoral votes and 53% of the popular vote. In all my adult years of sitting up watching election returns, I don’t ever recall the winner being announced as early as 10pm (CST). In addition, the Democrats… Read more »

November 2008 Investment Commentary

The number of new home foreclosures for the month of September was announced October 23rd. There were 265,968 new foreclosures according to RealtyTrac. This was a 21% increase from September, 2007 but a 12% decline from August. However, according to RealtyTrac, much of the decline from August to September can be attributed to new state… Read more »

October 2008 Investment Commentary

September was possibly the most interesting month in my 27+career in the investment industry. September 3rd – Ospraie Fund, a $4 billion hedge fund closes after losing 38% in 2008 on bad bets in copper and natural gas. Lehman Brothers owned a 20% stake in the Ospraie Fund. September 7th – the U.S. Government placed… Read more »

September 2008 Investment Commentary

We have been so dour lately (actually this entire calendar year) that some of you may have ceased reading our monthly Investment Commentary. We are confident that the day will come when we will write glowingly optimistic summaries of the global economic conditions and just as optimistic predictions of the future performance of securities markets…..but… Read more »

August 2008 Investment Commentary

We have had a lot of people ask us what will happen to the stock market and other investments if Obama is elected or if McCain is elected. First of all, we think any sitting president gets way too much credit if the economy is good and way too much blame if the economy is… Read more »

July 2008 Investment Commentary

Today marks the 27th anniversary of Rich’s career in the investment industry, beginning as a stock broker at the prestigious (but now extinct) firm of Kidder, Peabody & Co. You can learn a lot in 27 years, much of it the hard way. The most valuable trait one can acquire when working on Wall Street… Read more »

June 2008 Investment Commentary

This past month Rich had the opportunity to attend the annual conference of the CFA Institute. This 4 day event, held in Vancouver, BC., included financial analysts from all over the world and venues for future conferences include Edinburgh & Singapore (with Orlando, Boston & Chicago thrown in as well). There are many hotels that… Read more »

May 2008 Investment Commentary

First, the good news (our recent IC’s have been so negative, we wanted to start on a positive note). As this is being written: Oil is trading at $111 per barrel, down from $120 earlier in April. Gross Domestic Product increased in the first quarter 0.6%. Personal income increased 0.4% from February to March. Personal… Read more »

April 2008 Investment Commentary

On January 12th, 2007, Bear Stearns stock price closed over $171 per share. On March the 11th, 2008, it closed just below $63 per share. On Sunday, March 16th, the Federal Reserve Bank assisted JP Morgan in organizing a “rescue” of Bear Stearns by purchasing shares of Bear Stearns at $2 per share. A week… Read more »

March 2008 Investment Commentary

Unfortunately, our March Investment Commentary isn’t any more optimistic than our previous 4 Investment Commentaries. Our economy is in the middle of a significant economic slowdown and the beginnings of significant inflation, a deadly combination that plagued our economy for most of the 1970’s. One year ago, a bushel of wheat was trading for about… Read more »

February 2008 Investment Commentary

After cutting the Fed Funds Rate to 4 ¼% in December, the Federal Reserve Bank slashed the Fed Funds Rate ¾% on Tuesday, January 22nd and another ½% on Wednesday, January 30th to 3%. As we said in our January Investment Commentary, this is nothing more than throwing tennis balls at an oncoming train. The… Read more »

January 2008 Investment Commentary

As expected, the Federal Open market Committee (FOMC) reduced the Fed Funds Rate at their December 11th meeting. The rate was reduced by ¼ % to 4 ¼ %. The Fed was criticized by some for not reducing the rate more (to ease credit, stimulate the economy and avoid a recession). The Fed was also… Read more »

December 2007 Investment Commentary

On Tuesday, December 11, the Federal Open Market Committee (FOMC) will meet and their primary concern has to be the continued sub-prime mortgage mess and the credit crisis it has created. We are fairly certain the Fed will cut the Fed Funds rate by ¼%, conventional wisdom thinking this will rescue the US economy. We… Read more »

November 2007 Investment Commentary

It has been almost two full months since we established Boyer & Corporon Wealth Management, LLC. During that period we have seen the Federal Reserve reduce the fed funds rate twice, watched the dollar decline vs. almost all major currencies and have seen oil trade in excess of $96 per barrel. The Federal Reserve has… Read more »