Financial

Planning

- Retirement Planning

- Education Planning

- Tax Planning

- Estate Planning

- Insurance Planning

- Philanthropic Planning

Portfolio

Management

Education Planning

529 Plans

A 529 Education Savings Plan has long been a popular way to save for a child’s college education. The Secure Act 2.0 expanded the use of 529 Education Savings Plans, making these accounts even more appealing to those saving for future education expenses. Some basic questions many of our clients ask us include:

What is a 529 Education Savings Plan?

A 529 Education Savings Plan is a tax-deferred account, meaning that earnings in the account accumulate tax free. Generally, the account has one owner and one beneficiary (the child). The account owner retains control of the funds, has the ability to select the investments held inside the 529 Plan, and determines when to make distributions from the 529 Plan. If distributions are used to pay for the beneficiary’s “qualified education expenses,” distributions are free from income tax.

What is a “Qualified” Education Expense?

Qualified education expenses include tuition, fees, books, as well as room and board at an eligible education institution. The Tax Cuts and Jobs Act of 2017 expanded the definition of qualified education expenses to allow for distributions of up to $10,000 per year to pay for elementary and high school tuition. Although the federal definition of qualified education expenses was expanded to include elementary and high school tuition, some states have not yet adopted the federal definition.

Can I deduct my contributions to a 529 Plan on my income tax return?

Contributions to a 529 plan are not deductible on your federal income tax return. However, over thirty states currently offer some type of state tax incentive for 529 contributions.

What happens to the money if the beneficiary receives a scholarship or does not attend college?

If the beneficiary does not use the funds inside the plan, there are a few ways to utilize the funds:

- You may distribute your contributions without tax or penalty. However, the earnings portion of the 529 account may be subject to ordinary income tax and a 10% percent penalty if distributions are not used for qualified education expenses. It is important to note that there are exceptions to the penalty rule.

- You may roll unused funds – up to a lifetime limit of $35,000 – into a Roth IRA. The SECURE ACT 2.0 introduced a provision, allowing unused 529 dollars to be rolled into a Roth IRA for the beneficiary of the account. While this is a great way to redirect excess education dollars towards the beneficiary’s retirement savings, there are some very specific conditions that must be met.

- An owner can also change the beneficiary to another member of the beneficiary’s family without tax consequences.

Why should I consider a 529 Education Savings Plan?

This is one of the rare opportunities to take advantage of a potential triple tax benefit. Contributions may be eligible for a state income tax deduction, earnings inside of the account are not subject to taxation, and distributions are free from income tax if used for qualified education expenses.

How do I learn more?

If you have questions regarding a 529 Education Savings Plan, we at BCWM would be happy to help answer them. As always, please consult with your tax professional for specific advice related to your personal tax situation.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Retirement Planning

Choosing a Pension Payout Option

With defined-benefit pension plans on the verge of extinction, those who have participated in them are commonly presented with two options: receive a one-time lump-sum (LSO) payment now or receive lifetime monthly payments. And often at a first glance it is unclear which choice is better. If you are in this situation, you now have a dilemma. Which should you choose?

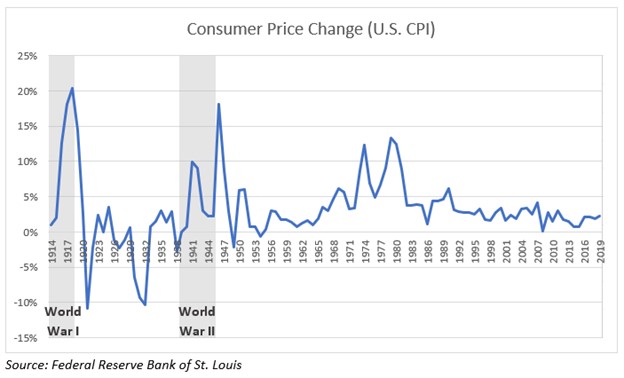

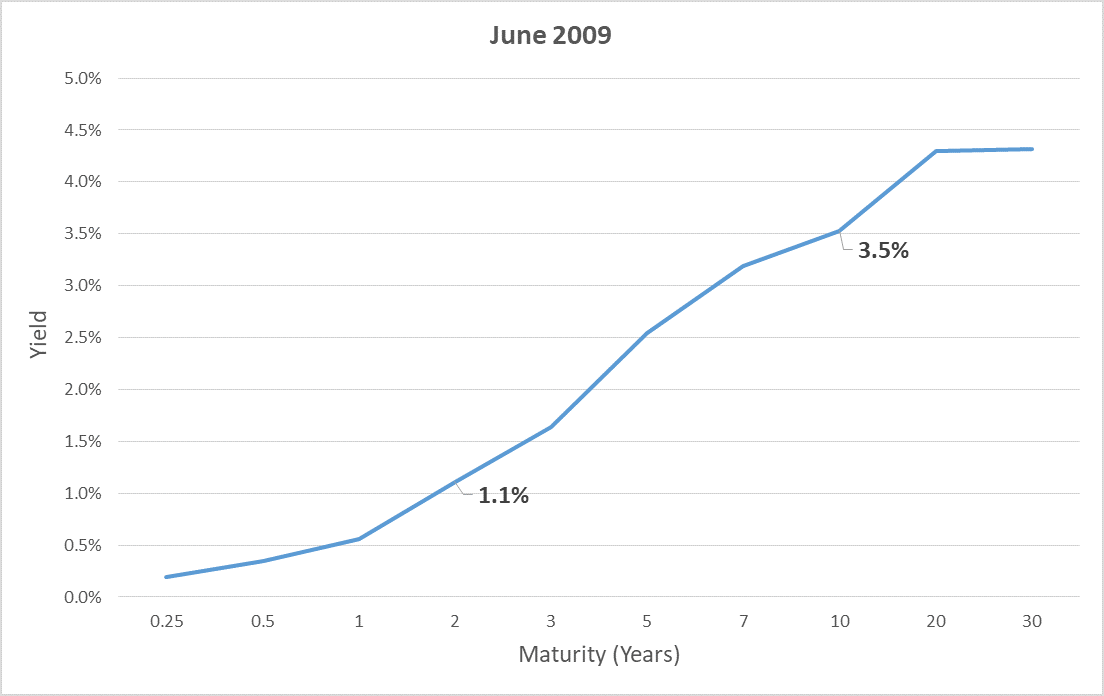

The best decision is not always obvious and can depend greatly upon your personal circumstances. For many of our clients, though, particularly in a relatively low-interest-rate environment, the LSO frequently wins out. One reason is that they have other income-producing assets available to them. This is also a reason why many of them choose to delay collecting their Social Security benefits. Most people do not have this luxury.

Both options present several pros and cons. Running out of money is one of the biggest risks associated with opting for the lump sum, whereas dying prematurely is one of the biggest drawbacks to choosing monthly payments.

To aid our clients in making their decision, we offer to calculate what we refer to as a “hurdle rate.” That is, if you were to take the lump sum and invest it, what average annual return would be required to make the options financially equivalent? An important variable in this calculation is how long you expect to live. And while your life expectancy (and that of your spouse, if married) can be somewhat reliably predicted with an actuarial table, what ultimately transpires is unlikely to align perfectly. Thus, incorporating information regarding your current health condition and your family’s history of longevity could be necessary.

We then compare the hurdle rate to our previously calculated overall risk assessment for the client (explained here), and both are stated as a percentage (3.78% vs. 5.50% could be an example). If the former number is equal to or less than the latter, we generally recommend the LSO. Occasionally the risk required by the client’s overall financial plan is materially lower than the hurdle rate, in which instance we generally recommend the lifetime payments.

If the LSO wins out, it is important that the distribution is processed as a rollover to an Individual Retirement Account (IRA) such that income taxes are not immediately due . . . otherwise, it might not be the best choice. And if you are not working with a trusted Wealth Advisor, be certain to practice fiscal discipline (aka – staying on budget) and make prudent investments. If you are confident of these two things, then you and your heirs will likely appreciate the long-term flexibility and control of the one-time payment.

As you can see, choosing between the LSO and lifetime payments is complicated. We at BCWM are available to assist in weighing your options so that your decision is informed.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Employee Stock Purchase Plans

Most of us realize that the types of benefits offered to employees can vary widely. Some employers offer basic benefits that are well known and easily understood, such as disability insurance, health insurance, and retirement plans. However, some companies offer other options, sometimes in the form of company stock. One such benefit is called an “Employee Stock Purchase Plan” (ESPP), which can be very advantageous.

First, the Basics

An ESPP offers employees the opportunity to purchase company stock at a discount (less than market value). Through payroll deductions, an employee can elect to have money withheld for the purpose of purchasing company stock at a later date (“purchase date”). While most companies limit the percentage of salary an employee can contribute to the plan, the IRS does limit the amount of stock an employee can purchase to $25,000 per calendar year.

Generally, in an ESPP the purchase of stock happens every six months.

At the end of six months, the money withheld from each paycheck will be used to buy as many shares possible for the participating employee. Those shares can usually be sold immediately at market value. Purchased at a discount and sold for market value. Risk-free! That’s a bargain!

Whether the company discount is 5% or 15%, this benefit can be a lucrative opportunity — one often overlooked by employees.

An Example

You are an employee making a salary of $100,000. You elect to participate in your company’s ESPP, which offers a whopping 15% discount. You choose to contribute 10% of your pay toward this benefit. Six months later, you have saved $5,000 to be used toward the purchase of company stock.

On the purchase date, your discount of 15% is applied to the lower of the two stock prices (either the beginning price or the ending price of the purchase period). Note: not all companies offer a discount to the lower of the two prices. Some companies simply provide a discount to the current market value.

For simplicity’s sake, let’s assume the price of the stock ($40) hasn’t changed a bit during the six months. Therefore, your purchase price would be 85% of $40 (remember the 15% discount?), which equals $34 per share.

The $5,000 you’ve had withheld from your paycheck can now purchase 147 shares for you. You decide to immediately sell the shares currently trading for $40. That trade of 147 shares x $40 per share = $5,880! That’s not a 15% rate of return on your $5000. That’s an 18% rate of return! All for doing nothing other than participating in a benefit program your employer offers you.

Now, let’s assume you work for a company whose growth has been significant recently. Rather than trading for $40 on the final day of the purchase period, the stock is trading for $60.

Your purchase price is still based on the lower of the two prices ($40 vs. $60). Just as in the previous example, you purchase 147 shares at a discounted rate of $34 per share. But now you can sell the shares immediately for $60 per share, for a total of $8,820. In this example, your participation in the ESPP resulted in a 76% gain ($3,820)!

Uncle Sam

Of course, most good investments also involve a little IOU to Uncle Sam!

The $6 discount (also known as the “bargain element”) in the example above is counted as ordinary income when the stock is sold. There is no way around that. If the stock continues to grow while you hold the shares, you will also pay tax on the realized capital gains once you sell the stock. Whether that capital gains tax is considered long-term or short-term depends on how long the stock is held before being sold. Don’t fret about the taxes. If you are paying taxes, that means you are making money!

Summary

If your employer-provided benefits include an ESPP, do not overlook it. It is likely you should enroll in it the next chance you get and maximize your contributions. Should you have questions about this benefit or other types of stock incentives offered by your employer, we at BCWM are available to help weigh the pros and cons relative to your overall need for risk.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Reasons NOT to Convert to a Roth IRA

Our industry has a knack for distorting things and oversimplifying. Buzz words such as “tax-free” are used to persuade investors to move their money, and gimmicks run rampant. Some schemes are downright criminal, while others are legitimate but overrated—such as converting your Traditional IRA into a Roth IRA.

You may have heard about the benefits of converting Traditional IRAs into Roth IRAs. And while in certain circumstances there are genuine gains to be realized, you have perhaps not heard that Roth conversions can possibly be destructive to your family wealth.

In a Roth conversion, funds are removed from a Traditional IRA, ordinary federal and state income taxes are paid on that amount, and then those funds are moved into a Roth IRA, where they grow tax-free. This conversion has very little to do with investments and a lot to do with taxes.

The decision of whether to convert funds from a Traditional IRA to a Roth IRA rests ultimately with a comparison of your tax rates: the tax rate at the time you are converting versus the forecasted tax rate when the funds are anticipated to be distributed. If the forecasted tax rate is higher, then it is better to convert now to a Roth IRA. If the forecasted tax rate is lower, then it is better to leave the funds in the Traditional IRA and pay taxes later.

It goes without saying (but we will say it anyway): you want to pay income taxes when you are in lower rate brackets and you want to avoid (not to be confused with evasion, which is illegal) income taxes when you are in higher rate brackets.

If you are still working, it is likely your current tax rate (on wages and other income) is higher than what it will be in retirement.

Also, if you are wealthy, it is likely that current tax rates are higher versus what the tax rate will be for your beneficiaries who stand to inherit your IRA.

The following example helps illustrate how a Roth conversion could be a bad idea:

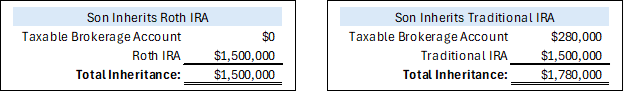

- A single mother has $1.5 million in a Traditional IRA and $630,000 in a taxable (non-IRA) brokerage account. She also has a well-paid job. With taxable income of $500,000 she is in the highest federal tax bracket: 37% (2025) and 5% state tax bracket (42% combined).

- In order to leave a tax-free Roth IRA to her son, she converts the entire $1.5 million Traditional IRA. In doing so, she owes approximately $630,000 in taxes. If she dies shortly thereafter, her son would inherit a $1.5 million Roth IRA, but the taxable account was exhausted to pay the taxes incurred by the conversion.

- Her son is 30 years old and a park ranger in Texas. His modest taxable income puts him in the 12% federal tax bracket with plenty of room to spare; Texas has no state income tax. Had he simply inherited the $1.5 million Traditional IRA, he could have distributed the account over 10 years, paying taxes at a much lower rate. In this scenario, he would have ultimately faced around $350,000 of taxes (paid from the taxable non-IRA account) – compared to the $630,000 his mother paid to convert it – resulting in an additional inheritance of approximately $280,000.

If you are in a high tax bracket and are charitably inclined, it might be even more appealing to avoid conversion to a Roth IRA. You can name a qualified charity as a beneficiary of the Traditional IRA (0% tax rate) and use other taxable assets to satisfy bequests to heirs.

Clearly, conversions to Roth IRAs often have merit; however, it is not the “no-brainer” that many think. We at BCWM are not CPAs, but we are available to work with you and your tax professional to help find the strategy that best fits your circumstances.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

What is Your Tolerance for Investment Risk?

In the data gathering phase of the financial planning process, assuming the process is followed, it is not uncommon for the typical financial advisor to ask questions related to their prospective client’s risk tolerance. A common financial profiling interrogation might sound like this:

Investing involves a tradeoff between risk and return. Historically, investors who have received high long-term average returns have experienced greater price fluctuations and higher potential for loss than investors who have received lower long-term average returns. Considering the above, which statement best describes your investment goals?

- Protect the value of my account. In order to minimize chance for loss, I am willing to accept the lower long-term returns provided by conservative investments.

- Keep risk to a minimum while trying to achieve slightly higher returns than provided by more conservative investments.

- Balance moderate levels of risk with moderate levels of returns. I am willing to accept occasional losses because I have the time horizon that allows time for recovery.

- Maximize long-term investment returns. Therefore, I am willing to accept large and occasionally dramatic fluctuations in the value of my investments.

It is likely these advisors have good intentions. The problem is the advisors are leaving it up to their clients to tell them how much risk they are willing to take without any regard for how much risk they NEED to take.

At BCWM we have enough combined industry experience to know investors’ tolerance for risk varies widely based on market conditions. When stock markets are on an upward trend, investors’ tolerance for risk tends to be higher. Conversely, when stock markets are on a downward trend, investors’ tolerance for risk tends to be lower.

At BCWM we maintain that investment risk has three key elements: Need, Ability and Willingness.

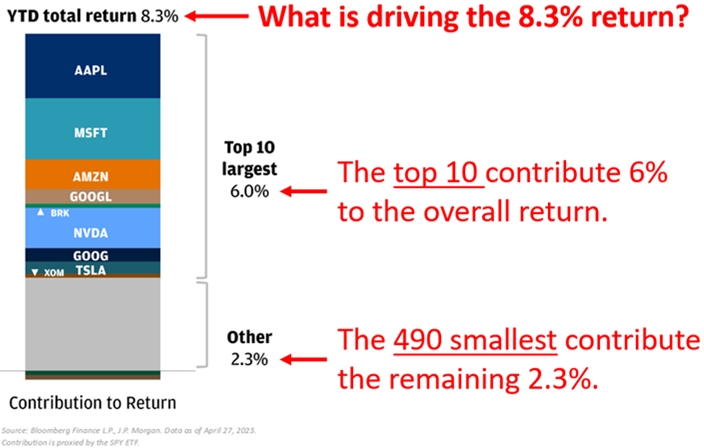

Instead of asking our clients to tell us their risk tolerance, our proprietary process tells them how much risk they need based on several key assumptions which are unique to them. The amount of risk an investor needs to take is determined by calculating the average, annual, after-tax rate of return which is required to make the investor’s financial plan succeed. The lower the required rate of return, the lower the need for investment risk. Our long-time clients have learned we refer to this as their level of risk, and it is closely monitored during regular Wealth Management reviews.

Next, we assess our clients’ ability to take financial risk. Interestingly enough need and ability are often inversely related. For example, Bill and Melinda Gates likely have the ability to survive a large loss on their investment portfolio, but probably do not need much return to meet their financial planning goals and objectives. By comparison, a 60 year-old couple who hasn’t saved much for retirement does not have the means to survive a large loss on their investment portfolio, but probably needs a fairly high return to meet their goals and objectives.

The last element is willingness. It is not uncommon for us to work with a client whose need for risk is low, but their ability is high…and therefore, so is their willingness. The key here is we have defined how much risk they need. From there it is up to them to tell us if they are willing to take on more risk, as unnecessary as it might be. At least this decision is being made from an educated, mathematical perspective rather than an emotional one.

You may remember the ad campaign from several years ago where a prominent financial services company was highlighting individuals with their “number” following them around like a storm cloud. This was certainly a catchy ad campaign; however, if you ever used their too-simple retirement calculator it would quickly spit out a large, “pie in the sky” dollar amount that would leave you asking, “OK, now what, and how do I get there?” I suppose it was their goal to invoke some fear so you might contact one of their financial advisors to shed some light (translated…sell you some product).

When reviewing investment performance, we feel it is important to not only know your rate of return, but to also understand how much risk was involved to earn said return. In other words, what was your “risk adjusted rate of return”? The investment with the highest return is not always the best investment after accounting for risk. This type of risk management is where our Portfolio Management Team excels.

If you are a client of BCWM and someone asks you, “What is your number?” you can confidently respond, “I not only know the number…I know how much risk I need to take to get me to that number!”

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Insurance Planning

Long-Term Care Insurance

This article was written in September of 2022.

Long-term care insurance (LTCi) can be purchased to help cover potential costs associated with professional care required for daily living. Because long-term care (LTC) can be expensive, often a policy is purchased to protect the financial assets of the owner. It is impossible to know when, if ever, you will need LTC assistance. Although LTC is typically associated with older individuals, the health of a younger person sometimes requires significant long-term care. So, how do you know if LTCi is right for you?

First, review your balance sheet to determine if your personal assets would suffice should you need to pay for care. According to most statistics, the average time spent in assisted living/a nursing home is 2–3 years. And depending on where you live in the United States, annual costs for a nursing-home stay could be well into six figures. Owning LTCi could help you mitigate this financial risk in the future if you are not able to self-insure.

If you choose to pursue LTCi, do not be overwhelmed with the various options. Take some time to familiarize yourself with a few key terms:

ADL – Activities of Daily Living – typical activities one must perform in daily life

There are six common ADLs that can be assessed to help determine eligibility payments from an LTCi policy: dressing, bathing, eating, transferring (moving to a chair, getting out of bed, etc.), toileting, and continence.

Typically, not being able to do two out of these six would qualify you for benefits.

Premium – the amount of money the policyholder must pay to keep the policy in force (active)

Elimination period – the length of time that must lapse before a benefit is paid

For example, a resident might move into assisted living, but if the policy has a six-month elimination period, the insurance payment will not begin until after six months of residency.

Benefit amount – the dollar amount the policy will pay for eligible expenses (typically listed as a “Daily Benefit Amount”)

Inflation Protection – an option to factor in future inflation rates on the benefit amount

Maximum Policy Benefits – the maximum dollar amount a policy will cover over the policyholder’s lifetime

Return of Premium – a feature that returns the amount (or a partial amount) of premium paid if the policy is surrendered or unused (as opposed to a “use it or lose it” type of policy)

When comparing policies, be aware of what can seem to be subtle differences in the benefits offered. Read the fine print. In addition, the “health” of insurance carriers can vary, as can the knowledge/experience of the insurance agents who sell the policies.

Work with someone you trust and they will help you customize a policy that suits your needs.

Part of the application process will likely include underwriting to assess your health and, ultimately, the policy’s premium.

_____________________________________

Finally, if you purchase LTCi, inform your Wealth Advisor. Generally, the Wealth Advisor is the one who helps you (and sometimes next of kin) understand how the cost/benefit of long-term care will impact your financial plan.

BCWM does not sell long-term care insurance, but we are able to help you find you an insurance agent, should you need one.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Disability Insurance

This article was written in September of 2022.

Disability insurance (DI) is a type of insurance you hope to never need. As with auto insurance and homeowner’s insurance, the policyholder pays a premium for financial protection against a tragic event. However, whereas these two other types of insurance protect property, DI insures your ability to earn an income.

It seems people are more familiar with life insurance than disability insurance – perhaps because the former is a one-time payment. You own a life insurance policy and die? Your loved one will receive money. The end.

However, what happens if you get injured or fall sick and are unable to work for a few months, a few years, or the rest of your life? How will you continue to pay routine bills? This is where DI is needed. People are much more likely to become disabled than die during their working years. Yet many do not make DI a priority – most likely, because it can be confusing and expensive. So, let’s review some of the basics connected to DI policies.

Disabled

First, for insurance purposes, what does it mean to be “disabled”? The technical definition depends on your policy and how your ability to work is affected. Two people with the same disability could be treated differently as it relates to qualifying for payouts from DI policies. For example, let’s assume two individuals are both diagnosed with a progressive disease that affects the nervous system, causing a slight tremble of the hands. Now let’s pretend one of these individuals is a basketball coach and the other is a heart surgeon. When it comes to carrying out their professional duties, it is likely the coach could carry these out much longer than could the surgeon. Therefore, while the surgeon would likely be considered “disabled,” the same might not be true for the coach.

Own-occupation vs. Any-occupation

An “own occupation” DI policy covers the insured in the event the insured cannot perform a specific job. With the example above, if the surgeon owned an “own occupation” policy and lost the control of her fingers, she would likely be considered disabled and would begin receiving payments from her DI policy. However, if she owned an “any occupation” DI policy, tremors in the hand might not qualify her as disabled since she could possibly find employment elsewhere that does not require precise hand movement.

Generally, an “own occ” DI policy is more expensive than an “any occupation” policy.

Benefit Period

Although there are many types of disability policies, the most common are either “short-term” or “long-term.” Short-term policies typically provide a financial benefit for a short period of time, say, three months to a year. Such protection/benefits can be helpful to people recovering from surgery, on maternity leave, etc.

Long-term policies will normally cover an extended period and could be useful to someone facing, for example, major surgery or a debilitating illness. Each DI policy should state the specific amount of time the insured is covered; and most policies will provide coverage until retirement age.

Benefit

When the policyholder has qualified for the disability benefit, the monthly benefit is usually calculated as a specific percentage (say, 60%) of the insured’s income prior to disability.

During your working years, you should at least understand the benefits of DI so you can decide whether or not you wish to minimize that financial risk. Many employers offer group disability coverage as an employee benefit. If yours is not one of them, perhaps you should consider obtaining a personal policy on your own.

_____________________________________

BCWM does not sell disability insurance, but we are able to help you find an insurance agent should you need one.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Life Insurance 101

How much life insurance do I need?

This is a common question we field regularly from clients. But we usually cannot answer that question until the client can answer this question: What do you want your life insurance to provide for your family if you were to die? This question generally precedes a moment of silence, followed by an in-depth conversation about the replacement of current income, retirement savings, college education, paying off debt, etc.

Simply put, most clients do not want their family’s financial plans shattered if the unforeseen happens.

Calculating the dollar amount of life insurance for you is a somewhat easy task, but there is also the matter of deciding which expenses you would like to fund if you pass away. Keep in mind that the need for life insurance shifts throughout your lifetime. For example, if you are just starting a family, it is likely you will need more life insurance, while as you age and near retirement, your needs will probably decrease.

There are many types of life insurance policies: term, whole life, and universal life, just to name a few. If you are not familiar with these options, talking with a broker might make your head swim. That is why we provide guidance on what type of life insurance to obtain. While we at BCWM do not write (sell) life insurance products, we can help point you in the right direction of obtaining the coverage you need.

The last step, and perhaps most important, in completing most applications for a life insurance policy includes naming beneficiaries of the policy. If you have had estate planning completed, be sure that who/what you name as the beneficiaries of your policy aligns with the plan your attorney created for you.

On that note, if you already own life insurance and you have not reviewed the beneficiaries lately, why not locate your original policy, dust off the cover, and do so? Better yet, call your life insurance company directly and confirm if any changes to the beneficiaries have been made over the years. (Yes, sometimes clients forget they made changes!)

Finally, be sure your Wealth Advisor is aware of all life insurance policies you own. Frequently we are the ones helping your heirs understand exactly what you owned and where. Spending a little time now organizing your financial life can be so meaningful to your loved ones down the road when they are faced with your death.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Tax Planning

2025 Tax Update

Federal tax updates for 2025 are a little less exciting compared to past years. The tax updates we believe to be the most important are as follows:

- Required Minimum Distributions (RMDs) from Traditional IRAs

- The age at which one becomes subject to an RMD remains 73.

- The RMD age will increase to 75 in 2033.

- The age at which one can use Qualified Charitable Distributions (QCDs) for gifting purposes from Traditional IRAs remains at 70.5, but the annual maximum QCD limit per IRA owner has increased to $108,000 (from $105,000) for 2025.

- Backdoor Roth IRA conversions are still allowed.

- Conversions from 529 Plans to Roth IRAs are still allowed.

- The annual limit for employee contributions to employer-sponsored retirement plans such as 401(k), 403(b) accounts, etc., has increased from $23,000 to $23,500.

- The catch-up contribution limit for those age 50+ remains $7,500 (now $31,000 total).

- However, a new law allows workers aged 60, 61, 62, or 63 by the end of 2025 to save even more, if the employer’s plan allows it.

- For people in this age bracket, they are allowed to save an additional $11,250 instead of $7,500.

- A reminder from last year: Secure Act 2.0 includes a rule that mandates catch-up contributions made by employees earning more than $145,000/year must be made to a Roth component in their retirement plan (403(b), 401(k), etc.) starting in 2024. However, due to the administrative complexity this change entails, a two-year transition period has been allowed, which pushes back the requirement to 2026.

- New this year, 401(k) participation will be automatic for any plans created after December 29, 2022. An employee can elect out of participation, if desired.

- IRA contribution limits will remain the same at $7,000 and the catch-up for those age 50 and older remains at $1,000.

- An increased contribution is allowed in 2025 for Health Savings Accounts (from $4,150 to $4,300 for individuals, and from $8,300 to $8,550 for eligible families).

- An additional catch-up contribution of $1,000 remains allowed for those aged 55 and older.

- The annual gift-tax exclusion amount has increased for 2025 from $18,000 to $19,000 per year, per individual.

- While the federal marginal tax brackets remain the same as 2024, the income limits have increased for each bracket by about 3%.

- The Standard Deduction for income taxes has increased by $400 for Individual filers (now $15,000), and by $800 for those who are Married Filing Jointly (now $30,000).

- The federal estate-tax lifetime exemption for 2025 has increased from $13.61 million to $13.99 million per individual, which means married couples can now leave $27.98 million tax-free to their heirs.

- Note: The current tax brackets/standard deductions/lifetime exclusion amounts are set to “sunset” December 31, 2025, decreasing to amounts allowed before the Tax Cuts and Jobs Act of 2017 was created. It is too early to know if the new Trump Administration will extend/amend these changes (via legislation) or if they will be allowed to sunset.

- Beginning in 2026, owners can use a limited amount of retirement account funds to pay Long-Term Care Insurance

- Social Security note: Recent legislation eliminated the Windfall Elimination Provision and the Government Pension Offset. As such, many Americans will receive increased Social Security benefits.

While we at BCWM are not legal or tax professionals, we are always available to work with our clients and their professionals to consider how current laws can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2024 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2024 Tax Update

Last year at this time tax professionals were scrambling to understand what the House of Representatives changed when they passed the SECURE Act 2.0 a month prior. This year the tax updates we believe to be the most important are as follows:

- Required Minimum Distributions (RMDs) from Traditional IRAs

- The age at which one becomes subject to an RMD is 73.

- Beginning in 2033, the RMD age will increase again to 75.

- The age at which one can use Qualified Charitable Distributions (QCDs) for gifting purposes from Traditional IRAs remains at 70.5, but the annual QCD limit has increased to $105,000 (from $100,000) for 2024.

- Beginning this year, direct transfers are allowed from 529 Plans to Roth IRAs, but with significant restrictions.

- The 529 must have been maintained for 15+ years; the Roth IRA receiving the funds must be in the name of the 529 beneficiary (not the owner); the annual limit is equal to that of regular contributions (so, no double-dipping); the lifetime maximum is $35,000; etc.

- Backdoor Roth IRA conversions are still allowed.

- The annual limit for 2024 for employee contributions to employer-sponsored retirement plans such as 401(k), 403(b) accounts, etc., has increased from $22,500 to $23,000.

- The catch-up contribution limit for those age 50 and older remains $7,500 (now $30,500 total) and will be even more for those age 60 to 63 beginning in 2025.

- Secure Act 2.0 included a rule that mandated catch-up contributions made by employees earning more than $145,000/year must be made to a Roth component in their retirement plan (403(b), 401(k), etc.) starting in 2024. However, due to administrative complexity this change entails, a two-year transition period has been announced, which pushes back the requirement to 2026.

- IRA contribution limits increased by $500 for 2024, from $6,500 to $7,000; but, the catch-up for those age 50 and older remains at $1,000.

- An increase is allowed in 2024 for Health Savings Accounts (from $3,850 to $4,150 for individuals, and from $7,750 to $8,300 for eligible families).

- An additional catch-up contribution of $1,000 remains allowed for those age 55 and older.

- The annual gift-tax exclusion amount has increased for 2024 from $17,000 to $18,000 per year, per individual.

- The federal tax brackets – as well as the Standard Deduction amount for 2024 – have increased 5.4%.

- The Standard Deduction for income taxes has increased by $750 for Individual filers (now $14,600), and by $1,500 for those who are Married Filing Jointly (now $29,200).

- The federal estate-tax exemption for 2024 has increased from $12.92 million to $13.61 million per individual, which means married couples can now leave $27.22million tax-free to their heirs.

- Note: The current tax brackets/standard deductions/lifetime exclusion amounts are set to “sunset” December 31, 2025, decreasing to amounts allowed before the Tax Cuts and Jobs Act of 2017 was created..

- Beginning in 2026, owners can use a limited amount of retirement account funds to pay Long-Term Care Insurance

While we at BCWM are not legal or tax professionals, we are always available to work with our clients and their professionals to consider how current laws can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2024 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2023 Tax Update (including SECURE Act 2.0)

This article was written in January of 2023.

Around this time three years ago we were deciphering the SECURE Act of 2019. In December 2022, the House of Representatives passed a spending bill that includes retirement legislation known as SECURE Act 2.0. Below, we have summarized what we deem the most important updates in this new law, in addition to recent IRS updates to various contribution limits and taxation thresholds:

- Required Minimum Distributions (RMDs) from Traditional IRAs: In 2022, the age at which one became subject to an RMD was 72. Beginning in 2023, however, the age will be pushed out to 73.

- Beginning in 2033, the RMD age will increase again to 75.

- It is important to note there was not an age increase for Qualified Charitable Distributions (QCDs) from Traditional IRAs; it remains at 70.5.

- Beginning in 2024, direct transfers are allowed from 529 Plans to Roth IRAs, but with significant restrictions. We are addressing this primarily because the restrictions have grabbed many headlines. They include:

- The 529 must have been maintained for 15+ years; the Roth IRA receiving the funds must be in the name of the 529 beneficiary (not the owner); the annual limit is equal to that of regular contributions (so, no double-dipping); the lifetime maximum is $35,000; etc.

- Speaking of headline grabbers, backdoor Roth conversions have not been eliminated or even restricted, as was initially considered.

- Beginning in 2026, owners can use a limited amount of retirement account funds to pay Long-Term Care Insurance premiums.

- The annual limit for 2023 for employee contributions to employer-sponsored retirement plans such as 401(k), 403(b) accounts, etc., has increased from $20,500 to $22,500.

- The catch-up contribution limit for those age 50 and older has increased to $7,500 (now $30,000 total) and will be even more for those age 60 to 63 beginning in 2025.

- IRA contribution limits increased for 2023, from $6,000 to $6,500; however, the catch-up for those age 50 and older remains at $1,000.

- Slight increases are allowed in 2023 for Health Savings Accounts (from $3,650 up to $3,850 for individuals, and from $7,300 to $7,750 for eligible families).

- An additional catch-up contribution of $1,000 remains allowed for those age 55 and older.

- The Standard Deduction amount for 2023 for income taxes has increased by $900 for Individual filers (now $13,850), and by $1,800 for those who are Married Filing Jointly (now $27,700).

- The annual gift-tax exclusion amount has increased for 2023 from $16,000 to $17,000 per year, per individual.

- The federal estate-tax exemption for 2023 has increased from $12.06 million to $12.92 million per individual, which means married couples can now leave $25.84 million tax-free to their heirs.

While we at BCWM are not legal or tax professionals, we are always available to work with our clients and their professionals to consider how current laws can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2022 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2022 Tax Update

This article was written in January of 2022.

As we write this brief 2022 tax update, bear in mind that the Build Back Better Act has been stalled in Congress. If it eventually passes, there might be changes to summarize. For now, here are some helpful updates:

- The limit for contributions to employer-sponsored retirement plans such as 401(k) accounts, etc., has increased from $19,500 to $20,500.

- The catch-up contribution limit for those age 50 and older remains unchanged at $6,500 (so, now $27,000 in total).

- No changes were made to the IRA contribution limits ($6,000; plus $1,000 for those age 50 and older).

- Slight increases are allowed for Health Savings Accounts (from $3,600 up to $3,650 for individuals, and from $7,200 to $7,300 for eligible families).

- An additional, catch-up contribution of $1,000 is still allowed for those age 55 and older.

- The standard deduction amount for income taxes has increased by $400 to $12,950 for individual filers, and by $800 to $25,900 for those who are married filing jointly.

- The annual gift-tax exclusion amount has been increased from $15,000 to $16,000 per year, per individual.

- The federal estate tax exemption has been increased from $11.7 million to $12.06 million per individual, which means that married couples can now leave $24.12 million tax-free to their heirs.

While we at BCWM are not legal or tax professionals, we are always available to work with our clients and their professionals to consider how current laws can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2021 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2021 Relief Bill & Tax Update

This article was written in January of 2021.

In last year’s 2020 Retirement Reform & Tax Update we deciphered the Secure Act and tax extenders and what they might mean in terms of retirement-planning opportunities and challenges.

Nowhere on our radar were impending COVID-19 relief measures, beginning with the 2020 CARES Act Highlights, and followed by an additional bill signed into law just prior to year-end (the Consolidated Appropriations Act of 2021). Below are what we consider to be a few highlights of the most recent relief bill that could be applicable to our clients. (And we recognize that yet another stimulus package is being proposed as this update is being drafted and disseminated.)

- Refundable income tax credit (one-time recovery payment/rebate) against 2020 income of up to $1,200 for married couples filing a joint return ($600 for individuals) plus up to $600 per eligible child.

- Like the CARES Act payments, Adjusted Gross Income (AGI) limits apply.

- Small business expenses paid with Payment Protection Program (PPP) funds can be deducted, while forgiven PPP loans are excluded from taxable income.

- Certain small businesses might be eligible for a “second draw” loan.

- Other notable provisions and tax extenders:

- The CARES Act provision that permits individuals to deduct up to $300 for charitable contributions made with cash as an “above the line” deduction has been extended through 2021 (meaning itemizing is not required to obtain the deduction) . . . and now joint filers can deduct up to $600.

- The AGI hurdle rate for deducting qualified medical expenses has become “permanent” at 7.5% (vs. 10%).

- The 2020 exemption on required minimum distributions (RMDs) has NOT been extended, meaning that those aged 72 or older in 2021 must take them by year-end.

There have been few noteworthy increases to maximum contributions allowed for certain qualified savings accounts in 2021:

- The limit for contributions to employer-sponsored retirement plans such as 401k accounts, etc., is unchanged at $19,500.

- Catch-up contribution limits for those aged 50 and older also remain unchanged at $6,500 (so, $26,000 total).

- The limit for contributions to IRAs remains unchanged at $6,000.

- The cap for catch-up contributions for those aged 50 and older also remains unchanged at $1,000 (so, $7,000 total).

- There is an increase from $3,550 to $3,600 for Individual Health Savings Accounts (HSAs), and from $7,100 to $7,200 for Family accounts.

- As a reminder, to be eligible to contribute, you must be participating in a qualified high-deductible health plan (HDHP).

On the estate-planning front, the federal estate tax-exemption increased from $11.58 million to $11.7 million. As a result, married couples can now leave $23.4 million tax-free to heirs. The annual gift-tax exclusion remains unchanged at $15,000 per year, per individual.The “wild card” for this year is any potential broad tax legislation the new administration may attempt to push through Congress. We caution against aggressive planning measures prior to the availability of much greater clarity; however, the following are some of the initially proposed items we have on our radar:

- Ordinary income rates might increase for individuals earning more than $400,000.

- Itemized deduction benefits could be limited.

- Long-term capital gains might be taxed at higher ordinary income rates on amounts in excess of $1 million.

- Capital assets might no longer receive a cost basis adjustment at death (often a step-up).

- The estate tax-exemption might decrease back to the 2017 pre-Tax Cuts & Jobs Act (TCJA) levels (was $5 million in 2011 . . . then adjusted only for inflation).

- Estate tax rates might also increase.

- Corporate tax rates might increase.

While we at BCWM are not legal or tax professionals, we are always available to work with our clients and their professionals to consider how current laws can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2020 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2020 CARES Act Highlights

In response to the unfolding COVID-19 global pandemic, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on March 27. This is an emergency fiscal stimulus package with a wide range of provisions intended to ease the effects of the resulting economic impact of the crisis.

This stimulus package comes on the heels of the 2020 Retirement Reform & Tax Update (Secure Act and tax extenders) and the 2018 Tax Reform (Tax Cuts and Job Acts of 2017).

Below are a few highlights from the CARES Act and other recent relief provisions that we believe are most likely to apply to our clients:

- Refundable income tax credit (recovery rebate) against 2020 income of up to $2,400 for married couples filing a joint return ($1,200 for individuals) plus up to $500 for each child under the age of 17.

- Phase-outs begin when Adjusted Gross Income (AGI . . . or “the line,” referenced again below) exceeds $150,000 (married) and $75,000 (individual).

- The phase-out is $50 per $1,000 over the AGI thresholds mentioned above.

- Rebates will be estimated and “fronted” based upon 2018 or 2019 AGIs (whichever tax return is the most recently filed) and then “settled up” once your 2020 return is filed.

- If you were shorted, you will be made whole. And if you received an excess payment, you get to keep it.

- Phase-outs begin when Adjusted Gross Income (AGI . . . or “the line,” referenced again below) exceeds $150,000 (married) and $75,000 (individual).

- Required Minimum Distributions (RMDs) are waived in 2020.

- There can be options to consider for returning distributions that have already been processed.

- This could create opportunities for Roth conversions; however, be aware there remain Reasons NOT to Convert to a Roth IRA.

- There is a new, $300 “above the line” deduction for Qualified Charitable Contributions (QCCs).

- This is helpful to those who no longer itemize their deductions and instead take the recently increased standard deduction.

- This contribution must be made in cash, as The Win-Win of Donating “In Kind” does not apply.

- Extended deadline for making 2019 IRA and Health Savings Accounts: Triple Tax Benefit (HSA) contributions.

- The IRS has confirmed these contribution deadlines, to align with the Treasury’s extended due date for tax-return filing and payments from April 15 to July 15.

There are many other provisions related to coronavirus-related retirement plan distributions, student loans, unemployment compensation benefits, small business benefits, big business bailouts, etc., which would be worth researching further if they potentially apply to you or someone you know.

While we at BCWM are not legal or tax professionals, we are always available to work with our clients and their professionals to consider how current laws may have an impact on their investment strategies and plans.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2020 Retirement Reform & Tax Update

Significant tax or retirement reformation has been infrequent, and yet it has now happened twice in the past two years. We recently experienced the 2018 Tax Reform, and we currently need to decipher the Secure Act and tax extenders and what they might mean in terms of retirement-planning opportunities and challenges. Below are what we consider to be a few highlights that could be applicable to our clients, effective January 1, 2020, in order of importance:

- Age increase for Required Minimum Distributions (RMDs) for Traditional IRAs, from 70.5 to 72.

- It is important to note there was not an age increase for Qualified Charitable Distributions (QCDs) from Traditional IRAs; it thus remains at 70.5.

- Elimination of the “stretch” provision for most non-spousal Inherited IRAs.

- Instead of having the ability to take RMDs over their life expectancy, non-spousal beneficiaries will now have just ten years to fully distribute the account.

- The good news is that RMDs are no longer required each year from these inherited assets. Instead, the account simply needs to be empty by the end of ten years.

- These changes apply only to IRA accounts whose owners die in 2020 or after.

- Restriction lifted on making contributions to a Traditional IRA after age 70.5.

- Earned income remains a requirement to contribute.

- Other notable provisions and tax extenders:

- Qualified education expenses for 529 Plans are now expanded to include student loan repayments (up to $10,000) and apprenticeships.

- The kiddie tax reverts children’s unearned income to be subject to the parents’ marginal tax rate (vs. trust & estate tax schedules).

- The Adjusted Gross Income (AGI) hurdle rate for deducting qualified medical expenses is to remain at 7.5% (vs. increasing to 10%).

There have also been some noteworthy increases to maximum contributions allowed for certain qualified savings accounts in 2020:

- For employer-sponsored retirement plans such as 401k accounts, etc., the increase is from $19,000 to $19,500.

- And for catch-up contributions for those age 50 and older, it has gone up from $6,000 to $6,500.

- The limit for contributions to IRAs remains unchanged at $6,000.

- The cap for catch-up contributions for those age 50 and older also remains unchanged at $1,000.

- The change is from $3,500 to $3,550 for Individual Health Savings Accounts (HSAs), and from $7,000 to $7,100 for Family accounts.

- As a reminder, to be eligible to contribute, you must be participating in a qualified high-deductible health plan (HDHP).

The most significant change on the estate-planning front is the federal estate tax-exemption increase from $11.4 million to $11.58 million. As a result, married couples can now leave over $23 million tax-free to heirs.

The annual gift-tax exemption remains unchanged at $15,000 per year, per individual.

While we at BCWM are not legal or tax professionals, we are always available to work with our clients and their professionals to consider how current laws can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2019 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2019 Tax Update

This year, in contrast with last year’s 2018 Tax Reform, there are few tax-law changes that should significantly affect individual and family planning, unless you are divorcing or are expecting to incur material medical expenses.

For many of our clients, we expect 2019 tax planning to remain focused on the same key points as in 2018. Examples include, but are not limited to, the following:

-

-

- Charitable contributions using appreciated securities (The Win-Win of Donating “In Kind”)…occasionally leveraging Donor-Advised Funds (DAFs) for “lumping.”

- Qualified Charitable Distributions (QCDs) for satisfying all or a portion of Required Minimum Distributions (RMDs) from Individual Retirement Accounts (IRAs).

- Proactive Traditional IRA distributions (sometimes processed as conversions to Roth IRAs) when current tax rates are expected to be lower relative to future years.

- Contributions to 529 Plans for education savings. As a reminder, 529-plan distributions can now be used free from federal tax for elementary- and secondary-school expenses (up to $10,000 per student, per year).

- Tax-loss harvesting of capital losses (or occasionally capital gains) in non-IRAs.

-

There have been some noteworthy increases to maximum contributions allowed for certain qualified savings accounts in 2019:

-

- From $18,500 to $19,000 for employer-sponsored retirement plans such as 401k accounts, etc. Catch-up contributions for those age 50 and older remains unchanged at $6,000.

- From $5,500 to $6,000 for IRAs. Catch-up contributions for those age 50 and older remains unchanged at $1,000.

- From $3,450 to $3,500 for Individual Health Savings Accounts (HSAs), and from $6,900 to $7,000 for Family. As a reminder, to be eligible to contribute you must be participating in a qualified high-deductible health plan (HDHP).

The most significant change on the estate planning front is the federal estate tax exemption increasing from $11.2 million to $11.4 million. So married couples can now leave $22.8 million tax-free to heirs.

The annual gift tax exemption remains unchanged at $15,000 per year, per individual.

While we at Boyer Corporon Wealth Management (BCWM) are not legal or tax professionals, we are certainly available to work with our clients and their professionals to consider how current laws can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2018 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

2018 Tax Reform

Significant tax reformation last occurred in 1986, under the Reagan administration. Thirty-two years later, we are not surprised that new tax legislation has arrived. If you prefer not to wade through countless articles and books to decipher how the Tax Cuts & Job Acts of 2017 might impact you, continue reading. We have laid out what we consider to be the highlights of the individual income tax changes, effective January 1, 2018. (We are purposely not addressing any changes made to corporate tax law.)

- Seven tax brackets remain; however, most are decreased by a few percentage points (to a top rate of 37% vs. 39.6%).

- For most people, the new brackets will result in at least a small reduction in marginal rates.

- The standard deduction is expanded (from $12,700 to $24,000 per year for married couples), but personal exemptions are repealed altogether (previously $8,100 for married couples with no dependent children). As a result:

- Fewer filers will claim itemized deductions at all.

- Some strategies, such as “charitable lumping” and/or Qualified Charitable Distributions, might increase in popularity.

- Most common itemized deductions remain, but are now more limited:

- There is now a $10,000 limit, for both individuals and married couples, on the combined total of property taxes (including real estate) and state and local income taxes (SALT).

- Mortgage interest deductions are now limited to the first $750,000 of acquisition debt principal (down from $1 million), applicable only to new mortgages taken out after December 15, 2017.

- Home equity indebtedness no longer offers deductible interest.

- All miscellaneous itemized deductions (subject to the 2% of AGI floor) have been repealed.

- Deduction rules for cash donations to public charities and medical expenses are slightly more favorable than in past law.

- The Child Tax Credit is doubled (from $1,000 to $2,000 per child), with drastically higher income phase-outs.

- Alternative Minimum Tax (AMT) remains; however, the exemption is widened such that significantly fewer households should be impacted.

- Long-term capital gain rates and qualified dividend rates (0%, 15%, and 20%) will continue to be determined by the old, 2017 tax brackets.

- The 3.8% Medicare surtax on net investment income will continue to apply with its own thresholds (not indexed for inflation).

- 529-plan distributions can now be used tax-free for elementary- and secondary-school expenses (up to $10,000 per student, per year).

Estate & Gift Tax Reform Highlights:

- The estate tax exemption is doubled from $5.6 million to $11.2 million.

- Because the concept of “portability” is retained, married couples can now leave $22.4 million estate tax-free to their heirs.

- The annual gift tax exemption has increased from $14,000 to $15,000 per year, per individual.

While we at Boyer & Corporon Wealth Management (BCWM) are not legal or tax professionals, we are certainly available to work with our clients and their professionals to consider how the new legislation can have an impact on their investment strategies and plans.

As in years past, clients of BCWM will soon receive additional correspondence from our office regarding important 2017 tax-year information specific to their accounts under our management.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Health Savings Accounts: Triple Tax Benefit

Although there have been significant changes in the health-care industry in recent years, one tool that remains available to many individuals and families — who are insured with a high-deductible health insurance policy — is a Health Savings Account (HSA).

An HSA allows people to save for future health-related expenses, with a triple tax benefit that is hard to beat. As with a traditional IRA or pre-tax 401(k), contributions made to an HSA are tax-deductible. Furthermore, the account can grow tax-free. And, finally, if you withdraw funds for qualified medical expenses (even long-term care insurance premiums are considered “qualified”), you will enjoy a tax-free benefit. The tax benefits of this tool are pretty fantastic.

Like many things in life, if the benefits are that good, you should not be surprised there are annual limitations on how much you can contribute to the account. As of 2025, individuals can pay a maximum of $4,300 into an HSA, while families can contribute up to $8,550 (individuals who are age 55 or older can contribute an additional $1,000). These limitations are indexed each year.

But what happens if you die and have thousands of dollars remaining in your HSA? If you are married and your spouse is listed as the beneficiary, the answer is simple: your spouse will inherit the HSA tax-free and would be able to continue using the funds for qualified health expenses, even if she/he is not insured with a high-deductible plan. However, if the beneficiary is a non-spouse, the funds received would be taxable to the recipient.

The annual limitations imposed by the IRS will likely keep your HSA from becoming a significant part of your investment portfolio, but when it comes to minimizing your tax burden throughout your lifetime, it can certainly help make a difference.

If you have questions regarding an HSA, we at BCWM would be happy to help answer them.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Estate Planning

Inheriting a Retirement Account

This article was written in December of 2021.

An inheritance can come in many shapes and sizes. Often, individuals inherit a Retirement Account from a deceased loved one. This type of asset is distributed to the beneficiaries designated on the account. Depending on their relationship to the deceased, the beneficiaries will have options from which to choose.

Spousal Beneficiary:

If you inherit a retirement account from your spouse, you generally have three options:

1. Take possession of the account by registering yourself as the new owner of that account.

2. Consolidate the inherited account into an existing and like-registered retirement account of your own via a spousal rollover.

3. Transfer the funds to a newly created Inherited IRA.

If the surviving spouse does not have an immediate need for funds in the inherited account, is not much older than the deceased spouse, or might process a Roth conversion from the inherited account, they may want to consider Option 1 or Option 2 described above.

If the spousal beneficiary needs the inherited funds, or they are several years older than the deceased spouse, it might be wise to transfer the account to an Inherited IRA (Option 3) as opposed to treating the account as their own (Option 1 or 2) – particularly if the surviving spouse is not yet old enough (generally age 59.5) to avoid 10% premature distribution penalties (which do not apply to Inherited IRAs) from their own retirement accounts.

Non-Spousal Beneficiary:

A Qualified Retirement Plan can be passed to a non-spouse individual, a trust, or even a qualified charity. If an IRA is left to a trust or charity, it is likely wise to enlist the help of a legal and/or tax professional.

If an individual inherits an IRA from someone other than a spouse, the inheritor must move the assets into a newly established Inherited IRA.

Account types that can be transferred into an Inherited IRA are IRAs (including Traditional, Roth, SEP, and SIMPLE) or employer-sponsored retirement plans (including 401(a), 401(k), and 403(b)).

Distributions From an Inherited IRA:

If the original account owner died after December 31, 2019, the SECURE Act of 2019 generally requires a non-spousal beneficiary to take out the entire balance of an Inherited IRA by the end of the tenth year following the death of the original account owner.

Surviving spouses are not subjected to the ten-year rule and they maintain the ability to postpone distributions until the decedent would have attained age 72.

If the decedent was not yet subjected to Required Minimum Distributions (RMDs) and did not designate a beneficiary, the account must be distributed within five years of the owner’s death.

If the decedent was subjected to RMDs but did not designate a beneficiary, distributions to their estate may occur over their remaining single-life expectancy.

Taxation of Inherited IRA Distributions:

The taxation of distributions is based on the tax status of the inherited account.

If the inherited account is “pre-tax” (Traditional IRA with no after-tax basis, Traditional 401(k), etc.), distributions are taxable according to the beneficiary’s ordinary income tax rate.

If the inherited account is “after-tax” (Roth IRA, Roth 401(k), etc.), and at least five tax years have passed since the original account was opened, distributions will be free from income tax.

If fewer than five tax years have passed since the “after-tax” account was opened, the earnings portion of the distribution will be subject to the beneficiary’s ordinary income tax rate.

A beneficiary’s personal income tax situation can help guide decisions related to taking distributions from an Inherited IRA.

For example, it might be wise to consider larger distributions from a “pre-tax” Inherited IRA during years the beneficiary has less taxable income and smaller distributions during years the beneficiary has more.

__________________________________________

The beneficiary of a retirement account has choices to make, and each comes with specific rules. We at BCWM are available to work with you and your trusted tax/legal advisors to help make an informed decision.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Contingent (Secondary) Beneficiary

It is not uncommon for account owners to misunderstand when and how a contingent beneficiary — also referred to as “secondary” beneficiary — becomes the receiver of assets. The easiest way to explain this is to walk through an example.

Let’s assume Jane and John are spouses. This is the second marriage for both of them and they each have children from their first marriages.

Jane has an IRA worth $800,000.

When Jane passes away, she would like to leave the assets to John for his personal use; but when John dies, she would like her children to inherit the leftover funds.

Jane thinks she accomplishes this two-tiered goal by naming John as the primary beneficiary on her IRA and listing her children as the contingent (secondary) beneficiaries.

She is wrong!

After Jane’s death, these assets would transfer out of Jane’s name and into John’s name (into a new account). John takes ownership of the assets and, at that time, he is able to name any beneficiary he chooses. For example, he could legally list his own children to become the beneficiaries of the money Jane had intended for her own children. Of course, we know John, our fictitious character, is a trustworthy fellow and would never consider doing such a thing. But as people age, they can get confused and make decisions they would have never made in their younger years.

So, when does a contingent beneficiary come into play? Actually, almost never.

A contingent beneficiary is needed in the event that the account owner and primary beneficiary die at the same time . . . or, the more likely scenario, the primary beneficiary dies prior to the account owner’s death. Thus, contingent means back-up beneficiary.

Back to Jane and John: If they both die in an accident and Jane’s children are listed as the contingent beneficiaries, the children would inherit the account (just as Jane had intended).

If John pre-deceases Jane and Jane never takes the time to update her primary beneficiary to her children, her children would inherit the assets at Jane’s death.

So, were Jane to die before John, what should she do now to ensure that the residual of her account is provided to her children following John’s death? Given that what she wishes for her money is a bit complicated, she really should seek the advice of her estate planning attorney. If she already has a Trust, perhaps naming her Trust as the primary beneficiary makes the most sense for her situation.

__________________________________________

Important Note: While the example above illustrates how beneficiaries work with an ERISA-exempt IRA, the rules change a bit if the account is governed by ERISA. With ERISA-governed accounts, spousal consent must be provided before anyone other than the spouse is named as the primary beneficiary.

__________________________________________

Another note: People commonly believe that their Last Will and Testament will dictate who gets what at their deaths. That is not necessarily true! If beneficiaries are listed on an account, the beneficiaries named will typically trump the Will.

We at BCWM are not attorneys, but we are available to work with you and your legal professional to help find and implement the strategy that best fits your circumstances.

Click here to read more about Basic Estate Planning documents.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Basic Estate Planning Documents

Most people correctly understand that estate planning is an important component of a holistic financial plan. Unfortunately, many people also mistakenly believe estate planning needs to be extremely complex and therefore difficult, which often leads to procrastinating.

Good, basic estate plans should, at a minimum, do two things:

1. convey how you want your assets managed and distributed after you die, and

2. indicate what should happen if you are incapacitated and unable to care for yourself.

Following are the most common and essential basic estate planning documents. Understanding them enables you to evaluate options and determine which might be best for you and your family.

- Last Will and Testament – This is a document that states how you would like your assets managed and distributed after you die. Within the document you name the executor of your estate, the person who ensures that your wishes are carried out. Perhaps most importantly, you also name the guardian for your minor children. This document must be submitted to the probate court for administration after death, and while the process is cumbersome, the costs and inefficiencies of it are often exaggerated. Nonetheless, the process can be avoided by designating beneficiaries wherever possible (such as on retirement accounts, life insurance policies, real estate deeds, etc.).

- Financial Power of Attorney – This is a document in which you designate someone to manage your financial affairs while you are living. You can choose whether that appointment goes into effect immediately (essentially stepping into your shoes) or only under certain circumstances (such as incapacity).

- Living Will – This is a document that states how you would like your medical care implemented in the event you become terminally ill and need to be on life support. Within the document you can articulate what measures you would like to have taken (or not) to save or extend your life.

- Healthcare Power of Attorney – This is a document in which you designate someone to make medical decisions on your behalf — laid out in your Living Will — if you are unable to do so yourself.

Clearly, some estate plans should be more complex, utilizing Trusts (both Revocable Living and Irrevocable), etc.; however, many do not need to be complex, and a basic estate plan is better than not having one at all. We at Boyer Corporon Wealth Management (BCWM) are not attorneys, but we are available to work with you and your legal professional to help find and implement the strategy that best fits your circumstances.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.

Philanthropic Planning

The ABC’s of a QCD

If you are 70½ or older, are charitably inclined, and hate paying taxes, you should probably read this.

Although many retirees do not realize it, they may be able to reduce their tax bill by making donations directly to a qualified charity from their IRA (including inherited ones) via a Qualified Charitable Distribution (QCD). This is because money donated to charity as a QCD is excluded from taxable income.

In the past, many donors were able to simply deduct charitable donations on their tax return to reduce their tax bill. The Tax Cuts and Jobs Act of 2017 raised the standard deduction, which prevents some tax filers from claiming deductions for those charitable donations.

The QCD may be an especially attractive strategy for those donors who do not itemize deductions — perhaps even more attractive than donating appreciated securities!

You can donate up to $108,000 per year via QCDs (hint: Any time the IRS puts a limit on something, you know it is a good deal!), and if you are subject to a Required Minimum Distribution (RMD), the donations count toward fulfilling it!

Although the SECURE Act raised the age at which you are first subject to an RMD, from 70½ to 73, it does not impact your ability to process a QCD beginning at age 70½.

You cannot process a QCD from a 401(k).

A QCD must be made directly from an IRA to a qualified charity, such as your local food pantry. Unfortunately, QCDs cannot be made to Donor Advised Funds (DAFs) or private foundations.

In order for QCDs to be applied against your current year’s RMD, they must be completed by December 31. If you write a check from your IRA to a charity, the check must clear by December 31!

QCDs are reported as normal distributions on your IRA custodian’s Form 1099-R. To avoid mistakenly paying income tax, you want to be certain to inform your tax professional of charitable donations you made as a QCD.