Late last night, Russia launched a full-scale invasion of Ukraine. It’s no secret it has been building up troops with precisely this in mind. Contrary to President Vladimir Putin’s recent assertions that Russia was undertaking a limited “liberation” of separatist regions of Ukraine, he has now opted for a full-scale takeover of the country.

So, what’s the logic here? Why Ukraine?

If you ever played the board game “Risk,” you might have the impression that Ukraine is a very significant piece of property the size of the United States . . . a property that divides eastern Europe from Russia. Just ask Newman from the TV series Seinfeld.

In reality, Ukraine is not as large and imposing as the board game would imply. It’s actually nearer the size of Texas.

No one can be 100% sure why Putin is so obsessed with Ukraine. One could say that the primary motivation is purely an exercise of his vanity, which can only be explained, to take poetic license with Churchill’s words, as a riddle, wrapped in a mystery, inside an enigma, locked in a vault of insanity, mendacity, and megalomania. Putin views Ukraine as part of Russia and rejects their right to exist as a sovereign nation.

Additionally, Putin has attempted to paint the invasion an issue of national security.

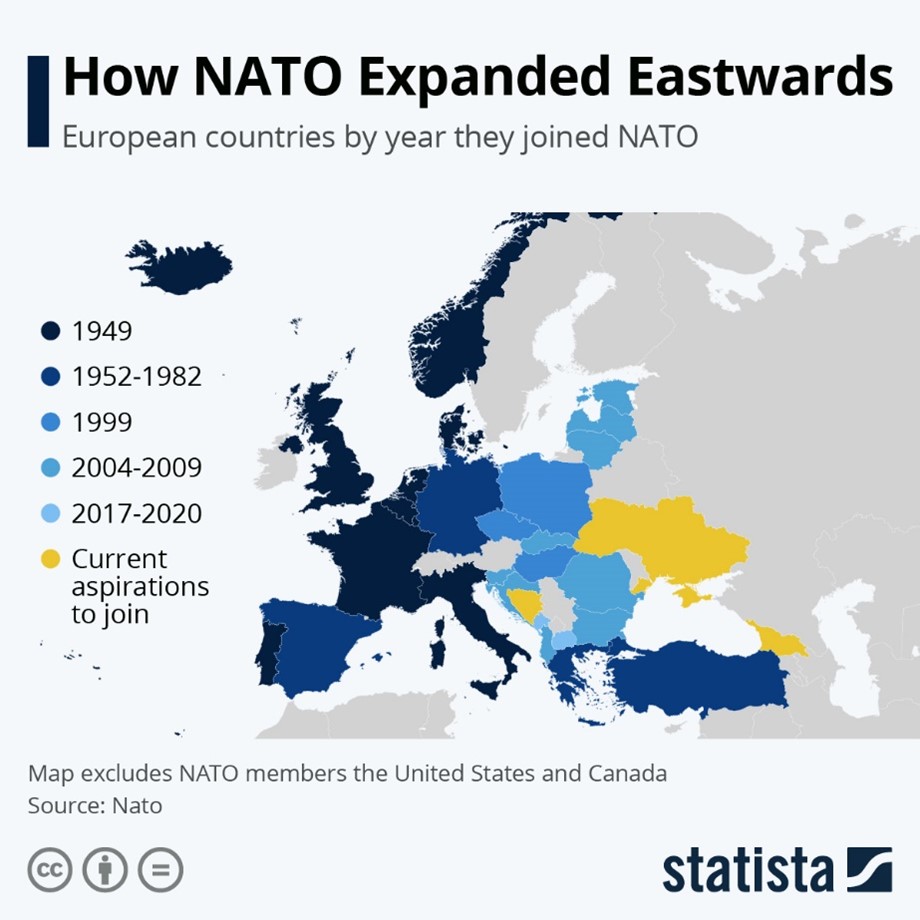

After the fall of the Soviet Union, in 1991, many of its republics broke off into individual countries, including six along the Soviet Union’s former western border. Ukraine was one of these. The newly independent nations were free to pursue their own foreign policies with the West.

Russia claims that promises were made at the end of the Cold War that NATO would not expand its membership to countries that shared borders with Russia. But fast forward thirty years and Estonia and Latvia have done this, along with a dozen other countries in eastern Europe.

Russia sees this slow, continual Western encroachment on its borders as a huge threat, and it has been pushing back.

Compounding this problem, the Russian birth rate saw huge declines in the 1990s. Thus, with fewer able-bodied soldiers to defend the wide-open Russian heartland, Putin seems to think that taking over part or all of Ukraine is strategically important while still feasible.

For him, it is apparently now or never. His popularity is waning, Europe’s reliance on Russian energy is high during the winter months (and energy prices are high), the coronavirus still has much of the world’s attention, he sees Biden as a weak opponent, and the Olympics just ended (so China won’t be angry with this invasion taking the Beijing games out of the spotlight).

Leading up to the invasion, there was so much uncertainty regarding what Russia would ultimately decide to do. The stock market seemingly reacted to whatever Putin had for breakfast every morning.

The markets now watch as war breaks out in Europe in a manner reminiscent of the late 1930s. Suddenly, safe-haven assets are back in vogue.

__________________________________________

When the Russian invasion is not making headlines, CNBC is reminding viewers of the Federal Reserve’s intention to raise interest rates.

One of the Fed’s primary responsibilities is to keep inflation in check. Over the past two years, billions of dollars paid directly to citizens, supply-chain disruptions, and labor-force shortages have led to the highest inflation in recent history. The Fed tries to curb high inflation by increasing the “federal funds rate” — an interest rate that applies only to banks but can influence the rates that get charged on all loans. When the Fed increases this rate, companies are less likely to borrow money, therefore economic growth slows a bit, and inflation slows down . . . as the theory goes.

We’re not so convinced that the Fed has the tools to fix some of the problems causing inflation today. For example, cargo ships parked off the coast of California are not going to unload any faster based on interest rates. This supply-chain issue is going to take time to balance out. And we still believe that, over the long-term, there are strong forces in play that will keep inflation low. Massive government debt combined with aging demographics are larger, long-term forces that will outweigh short-term supply-chain issues and labor shortages.

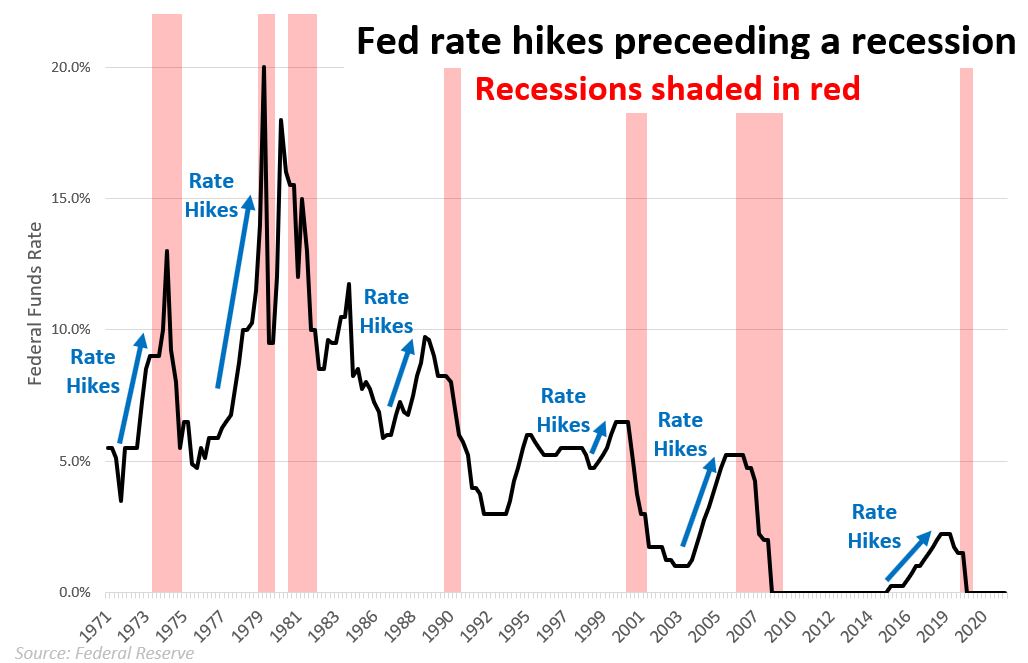

However, the market is concerned about what a series of Fed hikes could mean for the economy. Fed rate-hiking cycles have historically preceded recessions. The chart below shows the Federal Funds Rate over the past 50+ years. The blue arrows point out periods of interest rate hikes that led to economic recessions (shaded in red).

Why? One explanation is that when the Fed attempts to manage inflation, the rate hikes are too much for the economy to bear. Basically, the Fed pushes on the brakes too hard, and it eventually needs to cut rates again to help the economy recover. This Fed-induced recession is called a “hard landing.”

We’re two months into 2022, volatility is back, and the S&P 500 Index is officially in “correction” territory, which means it is down 10% from its previous high. The Federal Reserve and Vladimir Putin are somewhat to blame, but in our opinion, the root cause goes back to Why was the stock market up so much to begin with?

The last two years have been somewhat absurd. Stocks like Zoom, Peloton, Shopify, and Roku were priced as if no one was ever going to leave the house again. Newly minted day traders bid up the price of dead-end companies such as Gamestop and AMC Entertainment as a joke. People made millions from dog-themed cryptocurrency and digital pet rocks. To us, a correction was long overdue. All the market needed was a good excuse. And Russia-Ukraine and impending Fed rate hikes are as good excuses as any.

Rest assured, BCWM is prepared for investment environments like this. As market valuations became increasingly stretched over the last year, we increased our allocations to gold, U.S. Treasuries, and safe, dividend-paying stocks. Those asset classes do relatively well when global uncertainties rise. So, while you may be concerned about a rate-hike induced recession and the European conflict, you should sleep well knowing your portfolios have a tilt toward safety.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.