It now appears that the great Red Wave didn’t quite materialize during the mid-term elections. (We fondly recall the days when election results were almost always announced the following day.) And although Republicans now have a House majority, the Senate is still somewhat undecided. With a run-off election in Georgia yet to come, the Democrats currently have 50 seats, the Republicans 49.

This is a great time to remind you that, although there is some significance attached to which party controls Congress as well as the White House, there are always larger geopolitical and economic forces at work that have a greater effect on your investments over the long term.

Here is a list of just a few of the things the administration and Congress are not in control of:

- Russia invading Ukraine

- Rising (and then falling) energy prices

- Contagious viruses emanating from other nations (or our nation, for that matter)

- Acts of God (hurricanes, droughts, floods, etc.)

- Technological breakthroughs

- Corporate earnings (or lack thereof)

And remember, if you’re not happy about this election, two years from now we get to vote all over again. And two years goes by rather quickly.

_____________________________

At the risk of being wrong (a daily risk in our world), we have maintained that inflation peaked five months ago . . . that the global geopolitical and economic forces that drove inflation to an annual rate of 9.1% in June were slowly becoming “history.” And although inflation is not receding quickly, it appears that it IS receding:

Since that high print in June (“the highest in 41 years”), inflation numbers have consistently declined:

July 8.5%

August 8.3%

September 8.2%

October 7.7%

“Core Inflation,” which strips out volatile items like food and energy, came in lower as well. This all but confirmed that the inflation drop is genuine. Securities markets reacted positively (to say the least) to this announcement. Stocks went up over 5% in one day and bonds increased almost as much as interest rates plummeted in response to the news.

We’re not jumping up and down with excitement yet, but one year from now, we think consumers and investors will not be viewing inflation as their number one problem.

_____________________________

It is not only inflation that seems to be normalizing. The same can be said of the high-flying stocks that wowed the market the past couple years. And by “normalizing,” we mean these stocks dropped like a rock.

For the last two years the stock market has been characterized by over-hyped and over-priced companies trading at absolutely ridiculous valuations. It wasn’t a matter of if they were going to collapse, it was just a matter of when.

For some stocks, investors finally gave up on the idea that the pandemic-era lifestyle would last forever:

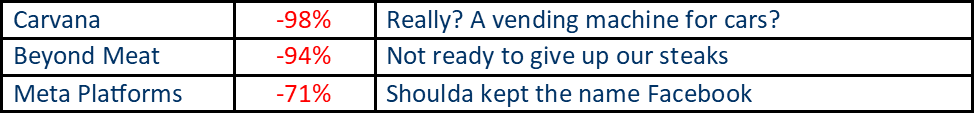

Other companies just didn’t have the best business model:

Some companies actually have a decent underlying business, but the stock price was the problem:

And of course, some stocks were literally being bought as a joke. Two companies that were approaching irrelevance pre-pandemic:

What’s the common thread? Stock prices that defied logic.

The price you pay matters, and buying these stocks last year was more akin to gambling than investing.

_____________________________

We have never understood cryptocurrency. Didn’t understand the need for it. Didn’t understand why there should be thousands of different types. Didn’t understand what cryptocurrency’s inherent value might be, if any. Didn’t understand how it might ever become ubiquitous. Just didn’t understand it.

Don’t get us wrong. We did our research. In our opinion, crypto is a solution looking for a problem. . . and it’s not useful for anything other than gambling (and maybe money laundering).

It aims to solve problems worked out years ago, problems that financial markets have already solved. Circumventing the need for a bank? Great idea, until your assets are stolen and no one is helping you get them back.

And we’ve always been fond of saying “if it’s too difficult to understand, it’s designed to rob you of your money.”

Well, it turns out this past week that a major crypto exchange did exactly that: robbed investors of their money. Billions of their money. FTX, a crypto exchange, has declared bankruptcy after it was discovered that billions of investors’ dollars/cryptocurrencies/whatever are missing.

Imagine that.

We have always said that there are three qualities we covet in an investment:

- Liquidity

- Transparency

- Control

We guess we should add a fourth quality

- Understandability

At BCWM, we will never invest your money in anything we don’t thoroughly understand.

As a reminder, here is a graph of the price of Bitcoin for the past few years.

Fifteen years ago, the day after Labor Day, we opened the doors to a new Registered Investment Advisory firm and called it Boyer & Corporon Wealth Management. Not a particularly catchy name . . . just the last names of the two co-founders combined with what we do — manage wealth.

Since that time, we have not only grown our client base significantly, but the assets under our management have grown as well . . . to over $600 million at one point, before this year put a tiny dent in it.

More importantly, we have also added quite a few talented team members, many of whom are now partners in the firm.

To that end, we felt that the original name didn’t adequately represent the present composition of the firm. So not long ago, we set about to change our name. To most of you, this is not news or a surprise. But we have never “officially” put this in writing and we felt like now was as good a time as ever.

So let it be known that our new (but not really that new) name is BCWM, LLC. And our firm logo is:

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.