During a recent webinar for the private clients of BCWM, we reminded everyone that

everything you’re already aware of,

everything you hear on TV,

and everything you read on the Internet . . .

. . . is already public information AND

is already priced into the stock market.

It is often tempting to make investment decisions based on a sound bite — one that was probably frightening, yet possibly exhilarating. Either way, that sound bite should be ignored because that information has already been incorporated into stock prices. If you know about it, so does everyone else.

Someone asked us last week, “If nearly the entire globe is in an indefinite recession (the worst description before you use the word “depression”), why is the stock market going up?”

It’s a solid question . . . that doesn’t necessarily have solid answers. But let us throw out a few.

One of the problems investors seem to face is a lack of many (if any) good alternatives to investing in the stock market.

Keep your money in cash? Not a bad idea if stock markets suffer a prolonged virus (pun intended). But not such a good idea if they don’t. Remember, the return on cash is virtually zero. And the key word here is “prolonged.” If the economy and stock market dive but recover more quickly than expected (a la February through May of this year), you would be better off just holding on to stocks and riding it out.

Or, if you were to get out of stocks, you could park your money in a 10-Year US Treasury Bond (an investment that we refer to as “risk-free”). However, that risk-free investment will only pay you 0.60% per year, which is probably a lot less than what you were planning to earn for the next ten years of your investment life.

And then there are corporate bonds, foreign bonds, real estate, gold, and precious metals, all of which carry their own share of risks and/or lack of cash flow and/or liquidity.

So perhaps stocks are going up because investors have few choices.

But there may be one other reason stocks continue to show strength. Maybe the “stock market” (we talk as if it is a living, breathing being . . . rather than a reflection of millions of living, breathing beings) somehow is looking beyond the next three to six months.

If all the COVID-19 bad news is already reflected in the stock market (as we postulate above), then possibly, just possibly, the stock market is looking toward the future and is banking on a vaccine . . . and a return to restaurants . . . and movie theaters . . . and sporting events . . . and schools.

Just possibly.

What we DO know from experience is that the stock market will almost always defy logic and go the opposite direction most investors expect.

__________________________________________

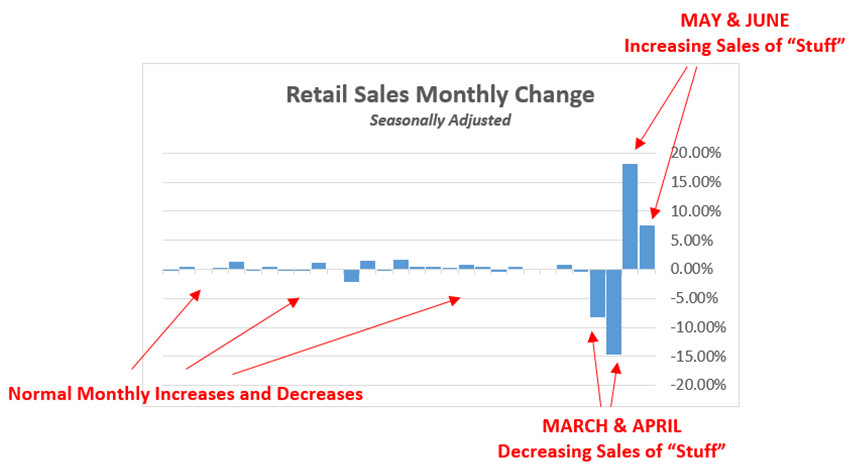

When economic activity comes to a screeching halt, there is probably no better place to see that reflected than in retail sales — buying “stuff” you need/want. Typically, the amount of retail sales doesn’t change much from one month to the next.

This graph of retail sales of the past two and a half years illustrates just how dramatic the drop was when the lock-down began, and just how impressively sales bounced back once we began to venture out of our homes again.

And although retail sales have staged an impressive comeback (aided by online orders you can make from your couch and have delivered to your doorstep the next day), the service sector of our economy is still struggling. And given that we spend about twice as much on services as we do on goods/stuff, the recovery of the service sector will determine how quickly these economic wounds heal.

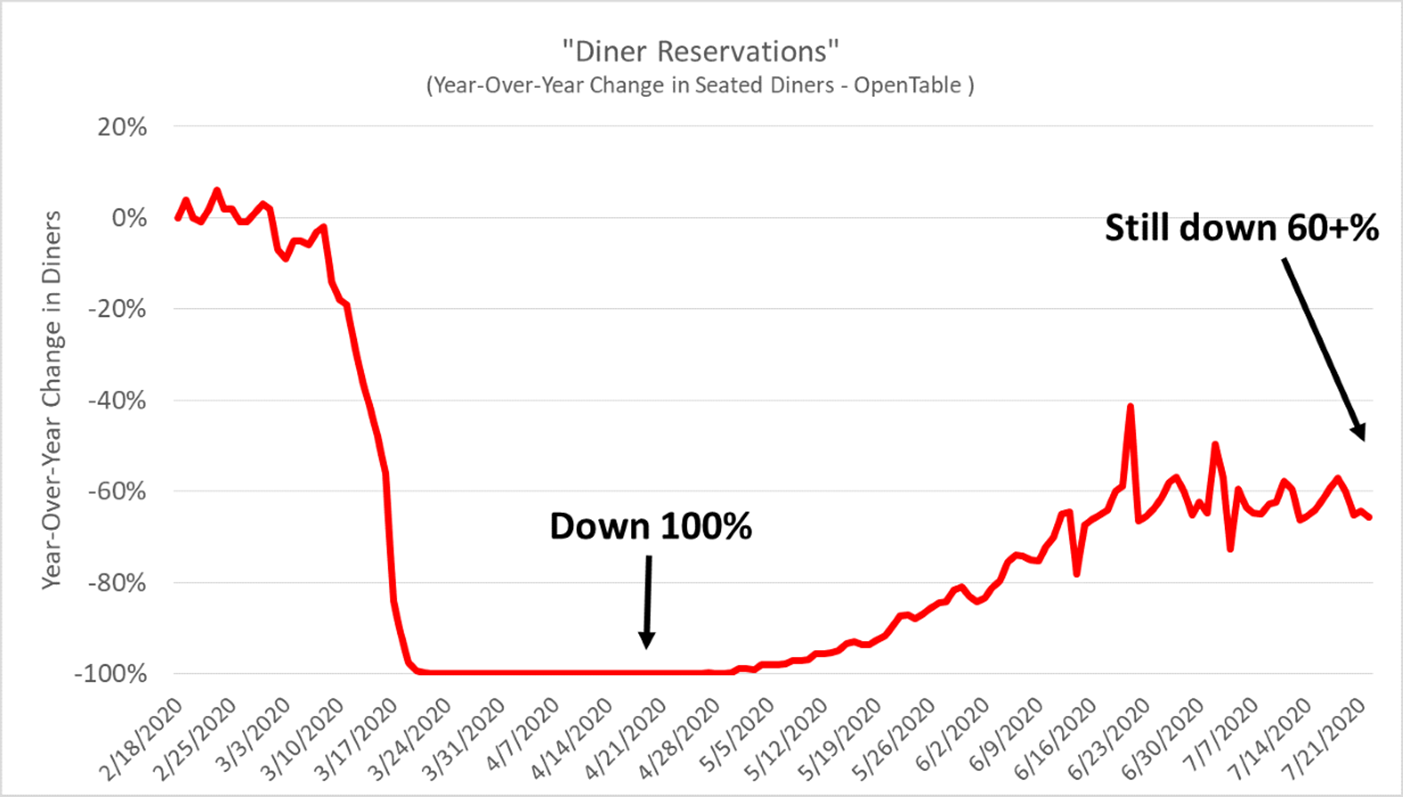

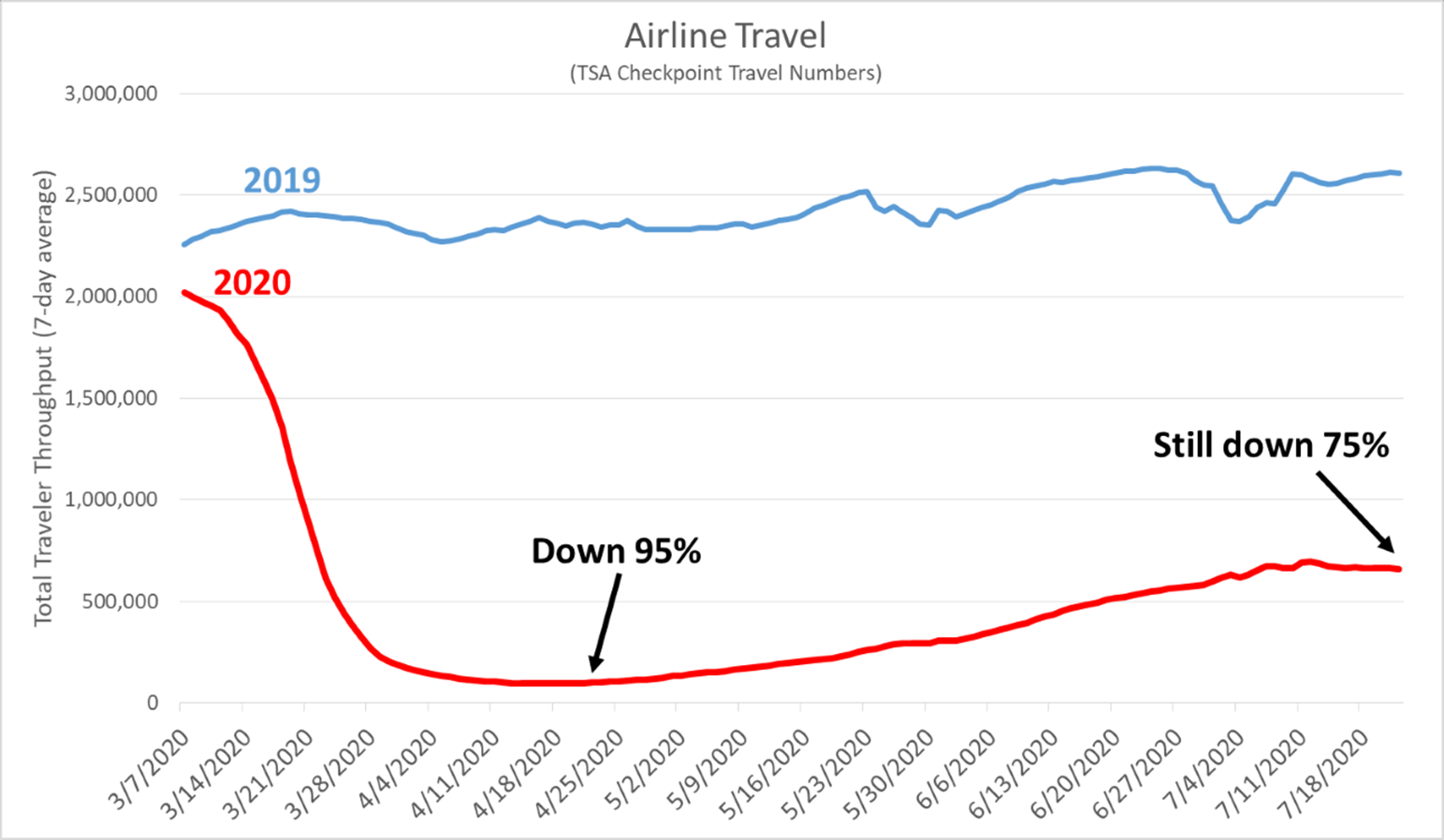

The next two charts show the striking impact of COVID-19 on business in two large service industries: restaurants and airlines.

Going out to dinner was COMPLETELY eliminated for a couple of months and is slowly returning, although this process has been more troubling in some parts of the country than in others.

Air travel took a similar beating and has been much slower to recover.

To some extent, COVID-19 has changed the world permanently as we have figured out other ways to get things done. We realized how easy it is to shop from home, even for groceries. We found out that restaurants will come to us. We discovered how to have meetings face to face, even though the other face is on your computer screen. And in doing so, we realized we didn’t necessarily have to travel to another city for an important meeting or conference, potentially saving thousands of dollars . . . dollars that would have gone to airlines, hotels, and rental car companies.

At BCWM, we think it is fairly obvious that our economy will take a long time to get back to where it was “pre-COVID.” We expect interest rates to continue to trend lower, which is good news for the bonds in our portfolios. And we expect the stock market to continue to confuse everyone . . . because that’s what it does.

This information is provided for general information purposes only and should not be construed as investment, tax, or legal advice. Past performance of any market results is no assurance of future performance. The information contained herein has been obtained from sources deemed reliable but is not guaranteed.